Buy KEI Industries Finance Ltd For Target Rs. 4,500 By JM Financial Services

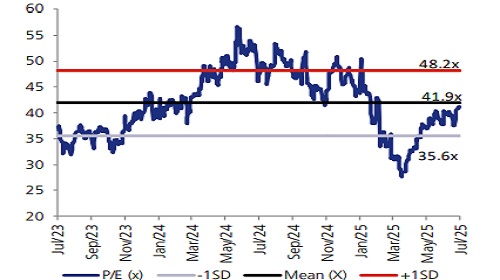

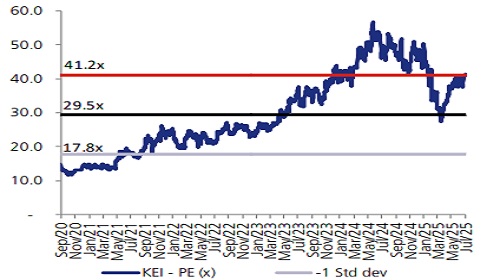

KEI’s 1Q numbers were a beat on JM and street estimates. 1Q revenue at INR 26bn, rose 26% YoY and PAT at INR 2bn, rose 30% YoY. KEI’s strong 1Q performance was driven by robust growth in, both, the domestic and export segments. Within the domestic business, both institutional (+39% YoY) and retail (+22% YoY) channels grew well. Further, KEI’s export business registered a 121% YoY growth. Incrementally, in line with the company’s strategy, revenue from the EPC segment declined. While 1Q was a good quarter for KEI, we await more clarity on the sustainability of this performance and the way forward. The concall is scheduled for 12PM tomorrow (click here to register). We maintain buy with a target price of INR 4,500 set at 40x Jun’27E EPS.

* Strong 1Q performance, PAT +30% YoY growth:

1Q revenue at INR 26bn, +26% YoY was a 6% beat on our estimate and 7% beat on consensus estimates. This was driven by strong growth in both, the domestic and export markets. EBITDA grew 20% YoY to INR 2.6bn, (~5% beat on our/consensus estimates) driven by a strong operating performance and lower-than-expected subcontractor expenses. 1Q EBITDA margins stood at 10%, 40bps lower YoY, and in-line with JM and street expectations. 1Q PAT stood at INR 2bn, +30% YoY; 10% ahead of our estimate and a 13% beat on consensus expectations.

* Good overall segmental performance, executing well on strategy: In 1Q, KEI’s cable and wires segment witnessed a robust 32% YoY growth in revenue to INR 24.7bn, with EBIT margins in this segment declining 20bps to 10.8%. Further analysing the product-wise revenue split we note that KEI’s EHV business registered a 56% YoY growth in revenue (inherently higher margin business but no major impact given only 5% of total revenue), while revenue from high voltage and low voltage cables registered a growth of 50% and 23% YoY respectively. EPC business revenue declined 53% YoY to INR 60mn from INR 130mn last year and contributed ~2% to overall business vs 6% last year, in line with the management’s strategy.

* Domestic and export channels, both fire well: KEI’s strong 1Q performance was driven by robust growth in, both, the domestic and export segments. Within the domestic business, both institutional (+39% YoY) and retail (+22% YoY) channels grew well, while revenue from the EPC business saw a decline to INR 994mn vs. INR 2.3bn YoY. The number of distributors increased to ~2,100 from ~2,000 last year. Further, KEI’s export business registered a 121% YoY growth.

* Sanand greenfield expansion on track: KEI’s INR 20bn greenfield capacity in Sanand is expected to be commissioned by Sept’25. This will be the first phase of this new capacity. Further, production of EHV cables in this facility is expected to commence by 1QFY27.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361

.jpg)

.jpg)