Add TCPL Packaging Ltd For Target Rs. 3,800 By InCred Equities

Margin resilience despite export headwinds

* TCPL posted a 1.8% yoy sales decline in 3Q, led by low double-digit volume growth in domestic biz, while exports continued to remain under pressure.

* Resilient delivery on margin front despite headwinds in exports. Domestic demand is likely to remain in a high single-digit to low double-digit trajectory.

* TCPL is well-placed to gain from improving trend in domestic business & a recovery in exports. We maintain our ADD rating on it with a new Rs3,800 TP

Weakness in exports cushioned by recovery in domestic business TCPL Packaging (TCPL) reported a marginal 1.8% yoy sales decline in 3QFY26, primarily driven by persistent headwinds in the export segment against a high base. While export momentum remained subdued throughout 9MFY26, resulting in a reduced sales mix of 31.6%, the domestic business provided a cushion with low double-digit volume growth. Looking ahead, the domestic segment is expected to maintain this trajectory, supported by FMCG players’ renewed focus on volume growth. However, we anticipate potential nearterm pressure on cigarette carton volumes as the industry navigates sharp price hikes and subsequent impact on industry volume growth

Trade deals can be a turning tide for TCPL’s export business Despite a sluggish fiscal year for international trade, recent bilateral trade agreements between India and the US and Europe are acting as catalysts for a turnaround. These deals have already stimulated a resurgence in customer inquiries. Furthermore, the Middle East (a primary contributor to TCPL’s export portfolio) is projected to stage a recovery back to the growth path, after recent stagnation, and show gradual improvement. This shift in the international landscape, combined with stable domestic demand, positions the company to capitalise on a broader recovery in global and local FMCG consumption.

Resilient margins despite export headwinds Despite a weaker export mix, gross margin expanded by 240bp yoy to 42.7% (vs. our estimate of 41%) in 3Q. Employee costs were up 19.9% yoy at Rs496m (10.5% of sales, up 190bp yoy), while other expenses declined 13.1% (14.9% of sales, down 195bp yoy). EBITDA grew by 14.7% to Rs810m, beating our estimate by 7%, while EBITDA margin expanded by 250bp yoy to 17.2%. APAT declined 3% yoy to Rs366m; however, due to exceptional items (labour code) at Rs116m, RPAT declined 33.6% yoy to Rs250m.

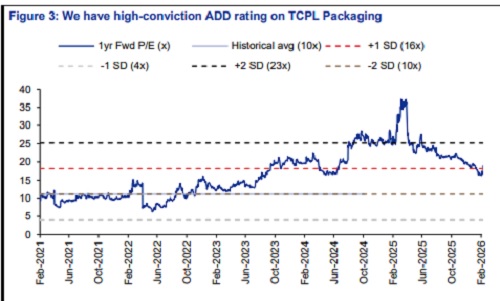

Well-placed to participate in a broader recovery in FMCG demand TCPL is well-placed to participate in a broader recovery in FMCG industry, led by improving demand trend in urban markets, steady demand in rural markets as well as an improving outlook on export business led by trade deals with the EU & the US, and a gradual recovery in the Middle East market. We retain our high-conviction ADD rating on TCPL with a lower target price of Rs3,800 (20x Dec 2027F EPS), from Rs4,100 earlier. Downside risks: Continued weakness in export momentum or subdued domestic demand.

Above views are of the author and not of the website kindly read disclaimer

.jpg)