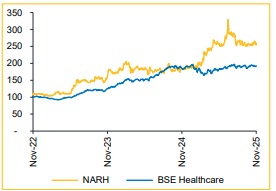

Buy Narayana Hrudayalaya Ltd For Target Rs. 2,500- Choice Broking Ltd

Strategic expansion to drive long-term outperformance:

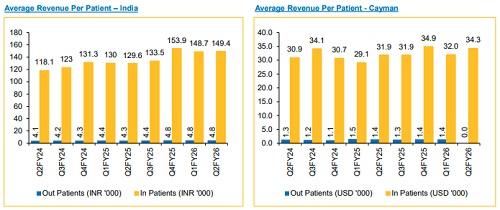

With an INR 3,000Cr expansion pipeline in India, NARH is well-positioned for sustained double-digit revenue growth. In India, initiatives, such as digitisation, patient mix optimisation and focus on high-end specialties, such as oncology and robotic surgeries will continue to drive ARPOB. The Cayman Islands business remains a strong profit engine, contributing ~25% of NARH’s consolidated revenues.

View and Valuation: We project Revenue/EBITDA/PAT to grow at a CAGR of 17.1%/20.3%/23.6% over FY25–FY28E. We are upgrading our valuation multiple to 26x EV/EBITDA (from 22x) on the average of FY27–FY28E, driven by the strong performance of its flagship hospitals in India, growth in ARPP (Average Revenue Per Patient) due to a favourable change in case mix, and continued traction in the insurance business. Accordingly, we revise our target price to INR 2,500 (earlier INR 2,110), implying a P/E of 40x/34x and PEG ratio of 1.1x/1.8x for FY27E/FY28E, and maintain our BUY rating. We expect steady revenue growth and ecosystem synergies to support sustainable profitability, with key breakeven milestones targeted over the next 12–18 months.

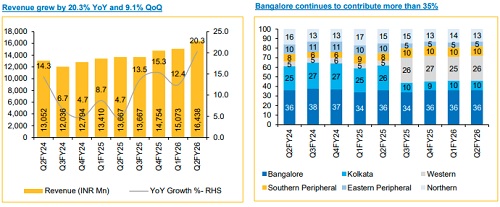

Recorded best-ever quarterly performance with strong revenue and margin

* Revenue grew 20.3% YoY and 9.1% QoQ to INR 16.4 Bn (vs CIE estimates of INR 15.9 Bn), driven by higher ARPP

* EBITDA stood at INR 4 Bn, up 30.3% YoY and 19.5% QoQ, with margin at 24.5%, (+189bps YoY and +213bps QoQ ) (vs CIE estimates of 23.2%)

* PAT grew by 30.1% YoY and 32.1% QoQ to INR 2.6 Bn (vs CIE estimates of INR 2.2 Bn), with a PAT margin of 15.8% as compared to 14.6% in Q2FY25

India capex pipeline: A multi-year capacity expansion story NARH’s India growth story is supported by a committed INR 3,000Cr capex plan over the next 3 years, covering greenfield hospitals, brownfield expansions, O&M models and acquisitions. As these hospitals come online, we expect a steady addition to capacity, revenue and operating leverage. This capex cycle is strategically curated to drive NARH’s next phase of domestic growth while deepening its footprint in high-potential regions. We expect that the flagship units will see increasing realisation while maintaining occupancy, supported by higher-end procedures including robotic cardiac surgeries and improved payermix strategies. These levers, combined with ongoing optimisation initiatives in place for the last 6–8 quarters, will contribute meaningfully to profitability.

Cayman Expansion: A high-growth engine with multi-year runway NARH’s Cayman business continues to be a standout growth engine, driven by the commissioning of the second Camana Bay hospital and strong traction in both, core hospital operations and the rapidly scaling up insurance vertical. The insurance business is also expanding aggressively, backed by strong employer adoption and a large, underpenetrated market of $300–350 Mn. As the size of the book grows, underwriting performance is stabilising, offering a path to breakeven over the coming quarters. With additional departments ramping up and operational efficiencies yet to peak, Cayman is poised to deliver sustained revenue and earnings momentum.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131