Buy Kaynes Technology India Ltd For Target Rs.5,624 by Prabhudas Liladhar Capital Ltd

Management clarifies key business concerns

Company hosted a conference call to address key business-related concerns, during which management provided detailed clarifications on the accounting treatment of goodwill vs intangible assets on account of Iskraemeco and sensonic acquisitions, progress on receivable management, and the steps taken to improve accuracy in related-party transactions, margin reporting, purchase price allocation, and related-party disclosures. Company also provided clarity on cash flow reconciliation and broader working capital metrics. Management indicated that financing arrangements such as bill discounting and factoring are not expected to materially impact on overall profitability. Smart metering will constitute a declining portion of the portfolio as other verticals—including automotive, industrial, EV, railways, aerospace, and defense—continue to scale. The company reiterated its ongoing efforts to strengthen internal controls, enhance disclosure quality, and improve receivable management.

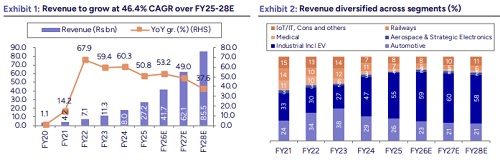

We downward revise FY26/FY27/FY28E earnings estimate by 1.8%/11.5%/7.8% and maintained our ‘BUY’ rating with our DCF-based TP is Rs 5,624 (earlier Rs 7,565), implying PE of 45x FY28E earnings. We estimate FY25-28E revenue/EBITDA/PAT CAGR of 46.4%/48.4%/41.2%, with EBITDA margin expansion of ~60bps.

Key Takeaways

* Iskraemeco Financial Performance & Receivable Management Update: In H2FY25 margins stood at 9% on revenue of Rs 5,327mn and PAT of Rs 489mn, while H1FY25 losses were driven by weak revenue of Rs 851mn, largely unchanged fixed costs, inventory write-offs from due diligence, and broader corporate clean-up adjustments. For Iskraemeco, H1FY26 receivables were Rs6.9bn and Rs2.4bn under other current assets, with management actively pursuing discounting and faster collections. H1FY26 revenue was ~Rs 5bn, with ~Rs3bn execution expected in H2FY26; part of H1 revenue will shift to non-current assets as it relates to pre-acquisition contracts.

* Goodwill & Intangible Asset Accounting Clarification: Kaynes acquired Sensonic and Iskraemeco for Rs 883mn, with identifiable intangibles of Rs1,150 mn recognized under technical know-how and a net capital reserve of Rs10.3mn. Management clarified that, as per Ind AS 103, these intangibles— mainly customer contracts—are amortized and netted off against goodwill, reflecting a more conservative accounting approach.

* Related-Party Transaction (RPT) Disclosure: Management clarified that all related-party transactions were properly eliminated at the consolidated level as per Ind AS, and the lapse was limited to an inadvertent omission in the standalone disclosure, which has now been rectified. To prevent recurrence, the company is developing an automated software-based contra-entry system for RPTs, currently implemented on a limited scale and to be expanded through full system integration.

* CAPEX: For OSAT capex of Rs10.3bn will be funded through QIP and internal accruals of ~3.8bn. For PCB, capex of 14bn of which balance requirement is of 3.2bn and central government subsidy of Rs3bn, will be funded with QIP and internal accruals of ~1.6bn.

* Interest cost: As per management, while calculating interest cost on average borrowings, the bill-discounting component also needs to be considered, and the effective interest cost works out to ~10%, including all discounted bills. The company’s response indicates that the discounting cost associated with long-term smart-metering receivables is already embedded in the contract pricing, and bill discounting is undertaken judiciously based on a cost–benefit assessment. With respect to receivables provisioning, all provisions are made strictly in accordance with the company’s Expected Credit Loss (ECL) policy.

* On the R&D expenses, management highlighted progress under the Kavach program, which is being developed using German technology. It was clarified that all experimental R&D expenditures are expensed, while only those costs that are developmental in nature and meet capitalization criteria are recognized as intangible assets and amortized once revenues commence.

* Regarding promoter shareholding, management reiterated that there are no plans in the near term to alter promoter stake.

* With respect to cash flows, management stated that while the EMS business has not yet achieved full free cash flow, operating cash flow is expected to remain positive and improve with better asset turns. However, free cash flow is expected to remain negative in the near term due to continued investments required for growth.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271

.jpg)

.jpg)