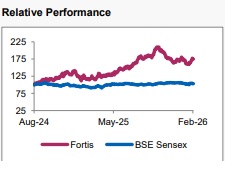

Buy Fortis Healthcare Ltd India Ltd for Target Rs. 1,070 by Axis Direct

Recommendation Rationale

* Strong Revenue Growth Led by Hospitals: Fortis delivered a strong operational quarter with 17.5% YoY growth in consolidated revenue to Rs 2,265 Cr, driven primarily by the hospital segment. Hospital revenue stood at Rs 1,938 Cr (+19.4% YoY), while Agilus reported 7.2% YoY growth in net revenue to Rs 327 Cr. Margin expansion was visible across both hospital and diagnostics segments on a YoY basis

* Stable ARPOB and Occupancy: ARPOB stood at Rs 70,100 (+4.5% YoY), while occupancy remained stable at 67%, supported by a 14% YoY growth in occupied bed days. Hospital EBITDA margin expanded to 21.7%, up 165 bps YoY but down 120 bps QoQ due to seasonality

* Cluster Led Expansion Strategy on Track: Fortis continues to execute its cluster-based growth strategy, adding ~750 operational beds YTD through acquisitions and leases. The Rs 430 Cr acquisition of People Tree Hospital in Bengaluru provides an immediate 125-bed presence in a key micro-market, with adjacent land enabling expansion to 300+ beds. Alongside inorganic additions, the launch of specialised facilities such as Adayu (mental health) strengthens Fortis’ positioning in high-demand urban clusters and enhances clinical depth. We have factored in People Tree Hospital ( Bengaluru) in FY27/FY28 in our assumptions

Sector Outlook: Positive

Company Outlook & Guidance: Fortis Healthcare’s management maintains a highly positive outlook for FY26 and beyond, projecting a sustained growth trajectory driven by aggressive brownfield expansion and optimised clinical operations. The company expects to maintain its current momentum with mid-to-high teens revenue growth in the hospital segment, while targeting a consolidated EBITDA margin of 24–25% over the next two years, up from the current 22.3%. Forward-looking growth is anchored by a significant capacity roadmap to add over 3,200 beds by 2030, with approximately 430 beds slated for operationalisation in FY27, including the key 200-bed new block at the FMRI flagship hospital. Management anticipates occupancy rates will recover from 67% and reach 70–75% within the next year as new assets like Adayu and People Tree Hospital ramp up, while ARPOB is guided to grow at a sustainable 4–5% annually, primarily through an improved speciality mix and higher-complexity quaternary care.

Current Valuation: EV/EBITDA 27x for Dec’FY28E EBITDA (Earlier 28x H1FY28E)

Current TP: Rs 1,070/share (Earlier TP: Rs 1,070/share)

Recommendation: BUY

Financial Performance

For Q3FY26, Fortis Healthcare delivered strong YoY growth, with consolidated revenue rising 17.5% to Rs 2,265 Cr, driven by 19.4% growth in hospital revenue (Rs 1,938 Cr) and 7.3% growth in diagnostics net revenue (Rs 327 Cr). Consolidated operating EBITDA increased 34.8% YoY to Rs 505 Cr, with margins expanding 290 bps to 22.3%, reflecting operating leverage and improved mix. PBT (before exceptional items) grew 21.9% to Rs 312 Cr, while reported PAT stood at Rs 197 Cr, impacted by a Rs 55 Cr one-off exceptional loss related to new labour codes.

Financial Performance (Cont’d) The hospital segment remained the key growth driver, with EBITDA margins improving to 21.7% (vs 20.0% YoY), supported by a 14% increase in occupied beds and a 4.5% rise in ARPOB to Rs 2.6 Cr p.a. High-end robotic surgeries grew 52% YoY, reflecting improving case mix and complexity. The diagnostics arm (Agilus) reported 8.3% gross revenue growth to Rs 371 Cr, with margins rebounding to 23.1%, indicating strong operating recovery and better mix.

Among newer assets, the Manesar facility is progressing well, with a current monthly run rate of ~Rs 15 Cr and now operating at EBITDA break-even; profitability is expected to improve further post completion of the new oncology block. Shrimann Hospital (Jalandhar) has been making a meaningful contribution following its acquisition, operating at an EBITDA margin of ~25% and integrating well into overall occupancy metrics. The Greater Noida unit is generating ~Rs 10 Cr per month; while currently dilutive to consolidated margins during stabilisation, it is expected to achieve ~15% EBITDA margin over the next six months

Fortis has added ~750 operational beds YTD, exceeding initial organic targets. This includes the Jalandhar acquisition, Greater Noida lease, and the Rs 430 Cr acquisition of the 125-bed People Tree Hospital in Bengaluru, which also includes an adjacent land parcel enabling future expansion to 300+ beds. Additionally, the company launched ‘Adayu’, a 36-bed specialised mental health facility in Gurugram, further strengthening its Delhi-NCR cluster. Net debt stood at Rs 2,547 Cr (1.24x Net Debt/EBITDA), reflecting recent investments including the Agilus stake acquisition and hospital expansions in Jalandhar and Bengaluru. Management indicated that, if required, promoter IHH Healthcare could infuse additional capital to support growth and maintain balance sheet flexibility.

Outlook

We remain confident on hospital segment’s strong momentum seen in H2FY26. Hospital revenue growth in H2FY26 is expected to remain comparable to H1 levels, supported by a 4–6% increase in ARPOB, led by a richer speciality mix and a higher share of complex cases such as oncology and robotic surgeries. The operating EBITDA margin is on track to exceed the FY26 guidance range of 22.0–22.5%, aided by operational efficiency gains and margin maturity in newer facilities. Over the medium term, management aims to achieve a 25% EBITDA margin, which is a welcome step. Further Occupancy may remain healthy, and with the planned addition of 430/465 beds in FY27/FY28, blended occupancy is expected to stay within 70–75%. The Manesar facility has turned EBITDA positive, while the Jalandhar and Greater Noida units are expected to meaningfully contribute to earnings as they scale up.

Valuation & Recommendation

We maintain a BUY rating on Fortis Healthcare with a target price of Rs 1,070/share, reflecting a strong upside potential of 17% from the CMP. This valuation is based on a 27x EV/EBITDA multiple for Dec’FY28E, factoring in sustained revenue growth and long-term margin expansion.

Key Risks to Our Estimates and TP

* The economic slowdown could affect the company's overall revenue growth.

* A high attrition rate of doctors might hinder the company's revenue growth. • Unplanned Capex has the potential to weaken the company's balance sheet.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633