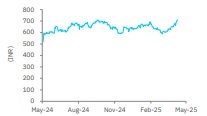

Accumulate Marico Ltd For Target Rs. 785 By Elara Capital

Holistic growth drives continued momentum

We maintain a constructive view on Marico (MRCO IN), underpinned by its strong mediumterm potential to deliver double-digit sales growth. This optimism is driven by a combination of strategic price increases, enhanced direct distribution capabilities, and robust momentum in its foods and premium personal care segments. Additionally, as its new business verticals continue to scale, we expect upside to margin in the long term, further reinforcing our positive stance. We reiterate our Accumulate rating with a higher TP of INR 785 on 50x FY27E P/E.

Pricing actions bolster robust revenue growth: In Q4, MRCO reported a 19.8% YoY rise in net sales to INR 27.3bn, surpassing estimates by 3.6%, led by 23% domestic business growth and improved volume growth of 7% (vs 6% in Q3). Parachute coconut oil (PCNO) posted 22% value growth but saw a 1% volume dip, due to higher pricing and reduced pack sizes; however, adjusted volume (excluding ml-age cuts) grew in low single digits. Saffola edible oil volume declined slightly, yet revenue rose 26% on the back of inflation-driven pricing. Value-added hair oils (VAHO) rose 1% YoY, indicating steady sequential recovery. The foods segment surged 44% YoY, crossing INR 9bn revenue in FY25, up 30%) while the international business grew 16% in constant currency terms.

Strong growth momentum to continue: The company expects its India business to sustain double-digit growth, driven by pricing in core segments, such as PCNO and Saffola edible oil, alongside strong momentum in new businesses. PCNO has seen a cumulative 30% price hike since Q1FY24, including 8–9% in April 2025, amid firm copra prices, which are likely to stabilize post-Q2 and support volume recovery. Edible oil growth will remain price-led in FY26, while VAHO is set to see gradual revenue improvement, led by distribution initiatives. Newer segments, such as foods and premium personal care (including digital-first brands) are set to grow robustly, with contribution to India revenue projected to rise from 22% in FY25 to 25% by FY27, aided by a 25% CAGR in foods and scaling the digital portfolio 2.5x over FY24 levels. Project SETU is progressing well and will further support core portfolio growth.

Near-term pressure on margin; long-term story intact: EBITDA margin declined 260bp YoY to 16.8% vs our estimates of 17.1%), hit by sharp input cost inflation — copra up 48% YoY and vegetable oil up 25% YoY. MRCO expects this pressure to ease by H1FY25, especially in copra. Despite the near-term margin squeeze, the company will continue high A&P spend and targets double-digit operating profit growth in FY26, supported by margin expansion in foods (gross margin up 1,000bp over two years), a scaled up digital-first portfolio (aiming for doubledigit margin by FY27), premiumization, and a stronger product mix in international markets.

Reiterate Accumulate with a higher TP of INR 785: We raise our FY26 and FY27 estimates by 1% and 3%, respectively, primarily due to higher revenue growth, aided by pricing intervention partly offset by margin contraction. We reiterate Accumulate with a higher TP of INR 785 from INR 752 on 50x (unchanged) FY27E P/E. We introduce FY28 estimates

Please refer disclaimer at Report

SEBI Registration number is INH000000933