Buy Aadhar Housing Finance Ltd for Target Rs. 590 by DAM Capital

Result Gist – In-line disbursement and AUM growth for the quarter. Calibrated disbursements in 1H resulted in relatively muted show growth, but management remains confident of a pickup in 2H to attain their guidance of ~20-22%.

Beat NII (CoF led) got negated by higher opex leading to in-line operating profit, but lower than expected credit cost (Despite PCR inch-up) led to some beat on earnings

Overall stress (30+DPD) improved by 7bps for the quarter. While all other peers have reported good increase in 30+ DPD in 1H, AADHAR has managed to report 9bps fall in 30+DPD vs Q4 FY25 levels. (Refer exhibit 1). RoA for the quarter at 4.3% and RoEs at 15.7%.

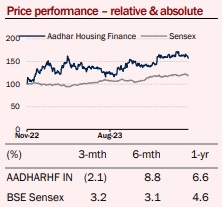

Valuation – The stock trades at ~2.2x on Sept27e book and ~14x on FY27/FY28e Avg EPS. For ~20% plus growth/earnings CAGR and ~17% RoEs, we ascribe a target multiple of ~17x on FY27/28 avg earnings. This fetches us a target price of Rs590 (~2.6x on Sept’27 book). 12M upside of ~20%.

Growth – AUM growth of 3.9% QoQ / ~21% YoY which stood at Rs276bn. Steady growth across retail home loans and other mortgage loans. Retail home loans grew 3.4% QoQ / 18.3% YoY while other mortgage loans grew at 5.2% QoQ / ~28% YoY. Of the incremental disbursement ~69% were towards retail home loans and rest towards other mortgage loans. Some inch-up in avg ticket size to Rs1.1mn (Rs 1mn in Q1) and LTV at 60%. Of the total AUM salaried customers account for 55% and self-employed account for 45%. Expect strong momentum in 2H driven by tailwinds of PMAY 2.0, GST rate-cut and festivities. We bake in ~20% CAGR for FY26-28e.

Margins – Reported yields remained stable while Cofs fell by 10bps leading to improvement in spreads by 10bps.Calculated NIMs inched up by ~20bps during the quarter. Management expects further 10bps of improvement in cost of funds (MCLR benefit). Decision on PLR rate cut will be taken post receiving the benefit on cost of funds and management expects the exit spreads of FY26 at 5.8%. Segmentation of branches as urban and emerging is progressing as per schedule which would ensure spreads are in the guided range

Asset Quality – Stage 3 inched-up by 9bps while Stage 2 fell by 16bps. PCR on Stage 3 inched up by 182bps and PCR on Stage 2 inched up by 15bps. 1+ DPD at 7.17% flat sequentially. While other peers have reported inch-up in stress, The company’s improved asset quality and lower credit costs are attributable to its widespread distribution network, absence of concentration risk (no single state accounts for more than 15% of AUM), minimal exposure to affected geographies such as Tirupur, Coimbatore, and Surat, and sustained recovery efforts by the collection team.

Above views are of the author and not of the website kindly read disclaimer