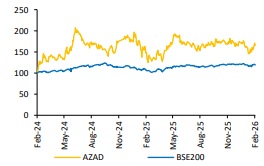

Buy Azad Engineering Limited for the Target Rs.1,900 by Choice Institutional Equity Limited

Calibrated Growth Despite Large Backlog

AZAD delivered a strong operational quarter, marked by meaningful margin expansion and continued execution discipline. The company is steadily scaling up its global top-tier OEM relationships, reinforcing its positioning in high-precision aerospace and turbine supply chains. Visibility is exceptionally strong owing to a robust order book of ~INR 65 Bn (~14.2x FY25 revenue). As programmes move from qualification in FY26 to anticipated peak utilisation by FY28, we expect volume-led operating leverage to structurally lift earnings.

We believe that AZAD stands to benefit from global aerospace and energy capex cycles in the next few years. Its 85–95% export exposure positions it favourably amid deepening India-US and India– EU industrial cooperation. Additionally, easing of tariffs on critical raw materials should support cost-efficiency. The upcoming delivery of India’s first indigenous jet engine platform provides optionality.

That said, the management continues to guide for a measured ~35% topline growth trajectory despite having a large backlog, indicating calibrated scaling up rather than aggressive ramp-up. In view of moderated near-term growth expectation, We trim our target multiple to 45x (earlier 50x). Following the recent correction, we upgrade the stock to BUY (from ADD) with a TP of INR 1,900, valuing it at 45x FY28E EPS.

Healthy Q3 show; marginally missed estimates

? Revenue for Q3FY26 up by 31.7% YoY and up by 9.0% QoQ at INR 1,587 Mn (vs CIE est. INR 1,595 Mn)

? EBITDA for Q3FY26 up by 45.3% YoY and up 18.4% QoQ at INR 622 Mn (vs CIE est. INR 578 Mn). EBITDA margin stood at 39.2%, which is an improvement of 366 bps YoY (vs CIE est. of 36.2%)

? PAT for Q3FY26 up by 46.4% YoY and up 6.5% QoQ at INR 347 Mn (vs CIE est. INR 354 Mn). PAT margin improved by 219 bps YoY, reaching 21.9% (vs CIE est. 22.2%)

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131