Buy Ahluwalia Contracts India Ltd for Target Rs. 915 by Axis Direct

* Robust Order Book to Drive Growth: The company has an order book of Rs 18,680 Cr (as of 31st Dec, 2025), providing revenue visibility for the next 2.5–3 years. The order book is primarily composed of Hospital at 7.9% (Rs 1,477 Cr), Commercial at 19.2% (Rs 3,586 Cr), Institutional at 7.7% (Rs 1,435 Cr), Residential at 44.7% (Rs 8,343 Cr), Infrastructure at 19.7% (Rs 3,680 Cr), and Hotel at 0.8% (Rs 160 Cr). By geography, East constitutes 17.7%, North 46.2%, West 28.3%, South 6.7%, and Overseas 1.1%. Accordingly, ACIL is expected to deliver revenue growth of 15% CAGR over FY25–FY27E

* Strong Order Inflow: The company reported robust YTD order inflows of Rs 9,562 Cr and currently holds L1 status in four projects aggregating Rs 2,485 Cr, indicating a healthy nearterm order conversion pipeline. For FY26, management had guided for order inflows of over Rs 8,000 Cr, which has already been achieved, reflecting strong execution on the business development front. The current bidding pipeline stands at approximately Rs 7,000 Cr. For FY27, management has indicated a relatively moderate order inflow target of Rs 5,000–6,000 Cr, as the strategic focus shifts toward improving execution efficiency, enhancing margins, and ensuring timely completion of existing projects

* NGT (National Green Tribunal) impact on Revenue Growth: The impact of NGT restrictions this year has been more prolonged than anticipated, adversely affecting sales during December and January, with disruptions continuing until the first week of February. The NGT directives led to project closures in Delhi, which is significant given that nearly 44% of the company’s order book is concentrated in the region, thereby materially impacting the topline. Additionally, management expects some disruption in March due to Holi-related labour shortages, which could further affect execution timelines. In light of these challenges, the company has revised its FY26 revenue growth guidance downward to 10–15% from the earlier 15–20%. However, it continues to maintain a revenue growth outlook of 15–20% for FY27, supported by normalization of project activity and execution ramp-up.

Sector Outlook: Cautiously Optimistic

Company Outlook & Guidance: For FY26, revenue growth of 10-15% is expected, with doubledigit EBITDA margins.

Current Valuation: 19x FY27E EPS (Earlier Valuation: 20x FY27E EPS).

Current TP: Rs 915/share (Earlier TP: Rs 1,085/share)

Recommendation: We maintain our BUY rating on the stock

Financial Performance

Ahluwalia Contracts India Ltd. (ACIL) reported a positive set of Q3FY26 numbers. The company reported revenue of Rs 1,061 Cr (up 11% YoY) and EBITDA of Rs 96 Cr (up 14% YoY). It posted a PAT of Rs 54 Cr (up 10% YoY), driven by a large executable order book and better execution. EBITDA margins stood at 9.1% in Q3FY26 (our estimate: 11.6%) compared to 8.9% in Q3FY25.

Outlook:

Given its large executable order book and favourable attributes—including a strong and diversified order book, a healthy bidding pipeline, steady order inflows, an asset-light operating model, and emerging opportunities in the construction space—ACIL is well-positioned to generate healthy cash flows and is expected to deliver revenue/EBITDA/PAT growth of 15%/29%/26% CAGR over FY25–FY27E. However, the continued impact of NGT restrictions remains a key concern, as it is likely to weigh on execution and revenue growth. Accordingly, we have moderated our revenue estimates to reflect the anticipated disruption.

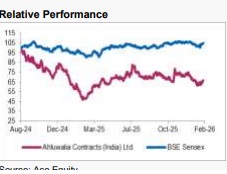

Valuation & Recommendation: The stock is currently trading at 20x/17x FY26E/FY27E EPS. We maintain our BUY rating on the stock, valuing the company at 19x FY27E EPS, with a TP of Rs 915/share, which implies a 15% upside from the CMP.

Key Concall Highlights

* Order Book: The company has an order book of Rs 18,680 Cr (as of 31 st Dec’25). The order book is primarily composed of Hospital at 7.9% (Rs 1,477 Cr), Commercial at 19.2% (Rs 3,586 Cr), Institutional at 7.7% (Rs 1,435 Cr), Residential at 44.7% (Rs 8343 Cr), Infrastructure at 19.7% (Rs 3,680 Cr), and Hotel at 0.8% (Rs 160 Cr). By geography, East constitutes 17.7%, North 46.2%, West 28.3%, South 6.7%, and Overseas 1.1%. The Central Government, State Government, and Private segments account for 20%, 10.6%, and 68.3%, respectively, with the balance from overseas projects

* Order Inflow: The company reported YTD order inflows of Rs 9562 Cr and holds L1 status in 4 projects worth Rs 2485 Cr. For FY26, management had guided for order inflows of over Rs 8,000 Cr, which has already been achieved.

* Capex and Working Capital: The company incurred a Capex of Rs 193 Cr in 9MFY26 and targets Rs 100 Cr in Q4FY26 and Rs 300 Cr in FY27.

* As of 31 st Dec’25: Unbilled revenue stood at Rs 639 Cr, retention money at Rs 431 Cr, and mobilisation advance at Rs 729 Cr. Cash balance stood at Rs 253 Cr, and Gross debt of Rs 22 Cr.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

.jpg)

.jpg)