Buy GAIL Ltd For Target Rs. 195 by Motilal Oswal Financial Services Ltd

Robust transmission outlook; petchem diversification to fuel growth

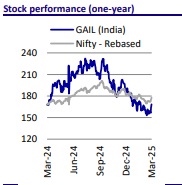

* In the last five-and-a-half months, GAIL’s share price has corrected ~30% with the stock now trading at 9.2x FY27E P/E. We maintain our positive outlook on GAIL, based on the following factors:

* Strong transmission and marketing outlook: We estimate a 7% CAGR in transmission and marketing volumes over FY24-27. The International Energy Agency (IEA) estimates India’s natural gas consumption to rise 60% by 2030 from 65bcm in 2023. Further, IEA estimates India’s LNG consumption to grow at 11% p.a. over 2023-2030, driven by the city gas distribution (CGD), power and industrial sectors. GAIL will be the key beneficiary of rising gas penetration in India. Key catalysts for GAIL in FY26 include the start of 3,115km new pipelines and a potential tariff hike in 1QFY26 (5% PAT impact).

* Larger and more diversified petchem capacity to power earnings: GAIL is set to expand its petrochemical capacity from 810ktpa currently to ~2.7mmtpa by FY27 as PDH-PP and Gail Mangalore Petrochemicals Ltd projects commence operations. Further, the petchem product mix is set to diversify, with the share of ethylene and derivatives decreasing from 100% to 30% of the portfolio as new projects come online. Feedstock sources too will be diversified, with PX and propane making up 70%. Overall, we believe a diversified product slate should help to reduce petchem earnings volatility and position the segment as a major profit driver for the company.

* Valuations are compelling; FY27 dividend yield at 4.3%: GAIL share price has corrected 30% over the past five-and-a-half months and now trades at 8.1x SA 1yr fwd. P/E (excl. listed investments). We foresee limited downside from the current level amid robust transmission volume growth, a steady marketing outlook and a diversified petchem portfolio. FY27E dividend yield of 4.3% is ~56% above the 10Y median dividend yield and looks attractive. We cut our EBITDA/PAT estimates by 7% to 11% for FY26/FY27, as we 1) lower our petchem margins amid sequentially weak spreads and soft outlook, 2) build in 3-6-month delays in the commissioning of upcoming petchem facilities, 3) slightly moderate our FY26/FY27 transmission volume assumptionsto 140/150mmcmd (vs. 144/154mmscmd earlier), 4) marginally lower our marketing segment EBITDA. We now value gas transmission, marketing and petchem segments at EV/EBITDA of 8x/5x/5.5x. Accordingly, we reiterate BUY on GAIL with our SoTP-based TP of INR195.

Transmission volumes to grow by 11/10mmscmd in FY26/FY27

* We are currently building in transmission volumes of 129/140/150mmscmd in FY25/FY26/FY27, in line with management guidance. Management expects ~2- 4mmscmd p.a. growth from CGD sector, 1mmscmd from NRL startup, and the rest from refinery and pipeline expansions. Our bullish view is also supported by IEA’s strong growth projection for gas demand in India, driven by Power, CGD, and industrial sectors. This is positive for transmission and marketing segments.

* As per IEA, India's natural gas consumption is projected to rise by nearly 60% by 2030 from 65bcm/year in 2023 to 103bcm/year.

* The CGD sector is expected to be the primary driver, supported by the rapid expansion of compressed natural gas (CNG) infrastructure and the cost advantage of gas over liquid fuels for small industrial users.

* Demand from heavy industrial and manufacturing sectors, including iron and steel production, will contribute an additional 15bcm per year by 2030.

* Gas consumption in oil refining is projected to rise by over 4bcm per year as more refineries connect to the grid. IOCL’s Panipat refinery expansion (from 15mmtpa to 25mmtpa) and Gujarat refinery expansion are expected to be completed in FY26.

* As per IEA, with targeted strategies and policy interventions, gas consumption could exceed the current forecasts and reach ~120bcm per year by 2030.

CGD key driver of natural gas demand

* Between 2023 and 2030, IEA expects city gas demand in India to grow by almost 70%, translating into an annual increase of 9bcm and a CAGR of nearly 8%.

* The majority of this growth will be driven by CNG (5.8bcm/year contribution) and small industries (2.8bcm/year contribution), while residential and commercial users are projected to contribute ~0.5bcm/year.

* During 2023-2030, CNG consumption is forecast to increase by over 75%, exceeding 13bcm/year by the end of the decade. This surge is driven by the expansion of the CNG filling station network, the continued cost advantage of CNG at the pump, and growing concerns over urban air pollution, particularly in cities where the transport sector plays a major role.

India's LNG imports projected to more than double from 2023 to 2030

* Between 2024 and 2030, while production will be supported by increasing onshore output from coal bed methane (CBM) and discovered small fields (DSF), overall growth will be limited by plateauing output from the KG-D6 fields and declining production from legacy assets such as ONGC’s Mumbai offshore fields.

* As a result, production in 2030 is projected to reach just under 38bcm, reflecting an increase of only around 8% compared to 2023 levels.

LNG consumption to grow at 11% p.a. over 2023-2030

* IEA expects LNG consumption to reach 64bcm per year by 2030, reflecting an average annual growth rate of 11% over the period, a rate that is double what was seen in the previous decade.

* After 2028, the gap between secured LNG contracts and projected demand is anticipated to widen considerably, which could leave India more vulnerable to fluctuations in the spot LNG market unless additional contracts are negotiated.

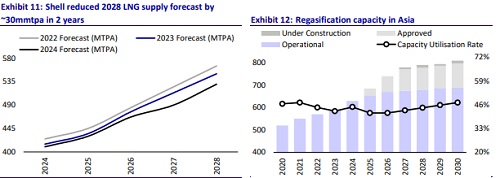

Shell anticipates softer spot LNG market in 2HCY25

* In its LNG outlook 2025 released recently, Shell highlighted that while global LNG demand and supply growth would align in 2025, the majority of supply expansion is anticipated in 2HCY25 and could potentially lead to a tighter spot LNG market in 1HCY25. Out of the expected capacity addition of 17-26mmtpa in 2025, Shell expects ~4-10mmtpa capacity to come up in 1HCY25. However, in 2HCY25, as new capacity becomes operational, LNG prices are expected to soften and should support LNG demand.

* In line with IEA, Shell also expects the long-term demand outlook for LNG to remain robust, notwithstanding the noise around de-carbonization and climate change. India and China are expected to be the primary drivers of global LNG demand growth, with Asia's regasification capacity projected to reach around 800mmtpa by 2030 (~620mmtpa in 2024).

* Shell has also lowered its forecast for additional LNG supply entering the market between 2024 and 2028 by ~30mmtpa over the past two years, underscoring persistent delays in supply growth and project timelines. We believe shifting project timelines remain a risk going forward for our/street’s base case scenario of softer spot LNG prices in 2HCY25.

Transmission tariff hike, robust volume growth to drive earnings

* We believe the probability of gas price-related tariff hikes coming through remains high, as PNGRB had considered a gas price of USD12.46/mmbtu for GUJS recently. We anticipate that GAIL could benefit from a 10-12% tariff increase, potentially boosting the company’s FY26E PAT by 5%.

* While gas transmission volumes grew only by 2mmscmd p.a. over FY15-FY24, they grew 9mmscmd during 9MFY25 and are expected to grow by ~10mmscmd p.a. over the next two years. For the same period, transmission business has generated average RoCE of 10% and is expected to generate 12% RoCE in FY25. Hence, with a robust volume growth outlook and strong RoCE generation, we value transmission business at 8x FY27E EV/EBITDA in our SoTP-based valuation.

Healthy FCF spurt expected in FY26 and beyond as capex winds down

* GAIL is currently constructing 3,115km of gas transmission pipelines, including the Mumbai-Nagpur-Jharsuguda, KKBM and JHBD pipelines, and ramping up its petchem capacity by 1,860ktpa. The company expects to incur a cumulative capex of INR153b for transmission projects and INR173b for petchem projects. They are scheduled for completion next year.

* As earnings contribution from these projects begins, we are building in FY26E RoE of 14%, up from 9.5% in FY23.

* With the impending end of the capex cycle and no major projects ahead, the small-scale LNG and CBG projects or LNG pumps for transport could emerge as potential avenues for capex. However, these are unlikely to entail significant investments and we estimate FCF to rise meaningfully in the coming years.

Petchem in transition as capacity ramps up, feedstock/product diversify

* We believe GAIL’s petchem segment is set to undergo a transition as 1) overall petchem capacity is set to rise from 810ktpa to ~2.7mmtpa by FY27 end, 2) overall product slate is set to diversify as ethylene and derivatives will form 30% of product slate (from 100% now) when new projects begin operations, 3) GAIL will achieve feedstock diversification with PX and propane forming 70% of overall feedstock. We think these factors should help GAIL lower earnings volatility and establish the petchem segment as a key profit engine for the company in the coming years.

* GAIL currently has a gas-based petrochemical plant at Pata with a capacity of 810ktpa. The 500ktpa propane-based PDH-PP plant at Usar, 1250ktpa PX-based GAIL Mangalore petrochemical PTA plant and 60ktpa Polypropylene plant at Pata – all are expected to be commissioned in FY26/1HFY27. In the 3QFY25 conference call, management had guided that the current average realization of INR88k/mt at Pata is likely at the bottom already.

* For the PDH-PP plant at Usar, GAIL has already tied up a 15-year propane supply contract.

Valuation and View

* We reiterate BUY on GAIL with our SoTP-based TP of INR195. During FY24-27, we estimate a 10% CAGR in PAT driven by:

* an increase in natural gas transmission volumes to 150mmscmd in FY27 from 120mmscmd in FY24;

* substantial improvement in petchem segment’s performance over FY26-FY27 as the new petchem capacity will be operational and spreads are bottoming out;

* healthy trading segment profitability with guided EBIT of at least INR45b/INR40b in FY25/FY26.

* We cut our FY26/FY27 EBITDA/PAT estimates by 7% to 11%, as we 1) lower our petchem margins amid sequentially weak spreads and soft outlook, 2) build in 3-6- month delays in commissioning of upcoming petchem facilities, 3) slightly moderate our FY26/FY27 transmission volume assumptions to 140/150mmcmd (vs. 144/154mmscmd earlier), 4) marginally lower our marketing segment EBITDA. We now value gas transmission, marketing and petchem segments at EV/EBITDA of 8x/5x/5.5x.

* We expect RoE to improve to ~14.2% in FY26E from 9.5% in FY23, with a healthy FCF generation of INR65.2b in FY26 (vs. -INR45.3b in FY23), which we believe can support its valuations.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412