Buy Indraprastha Gas Ltd for the Target Rs. 235 by Motilal Oswal Financial Services Ltd

CNG volume growth key monitorable

? IGL’s 3QFY26 EBITDA/scm (adjusted for labor code impact of INR293m) came in 5% above our est. at INR5.8. Gas costs decreased ~INR0.9/scm QoQ in 3Q. Total volumes were slightly below our estimate at 9.42mmscmd, up 3% YoY. Resulting adj. EBITDA was 4% above our estimate at INR5b (+38% YoY). IGL’s adj. PAT came in line with our est. at INR3.8b (+33% YoY).

? Key things we liked about the result: 1) Raw material costs declined INR0.8/scm QoQ amid margin headwinds despite a 23% QoQ increase in Henry Hub (HH) price and rupee depreciation of 2% QoQ in 3Q. 2) Management has guided for a robust 1mmscmd YoY growth trajectory in FY27/28 and stable EBITDA margin of INR7/scm. 3) Zonal tariff reform and tax reduction in Gujarat should result in EBITDA margin gain of ~INR1/scm for IGL. 4) The company plans to add 80-100 CNG stations p.a. over the next few years to drive volume growth.

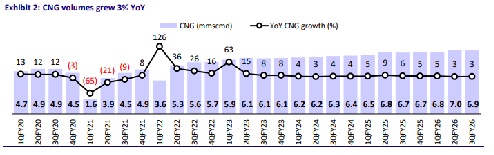

? Key investor concerns: 1) CNG volume growth stood at only ~3% YoY, primarily due to falling volumes from DTC buses. However, management has highlighted that DTC buses would go to zero in 4QFY26. CNG volume growth, excl. DTC and DIMTS buses, was ~10% YoY in 3Q. 2) With HH prices averaging USD7.2/mmbtu in Jan’26 compared to USD3.7/mmbtu in 3QFY26, EBITDA/scm margins are likely to face pressure in 4QFY26.

? Valuation and view: We value IGL at 15x Dec’27E SA P/E and add INR43/sh as the value of JVs to arrive at our TP of INR235/sh. At 3% FY27E dividend yield and 9% EPS growth over FY25-28, we believe the valuation is attractive. Reiterate BUY.

Key takeaways from the 3Q earnings call

? IGL maintains volume guidance of 10mmscmd by FY26-end. The company plans to add 1mmscmd per annum over FY26-28.

? Regulatory developments: 1) Replacement of 15% VAT with 2% CST on domestic gas sourced from Gujarat will result in lower gas costs for IGL by ~INR0.25/scm. 2) Two-zone tariff reform will also benefit IGL in terms of lower gas cost by ~INR0.75/scm (after partial pass-through to customers). 3) Owing to these factors, management has maintained EBITDA/scm margin guidance of ~INR7/scm.

? Other takeaways: 1) IGL will incur core capex of INR12.5b in FY26 (INR8.5b spent in 9MFY26) and INR12-13b in FY27. 2) 3Q gas sourcing split for priority segment sale: APM/NW gas/HP-HT/RLNG: 3.38/0.57/0.5/5.3mmscmd; 3) Middle East tender process: IGL sees a sales potential of ~6mmscmd (1.5mmscmd per city x 4 cities); IGL will submit tender for phase 2 by Apr’26

In-line performance; Volume growth disappoints

? Total volumes were slightly below our estimate at 9.42mmscmd (our est.: 9.53mmscmd), up 3% YoY.

? CNG and PNG volumes stood 1%/3% below est.

? EBITDA/scm (adjusted for labor codes impact of INR293m) came in 5% above our est. at INR5.8.

? Realization decreased by ~INR0.1/scm QoQ and gas costs decreased by ~INR0.9/scm QoQ, while opex increased by ~INR0.2/scm QoQ.

? Resulting adj. EBITDA was 4% above our estimate at INR5b (+38% YoY).

? IGL’s adj. PAT came in line with our est. at INR3.8b (+33% YoY).

? The board has declared an interim dividend of INR3.25/sh (FV: INR2/sh).

Valuation and view

? IGL currently trades at 14.9x 1-year fwd. P/E, below its mean – 1 S.D. P/E. However, we believe that earnings have bottomed out now. We estimate EBITDA margin to improve to INR5.5/INR6.5/INR6.5 per scm and volumes to clock 6% CAGR over FY25-28E. Resultant EBITDA and PAT are estimated to clock a CAGR of 9% each over FY25-28E.

? We value IGL at 15x Dec’27E SA P/E and add INR43/sh as the value of JVs to arrive at our TP of INR235/sh. At 3% FY27E dividend yield and 9% EPS growth over FY25-28, we believe the valuation is attractive. Reiterate BUY.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412