Buy Mahindra & Mahindra Ltd For Target Rs. 3,654 By Elara Capital Ltd

Decoding Tesla’s entry in India

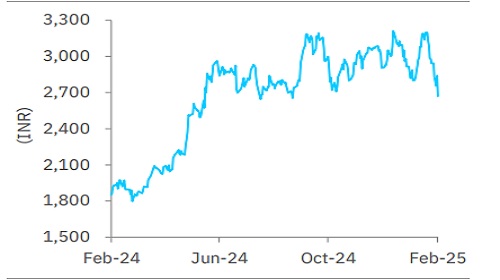

Mahindra & Mahindra’s (MM IN) stock price has corrected ~15% in the past two weeks vs the Nifty which was down ~3%, largely after news flows of Tesla entering India, with a reduced duty structure. Contrary to news flow, we believe Tesla is more likely to enter the country with the pricier Model Y and not even the Model 3, leave alone the yet to be launched Model 2. We believe it is likely to expand BEV (Battery Electric Vehicles) market than impacting M&M BEV. We revise our rating to Buy with an unchanged SOTP-based TP of INR 3,654.

We believe Tesla will introduce the Model Y first in India:

As per media reports in CY21 (link), the Tesla Model 3 had issues passing ground clearance tests in India; hence, we believe Tesla will likely enter India first with the Model Y. The Model Y would likely come at price point of INR 4.5-5mn at a reduced 15% import duty significantly higher than M&M BEV products of INR 2.8mn (ASP of the 30k bookings of customers).

Tesla entry likely to expand the BEV market instead of a direct threat to MM BEV:

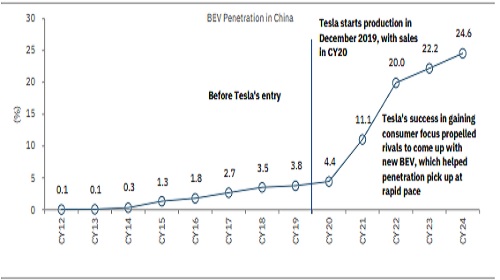

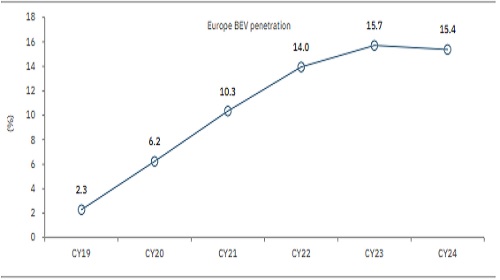

Whenever Tesla enters a market, it expands BEV penetration of that market. Also, ex of Tesla entry, we were expecting MM BEV to eat into ICE products. Even if Tesla were eventually to launch a cheaper USD 25,000-30,000 vehicle (its launch has been delayed globally), it would be with fewer features than current MM BEVs. A customer buying a BEV at INR 2mn+ over ICE is not going to buy it looking at total cost of operations but by considering, either: 1) high brand aspirational value with fewer features (in this case potentially the Model 2), or 2) a superior product in terms of features and capabilities, such as MM BEV over other recent BEV launches; thus lowering threat for M&M.

Source: Bloomberg

Scenario analysis of Tesla’s India market share:

Tesla prices in India are likely to be ~4x+ average selling prices of vehicles currently and ~2x over the next five years if the Model 2 is launched. In the EU, the US and China, this ratio currently is ~1.0-1.5x; Tesla’s BEV market share is 10-15% in the EU & China and ~44% in the US. This translates to PV market share of less than 5% in these regions. If we were to assume a 10-15% market share in BEV in India by FY30E, Tesla would garner a mere ~1.5-2.0% share of PV for 15% BEV penetration in base case and 3.0-4.5% for ~30% BEV penetration in a bull case.

Product quality and execution of software key for MM BEV even ex of Tesla entry:

Seamless execution of product quality and glitch-free software experience are key monitorable for MM BEV. As highlighted in our recent thematic “China energizing seismic shifts”, released on January 27, major global legacy OEM have struggled with software issues which hit BEV brands. Tesla is known for its superior software capabilities and customers will have a credible benchmark. We also are monitoring China’s BYD manufacturing in India, as its products globally are priced lower. Currently, BYD does not seem to have plans of taking advantage of India’s EV policy, as per media reports (link).

Revise to Buy with an unchanged TP of INR 3,654:

Given ~15% stock price reaction in the past two weeks, we revise to Buy from Accumulate with an unchanged SOTP-based TP of INR 3,654. The stock is trading at ~11.9x FY27E EV/ EBITDA (ex of subsidiary), cheaper than Maruti Suzuki’s 12.5x. Failure of BEV launches and tractor downcycle are key risks to our call.

Exhibit 1: BEV penetration picks up sharply post Tesla’s entry in China

Note: Automobility, Elara Securities Research

Exhibit 2: In the EU, BEV penetration picks up post COVID-19 and Tesla Model Y launch

Please refer disclaimer at Report

SEBI Registration number is INH000000933