Buy Galaxy Surfactants Ltd for the Target Rs.2,500 by Motilal Oswal Financial Services Ltd

Healthy operating profit led by favorable mix and cost optimization Earnings beat estimate

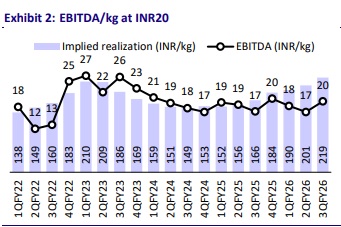

* Galaxy Surfactants (GALSURF) delivered a healthy quarter, with EBITDA growth of 13% YoY in 3QFY26. EBITDA/kg stood at ~INR20.1, up 15% YoY, driven by strong volume growth from non-tariff-affected customer accounts, improved contribution realization from the master segment in India, and lower logistics costs.

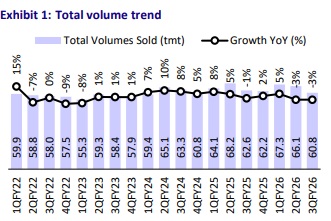

* Total volumes remained flat YoY, driven by short-term disruptions in both the domestic and Africa, Middle East, and Turkey (AMET) markets. However, this softness was partly offset by strong double-digit growth in Latin America and the Asia-Pacific region.

* We expect a CAGR of 13%/6%/7% in revenue/EBITDA/adj. PAT, along with a volume CAGR of 5% over FY25-28. We maintain our FY26/FY27/FY28E earnings for GALSURF. Reiterate BUY with a TP of INR2,500 (based on 24x FY28E EPS).

Healthy revenue growth offset by gross margin contraction

* Consolidated revenue grew 28% YoY to INR13.3b (est. in line), primarily led by higher realizations. Overall volumes remained flat YoY.

* Revenue from India/Rest of World (ROW)/AMET grew 44%/24%/3% YoY to INR5.7b/INR4.6b/INR2.7b. Revenue from local and niche/MNC players grew 50%/25% YoY to INR6.2b/INR6.3b. However, revenue from regional players declined 31% YoY to INR796m.

* The revenue contribution of Performance Surfactants now stands at 63% compared with 61% in 3QFY25.

* EBITDA margin contracted 120bp YoY to 9%, hurt by gross margin contraction of 620bp YoY to 24.9%. Employee costs as % of sales stood at 6% (vs. 7.1% in 3QFY25), while other expenses stood at 10% (vs. 14% in 3QFY25).

* EBITDA grew 13% YoY to INR1.2b (est. INR1.1b), and adj. PAT grew 6% YoY to INR686m (est. INR646m).

* In 9MFY26, GALSURF’s revenue grew 6% YoY to INR32.5b, while EBITDA remained flat at INR3.6b, and adj. PAT declined 2% to INR2.2b.

Key highlights from the management commentary

* Guidance: Management expects a gradual recovery in growth momentum over the coming quarters, supported by improving India volumes (with continued double-digit growth in the specialty segment). Management expects a recovery in AMET volumes from 4Q onward and has reiterated its overall volume growth guidance of 6-8% over the next two years.

* India: Domestic revenue growth (+44% YoY) was driven by strong traction from non-Tier 1 and D2C customers. While the Performance segment declined due to reformulation at a key Tier 1 account and temporary GST-related inventory disruptions in October, the Specialty segment delivered robust 35% YoY volume growth

* US tariffs: The reciprocal tariffs adversely impacted India-origin Specialty exports during the quarter and led to temporary uncertainty among certain clients, resulting in a pause on select pipeline projects. Following the recent tariff reduction and trade agreement, the company has resumed discussions with customers on previously suspended projects. While early signs of revival are visible, the meaningful impact of this development is expected to materialize next year.

Valuation and view

* We expect the near-term headwinds to gradually ease, supported by GST reforms that are likely to unlock medium-term consumption growth in the domestic market, a gradual recovery in the AMET region, and a significant boost to the North America specialty business, driven by recent tariff reductions and stable growth momentum.

* GALSURF’s long-term growth will be driven by 1) the company’s consistent focus on R&D, 2) improving domestic demand, 3) better raw material availability, and 4) enhancing and expanding global operations.

* We expect a CAGR of 13%/6%/7% in revenue/EBITDA/adj. PAT, along with a volume CAGR of 5% over FY25-28 and maintain our FY26/FY27/FY28E earnings for GALSURF. We reiterate our BUY rating with a TP of INR2,500 (based on 24x FY28E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412