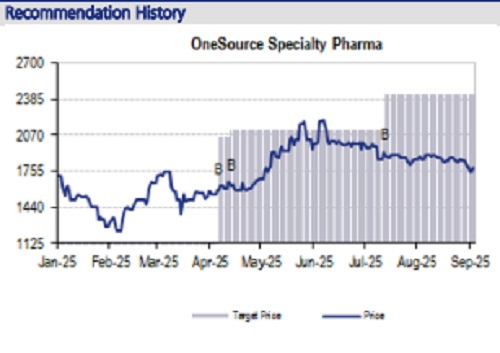

Buy OneSource Specialty Pharma Ltd For Target Rs. 2,417 By JM Financial Services Ltd

OneSource Specialty Pharma has approved a strategic deal to acquire Steriscience’s Polandbased CDMO business and Brooks Steriscience’s anti-infective unit in India. The acquisitions, valued at a relative discount, are expected to add USD 100mn revenue and USD 35mn EBITDA by FY27, taking OneSource’s top line beyond USD 500mn by FY28. While the transaction entails ~18.5% dilution and increases promoter holding to ~36%, it diversifies the portfolio beyond GLP-1, strengthens injectables capacity, and de-risks operations with a European footprint. Although this transaction was announced a few months back, the company published merger ratios and valuation over the weekend.

* Overview: OneSource has approved a strategic transaction aimed at strengthening its global capabilities and expanding capacity. The transaction involves the acquisition of Steriscience’s European CDMO business in Poland and Brooks Steriscience’s anti-infective operations in Vadodara, India. The merger process is expected to take up to 15 months, with approvals required from SEBI, NCLT, Singapore courts, and other regulatory authorities.

* Brooks Steriscience: Brooks Steriscience JV, which has a manufacturing unit to produce penem injectable products, is likely to be added at ~USD 105mn valuation (10.4x EV/EBITDA). It expects the Brooks Steriscience entity to generate ~USD 34mn in revenue by FY27 (FY25 at ~USD 4.7mn) at ~29.4% margin, led by the ramp-up in key products like Meropenem, Ertapenem, and others. Steriscience holds a 51% stake in the Brooks Steriscience entity, which will be merged with OneSource. Brooks, which holds a 49% stake, will receive OneSource shares.

* Steriscience Singapore: The second entity, which is the larger of the two, Steriscience Singapore, owns an injectable unit in Poland. This unit is likely to generate ~USD 73mn in sales and ~39.7% margin by FY27, while FY25 revenue was ~USD 27.7mn. This growth will be led by certain European customer contracts, which consist of some 505(b)(2) product opportunities. This business is valued at ~USD 520mn at an 18.3x EV/EBITDA multiple.

* Financial implication: Both entities combined can add ~USD 107mn to the top line and ~USD 39mn EBITDA by FY27, taking OneSource’s total top line guidance for FY28 beyond USD 500mn.

* Valuation: The transaction values OneSource at USD 2.7bn, reflecting an 18.6% premium to the company’s closing price as of 26th Sep’25, while the incoming assets are acquired at a relative discount to OneSource’s multiples. Shareholders of Brooks Steriscience will receive 137 shares of OneSource for every 10 shares held, and shareholders of Steriscience Singapore will receive 53 shares of OneSource for every 100 shares held. The transaction will lead to approximately 18.5% dilution for existing OneSource shareholders. Post-merger, promoter shareholding will increase from ~30% to ~36%, while public shareholding will dilute from ~70% to ~64%.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361