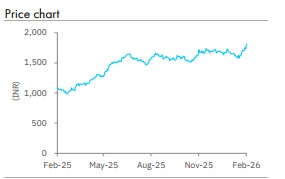

Accumulate Max Financial Services Ltd for Target Rs 2,040 by Elara Capitals

Max Financial Services (MAXF IN) reported a stable Q3FY26 performance, with Axis Max Life delivering ~28.8% YoY Annual Premium Equivalent (APE) growth to INR 27.8bn, driving ~34.8% YoY Value of New Business (VNB) growth to INR 6.6bn and a 90bp expansion in VNB margin to 24.1% (9MFY26: 23.6%, +175bp). Growth was supported by a balanced product mix and strong traction in high-margin protection (+98.5%) and annuity (+141%) segments, aided by GST tailwinds. The proprietary channel posted 51.7% YoY growth, driven by higher advisor activation and productivity, while the partnership channel grew ~13% with new relationships contributing ~5% of individual APE. Key monitorables include: 1) sustained APE growth, higher than industry through better agent activation and banca channel, 2) VNB margin in the range 24-25%, led by better product mix, especially retail protection, and 3) the impact of operating variance on EV due to weakening early bucket persistency. We revise to Accumulate with a higher TP of INR 2,040.

Robust VNB growth and margin expansion: Strong VNB performance was underpinned by a meaningful expansion in margin, which rose 90bp YoY to 24.1% in the quarter (from 23.2% in Q3FY25) and APE growth. Margin improvement was primarily driven by a well-balanced and resilient product mix -- with ULIP at ~36%, participating products at ~19%, non-par savings at ~17%, protection at ~17%, and annuities at ~10% in Q3FY26. Despite a ~300-350bp gross GST drag from loss of input tax credit, the company offset one-third of the impact through cost optimization, distributor negotiations, and product mix shifts toward highermargin segments. Margin sustainability would be supported by protection and annuity scaling, higher proprietary channel productivity, and digitization-led efficiency gains. We build in ~14.6% APE CAGR during FY26-28E, with a VNB CAGR of ~17.7%.

Proprietary-led distribution momentum: Axis Max Life’s distribution strength continues to drive outperformance, with proprietary channels posting strong growth across agency, direct sales force, and cross-sell engines, led by improved advisor activation and productivity gains. Persistency remains healthy, with 25-month persistency at a record 76% and 13-month at 85% in Q3FY26, although some early-bucket softness has emerged from select post-surrender regulation products, which is already factored into the pricing. Management expects stabilization, led by digital engagement initiatives, proactive servicing, and a continued focus on quality acquisition

Revise to Accumulate with a higher TP of INR 2,040: We revise to Accumulate from Buy, primarily due to stretched valuation. We raise our P/EV to 2.2x from 1.8x, supported by visibility on growth, industry-leading RoEV, and a reversal of the holdco discount. We raise our TP to INR 2,040 from INR 1,790 as we roll forward our valuation by a quarter. We increase our APE estimates by 1.7% for FY26, 1.7% for FY27 & 0.5% for FY28E and VNB estimates by 5.1% for FY26, 6.5% for FY27 & 5.6% for FY28, due to better visibility of higher VNB margin and the prominent steps taken to offset the impact of GST.

Please refer disclaimer at Report

SEBI Registration number is INH000000933