Buy Ajanta Pharma Ltd For Target Rs. 3,180 By Choice Broking Ltd

Business Overview: Ajanta Pharma (AJP) is a specialty pharmaceutical company engaged in the development, manufacturing, and marketing of high-quality generic and branded formulations, primarily focused on specialty segments such as ophthalmology, dermatology, cardiology, and anti-malarials. The company derives a significant portion of its revenue from branded generics in emerging markets (43% in FY25) across Asia and Africa, while its US generics business continues to expand, contributing 23% to overall revenues as of FY25. AJP operates six manufacturing facilities—two of which are US FDA-approved—supporting its global footprint across over 30 countries. The company’s product portfolio spans over 250 molecules with multiple dosage forms, including tablets, capsules, injectables, and ophthalmic solutions. Its strong R&D capabilities are reflected in a robust pipeline of differentiated ANDAs and branded formulations tailored to underserved therapeutic areas.

How meaningful are AJP’s recent and upcoming launches in driving its next leg of growth across key markets?

AJP’s recent product launches are not just additions—they’re strategically significant for driving growth. In the US, Oxtellar XR, launched as an authorized generic, targets a limited-competition segment with attractive margins. Fluvoxamine ER, a complex antidepressant, adds depth to AJP’s neuro-psychiatric portfolio. With seven additional US launches planned in FY26, including differentiated and difficult-to-make products, we expect strong revenue ramp-up, supported by AJP’s strong supply chain and high fill rates. In Asia and Africa, the launch of 25 and 13 branded products respectively, with a focus on chronic therapies, strengthens AJP’s leadership in key sub-therapeutic segments. We believe these launches will sustain low double-digit growth in branded generics and drive high-teens growth in US generics, in line with management guidance.

With expanding operations and field strength, can AJP manage cost pressures while sustaining earnings growth?

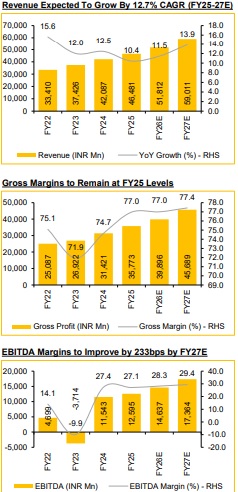

AJP’s operating costs are set to rise in FY26E, driven by higher promotional spend, field force expansion (~450 MRs added), and pre-commercialization investments for new product launches across India, US, and emerging markets. While this will likely cap EBITDA margin expansion in the near term (guidance: 27–28%), absolute EBITDA is still expected to grow YoY. We view this as a transitory phase, with investments laying the foundation for stronger operating leverage from FY27E onward. As the product pipeline commercializes and promotional intensity normalizes, we expect a margin recovery and a stronger earnings trajectory. Ajanta remains well-positioned for sustainable, profitable growth.

Why Invest in AJP?

AJP is well-positioned for sustainable growth driven by strong execution and strategic investments:

? Revenue Visibility Across Key Markets: Strong growth expected in FY26 led by high-teen growth in US generics (Oxtellar XR, Fluvoxamine ER + 7 launches) and low double-digit growth in branded generics across India, Asia, and Africa.

? Strategic Capacity Addition: New Pithampur liquid plant enhances control and scalability in emerging markets, replacing third-party manufacturing.

? Short-Term Margin Impact, Long-Term Upside: Elevated promotional and field expenses (~450 MRs added) may cap margin expansion in FY26, but set the stage for operating leverage and margin rebound in FY27.

Key Risks:

? Regulatory and Compliance Risks: Delays or adverse outcomes in regulatory approvals, especially in the US, could impact product launches and revenue visibility.

? Rising Promotional Spend: Continued expansion of the field force and promotional intensity may pressure EBITDA margins if revenue growth lags expectations.

? US Generic Pricing Pressure: Sustained price erosion and competitive intensity in the US generics market could offset gains from new launches.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131