Banking Sector Update : Capital market players outshine lenders comfortably by Kotak Institutional Equities

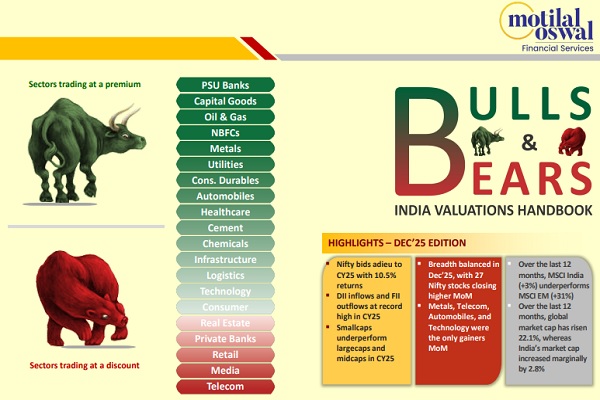

A tough quarter for lenders: (1) Banks and NBFCs—revenue and earnings growth have been under pressure. Banks are facing pressure on NIM and loan growth, while provisions have a few one-offs. Asset quality is still less worrisome for banks, while NBFCs have had a mixed performance. (2) Capital market players continue to leverage the market momentum, leading to fewer concerns they have to deal with outside the valuation.

Banks: Several headwinds come into action

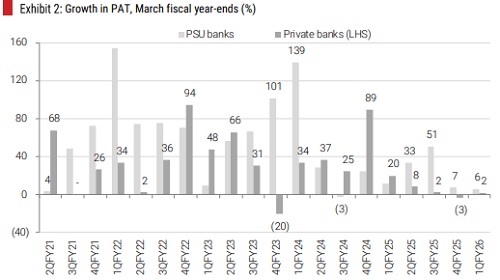

Banks under coverage posted 4% yoy earnings growth, as higher provisions (~90% yoy) offset the 20% yoy growth in operating profits. NII growth was weak at ~2% yoy. Public banks delivered ~6% yoy earnings growth, while it grew 2% yoy for private banks. From a headwind perspective, (1) NIM declined ~10-20 bps qoq across lenders, as the liability side re-pricing is slower than the asset side re-pricing; we expect 2QFY26 to be the most challenging quarter on this metric, considering the recent rate cycle, (2) loan growth is still muted, led by weaker demand rather than supply, (3) operating profit growth is likely to be weak in 2QFY26 due to negligible operating levers at play and (4) asset quality remains the only sweet spot as slippages are still at comfortable levels. There were a few one-offs in large banks (HDFC Bank’s contingent provisions, Axis Bank’s technical slippages), but overall trends are still not yet showing any signs of stress. Improvement in the MFI portfolio is largely tracking trends, with slippages likely to decline from 3QFY26 quite sharply.

NBFCs: Asset quality outlook dominated discussions

FY2026 has started off with mixed views on asset quality performance, carrying forward of FY2025 weakness and hopes of 2H recovery. This dominated investor discussions, with MSME loans at the center of it, especially after caution expressed by large players. Disbursements have been tepid across large NBFCs, with the risk of downgrades not ruled out. NIM faces tailwinds from funding cost reductions, more reflected for larger players in 1Q, but will benefit all NBFCs over the course of the year.

Capital markets: Market pull back and flows drive upbeat earnings

Capital market players delivered a steady performance in 1QFY26, aided by AUM growth and improving flows. HDFC AMC and Nippon AMC led earnings momentum on strong equity AUM and stable yields, while ABSL AMC showed early signs of recovery, whereas UTI AMC's performance was more muted. Kfin and CAMS saw yield compression in MF RTA, with limited upside from non-MF segments. Angel One beat revenue estimates, but saw sharp margin compression; recovery remains a key monitorable. 360 One posted stable earnings, but weak net flows; RM attrition and execution in new segments need tracking. Rating agencies retained core momentum, but non-ratings growth and valuation comfort remain limited.

Private banks’ earnings are down 2% yoy, while public banks’ earnings are up 6% yoy

Above views are of the author and not of the website kindly read disclaimer

More News

Pharmaceuticals: 3QFY26 preview: Ex-US to drive growth by Kotak Institutional Equities