Buy Zensar Technologies Ltd For Target Rs. 1,130 by Choice Broking Ltd

NEW LEADERSHIP DELIVERY EVIDENT FROM IMPROVED FINANCIALS

We believe Zensar is a new turnaround story unfolding at RPG group led by its new leadership team. This is evident from strategic changes undertaken like:

* CEO Manish Tandon leading Zensar’s story to bring in stability and agility

* Large deal wins fueled by incentivizing sales team structure

* Client centricity reflected in improved customer experience scores

The new initiatives are getting reflected on company’s industry lowest attrition rates, better customer experience scores and improving profitability, which has witnessed 40% CAGR from FY23-25.

FOCUSED SERVICES AS ONE VALUE PROPOSITION DIFFERENTIATES

Zensar’s focused services clubbed together as one value proposition has witnessed growth of 8.2% YoY v/s overall Top-line growth of 5.4% YoY in FY25. These services are resonating well with large clients meeting their customized needs at one go. This value proposition is also leading non-TMT verticals to drive double-digit growth for the company, further aided by broad-based geography growth strategy with expected recovery in South African market.

LEADING TCV CONVERSION, STRONG CASH, POISES ZENSAR FOR LEAP

Stable TCV wins with impressive industry leading revenue conversion rate of 90% builds confidence on future executional capabilities of Zensar. Moreover, it has witnessed 35% CAGR in cash equivalents from FY19-25, with zero debt on books & Mcap/OCF ratio of 30x, which retains investment comfort. We believe, Zensar’s strong liquidity position compels for strategic buyouts/ investments on large deals, which would help accelerate its growth & profitability in future.

ZENSAR’S AI PLAYBOOK TO DRIVE INTELLIGENT OUTCOMES

Led by technology innovation at heart, Zensar aims to ride on the AI playbook, which is currently witnessing good client conversations across IT Industry. 44% of Zensar’s deal pipeline is led by AI client conversations. Enterprises globally are looking for strong vertical led value propositions to invest on, which would accelerate their growth and profitability for long-term. Hence, Zensar is focussing on R&D initiatives through ZenLabs to come out with low cost, better technology offerings that would add great value to client’s business outcomes.

INVESTMENT VIEW

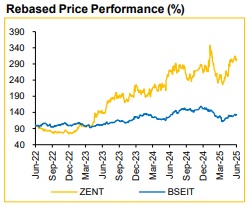

Given its strategic long-term growth plan, we expect Zensar to deliver Revenue/ EBITDA/ PAT CAGR of 9.8%/ 10.4%/ 15.4% from FY25-FY27E on organic basis. Thus, we initiate coverage on Zensar with a BUY recommendation and Target Price of INR 1,130 which is an upside of 34%, by valuing the company at a PE of ~30x based on FY27E EPS of INR 37.7. Our target PE valuation stays conservative compared to higher valuations at which other mid-cap Indian IT companies are trading currently. Also, based on DCF valuation considering terminal growth rate of 3% we arrive at INR 1,150 as implied fair value per share. We consider DCF methodology from sanity check & analytical rigor perspective.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131