Add L&T Finance Ltd For Target Rs. 285 By JM Financial Services

Inline quarter; limited upside on back of recent rally

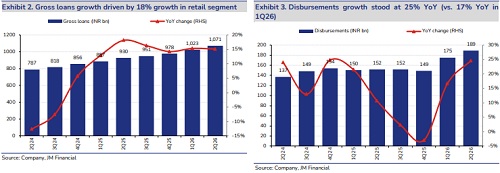

L&T Finance (LTF) reported largely inline PAT with +6%/+5% YoY/QoQ growth, (-2% JMFe), leading to reported RoA of ~2.4% (+4bps QoQ). NII grew ~8% YoY/QoQ (+3% JMFe) as reported NIM was up ~18bps QoQ. PPoP grew 22%/5% YoY/QoQ while credit costs inched up (+20bps QoQ) despite utilizing macro provisions of INR 1.5bn. Gross loans grew (+15%/5% YoY/QoQ) led by strong disbursals of ~INR 189bn (25%/8% YoY/QoQ). Management remains confident on its retail growth trajectory led by Project Cyclops and digital partnerships, and plans to maintain NIM+fees at ~10-10.5% going forward. With its gold branch count to move up to 200+ by FY26 end, we expect opex to remain elevated and credit costs to normalise gradually. The stock has rallied 30%+ over last 3 months mainly due to improving sentiments around MFI loans. Due to recent sharp rally, stock looks fairly valued given growth/RoE profile on offer. We revise our target multiple for LTF to 2.3x FY27E BVPS with a revised TP of INR 285 (vs. earlier TP of INR 240) and downgrade to ADD.

* Growth pick up led by gold book:

Disbursements growth during the quarter was strong at (+25%/8% YoY/QoQ both) majorly led by pick-up in consumer loans (+50% QoQ), 2W (+18% QoQ), SME (+15% QoQ) and rural BL (+13% QoQ). Farm equipment de-grew (-25% QoQ), MFI (-11% QoQ) and HL (-4% QoQ) segments. As a result, overall growth came in strong at +5% QoQ, +15% YoY. Within the retail book, growth was driven by PL (+16% QoQ), gold loans (+8% QoQ), LAP (+8% QoQ), SME finance (+7% QoQ) and 2W (+6% QoQ). The company aims to add 70+ gold loan branches (currently at 130 branches) by FY26E which will also cross-sell microLAP, SME and PL. Wholesale book remained largely flat QoQ. Management guides for 20- 25% AUM growth for FY26E led by Project Cyclops and government initiatives such as GST rationalization. We build in gross loan growth of ~19% CAGR over FY25-27E (~21% CAGR in retail loans).

* Margin improves sequentially:

LTF reported largely in PAT of INR 7.4bn (+6%/+5% YoY/QoQ, - 2% JMFe NII grew ~8% YoY/QoQ (+3% JMFe) as reported NIM was up 18bps QoQ led by 18bps decline in yields and 36bps decline in CoFs. PPoP grew 22%/5% YoY/QoQ while credit costs continued to remain elevated at 2.4% (+20bps QoQ) post utilizing macro provisions of INR 1.5bn. Adjusting for this, credit costs would have been 3% (vs 3.4% in Q1). Management highlighted that the company would not have to use its macro provisions moving forward and guided credit costs of ~2% over medium term. We expect EPS CAGR of ~19% over FY25-27E.

* Steady asset quality:

GS3 was largely steady at 3.29%/1% (-2bps/+1bp QoQ), with PCR at 70% (-53bps QoQ). Retail GS3 improved marginally by -1bp QoQ at 2.92% on which the company maintains PCR of 71.5% (72.3% QoQ). Due to macro utilization during the quarter, the ECL cover on its retail stage 2 declined sharply from ~29% in Q1FY26 to ~23% leading to total provision cover to decline to 3.1% from 3.4% QoQ. The LTF+3 or more lenders now comprise 3.6% of total book (vs 5.2% in Q1FY26). We build in avg credit costs of ~2.5% over FY26-27E.

* Valuation and View:

The stock has rallied 30%+ over last 3 months with improving sentiments in MFI loans. We believe that the stock is fairly valued given growth/RoE profile. We revise our target multiple for LTF to 2.3x FY27E BVPS with a TP of INR 285 (vs earlier TP of INR 240).

Quarterly Trends

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361