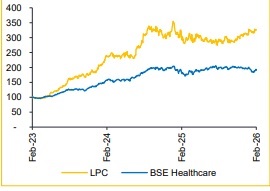

Buy Lupin Limited for the Target Rs.2,630 by Choice Institutional Equity Limited

Execution Strength Intact; High-value Launches Support Growth in FY26 We continue to believe the company will sustain its strong growth trajectory, driven by high-value launches in North America and an improving product mix in India. Given the unusually strong launch pipeline in FY26, we expect robust double-digit revenue growth, with EBITDA margin in the 27–28% range, in line with management guidance. However, growth is likely to normalise to the lowteens in FY27, with margin moderating to ~25% as certain products lose exclusivity. That said, the company’s structural growth outlook, supported by a healthy pipeline of differentiated products, remains compelling. In line with the improved near-term outlook, we have revised our FY26/27E estimate upwards by 17.2%/13.2%, respectively. We continue to value the stock at 25x the average of FY27–28E EPS, resulting in a revised target price of INR 2,630 (from INR 2,375). We maintain our BUY rating.

Healthy Margin Expansion; PAT Impacted by One-offs

? Revenue grew 24.3% YoY / 1.7% QoQ to INR 71,675 Mn (vs. CIE estimate: INR 73,225 Mn).

? EBITDA grew 66.8% YoY / declined 3.4% QoQ to INR 22,619 Mn; margin expanded 805 bps YoY / contracted 166 bps QoQ to 31.6% (vs. CIE estimate: 28.2%).

? PAT grew 36.9% YoY / declined 20.5% QoQ to INR 11,756 Mn (vs. CIE estimate: INR 14,523 Mn).

? The company reported an exceptional expense of INR 4,266 Mn toward legal settlements; adj. PAT stood at INR 15,064 Mn.

North America Momentum; Moderation Ahead

North America delivered another quarter of strong growth, primarily driven by Tolvaptan, which captured ~35% market share under its 180-day exclusivity, alongside a recovery in the base business. We expect the region to remain a core growth engine in FY26, with strong double-digit growth. However, from FY27, we anticipate moderation in growth momentum, reflecting increased competition in Tolvaptan, lower per-unit profitability in Mirabegron and the gradual ramp-up of biosimilars slated for launch in Q4. While near-term growth may normalise, we believe the structural growth outlook for North America remains intact

India: LOE Weighs on FY26;

Recovery in FY27 India growth remained in the mid-single digits, impacted by loss of exclusivity (LOE) in key diabetes brands and lower contribution from local tenders. We expect FY26 growth in the high single digit, supported by stronger traction in the chronic portfolio, while FY27 could see low-teens growth, driven by the Semaglutide opportunity and incremental in-licensing launches. The company continues to expand its field force, including the addition of ~200 dedicated medical representatives for Semaglutide. While this strengthens execution capability, it may exert near-term pressure on EBITDA margin in FY27.

Management Call – Highlights

US Business

? Highest-ever quarterly US sales achieved, supported by new product launches and base business recovery

? Tolvaptan – currently the sole generic with ~35% share; continues to be a meaningful revenue and margin contributor.

? Pegfilgrastim biosimilar to be launched in Q4FY26 and Ranibizumab biosimilar expected in FY27.

? Holds a 40% generic market share in Mirabegron and despite a settlement-related profit impact, remains an attractive and meaningful contributor to revenues through FY27 and part of FY28, with continued cost control supporting Gross and EBITDA margin.

? 3 product launches in this quarter; 1 ANDA approval received; plans to file 10-15 ANDAs in FY26 including two 505(b)(2)s.

? Single-digit price erosion; offset by higher volumes and seasonal tailwinds.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131