Buy JK Lakshmi Cement Ltd For Target Rs 926 By Elara Capital

Weak realization drives EBITDA miss

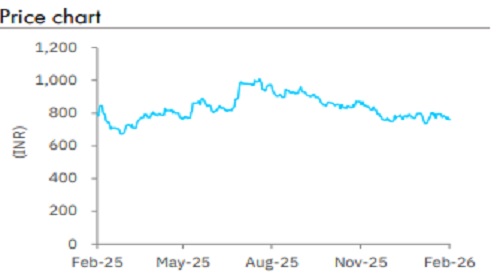

JK Lakshmi Cement (JKLC IN) reported consolidated EBITDA of ~INR 2.05bn, below our and consensus estimates of ~INR 2.3bn each. The miss was led by a sharp drop in realization, due to a higher share of non-trade sales, particularly in Gujarat, along with ramp-up of the Surat grinding unit that was recently commissioned, which knocked off the benefit of higher volumes. Expect ramp-up at the Surat grinding unit to prop volume growth, while recent price hikes should aid realization recovery. Execution of ongoing and announced expansion projects may strengthen long-term growth momentum. The stock is currently trading at an EV/tonne of INR 5,276 based on FY27E capacity, near 3.25-year low and below the brownfield capex replacement cost. Given an implied upside of ~22%, we upgrade JKLC to Buy from Accumulate, with a lower TP of INR 926, based on 8x December 2027E EV/EBITDA.

On track to reach ~30.0mn tonnes capacity by 2030: JKLC commissioned its 1.35mn tonne grinding unit at Surat, Gujarat, and completed debottlenecking at its Jaykaypuram and Sirohi (Rajasthan) cement mills in Q2FY26, raising total cement capacity from ~16.5mn tonnes to ~18.0mn tonnes by end-Q2FY26. Ongoing clinker and cement expansion projects across locations are progressing as planned and are slated for phased commissioning by March 2028. Post completion, consolidated clinker capacity is expected to increase from ~10mn tonnes in FY25 to ~12.3mn tonnes, while cement capacity will rise from ~16.5mn tonnes to ~22.6mn tonnes. Further, to achieve its long-term target of ~30mn tonnes by FY30, JKLC has planned three greenfield projects —~3mn tonnes each at Nagaur (Rajasthan) and Kutch (Gujarat), and ~2.0–2.5mn tonnes in Assam — supporting sustained long-term volume growth

Volume-led growth partly diluted by realization pressure: Sales volume increased ~8% YoY and ~15% QoQ to 3.3mn tonnes, driven by the ramp-up of the Surat grinding unit. However, realizations declined ~2% YoY and ~10% QoQ to INR 4,841/tonne, with sharper-than-expected fall attributable to a lower share of trade sales, which declined to 49% from 53% in Q2FY26. This was led by a higher contribution of non-trade sales from the western markets of Gujarat and Mumbai. The impact of weak realizations was partly offset by lower-than-expected operating costs, supported by a decline across major cost heads. Nevertheless, EBITDA/tonne fell ~6% YoY and ~15% QoQ to INR 625, below our estimate of INR 688.

Revise to Buy with a lower TP of INR 926: Recent price hikes in core markets, and ramp-up at the Surat project, bode well for near-term performance. Ongoing and newly announced expansion projects shall support long-term growth. Higher use of green power, addition of railway sidings, and other cost-efficiency initiatives should improve margin. Factoring in weaker-than-expected Q3, we cut our EBITDA estimates by ~1% for FY26E, and by ~3% each for FY27E-28E. Given the continued earnings volatility and persistent underperformance versus peers, we lower our target multiple to 8x (from 9x) and roll forward our valuation to December 2027E, resulting in a revised TP of INR 926 (from INR 1,008). Nevertheless, the recent correction in the stock price implies an upside of ~22% to our revised TP, leading us to upgrade the stock to Buy from Accumulate. Key risks to our call include sub-par demand, weak cement prices, and a sharp rise in fuel costs.

Please refer disclaimer at Report

SEBI Registration number is INH000000933