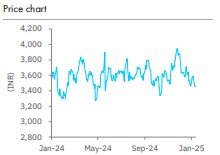

Accumulate Larsen & Toubro Ltd For Target Rs. 4,051 By Elara Capital Ltd

Inflows shine, set to surpass FY25 guidance

Larsen and Toubro (LT IN) delivered 18% growth in inflows in 9MFY25 (vs FY25 guidance of 10%) and is well placed for a healthy intake in Q4 as well, led by a robust order pipeline. With limited slow-moving orders, strong execution momentum is likely to continue with potential margin improvement, led by the change in mix toward hydrocarbons and precision engineering segments. We expect an E&C order inflow CAGR of 8% during FY24-27E on strong base with a revenue CAGR of 14% and an EBITDA CAGR at 16%. The company seems to be on track for its Lakshya 2026 consolidated revenue target of INR 2.7tn by FY26 (estimated growth of 5-10% in FY26E). Given growth opportunities coupled with strengthened core capabilities, we reiterate Accumulate with a SOTP-based TP at INR 4,051, valuing the E&C business at 26x FY27E P/E.

Inline Q3 performance:

Consolidated revenue grew 17% YoY to INR 646bn, in line with estimates, led by 20% growth in E&C, displaying robust execution on the international front with revenue up 56% YoY. Domestic execution was flat YoY on account of the slowdown in Jal Jeevan Mission project, due to delayed payments (expected to pick up from Q4). E&C margin was flat YoY at 7.6%, lower than guidance of 8.2%, on account of old projects in hydrocarbons nearing completion and new projects yet to reach threshold. Management is confident of surpassing revenue target of 15%, due to robust 9M execution growth of 22% and targets to clock in flat EBITDA margin of 8.2% with the onset of new hydrocarbon projects and favourable project mix. Net working capital improved 390bp YoY to 12.7%, led by healthy collections.

Healthy visibility for 4Q:

LT received the highest-ever quarterly order intake in Q3 with core E&C inflows of INR 987bn, up 64% YoY, led by receipt of ultra mega orders in boiler turbine generator (BTG) from NTPC and renewables from the Middle East contributed equally by domestic (48%) and international markets (52%). With robust momentum in inflows, receiving 90% of last year inflows in 9MFY25, along with a healthy pipeline of INR 5.5tn for the next three months (in infra at INR 4tn), we factor in 13.9% growth in inflows in FY25E. Orderbook at INR 5.6trn provides a book-to-bill visibility of 3.2x. With healthy orderbook coupled with a mere 0.5% slow-moving orders, we assume 18.7% E&C execution growth for FY25E with stable margin at 8%, down 20bp YoY.

Status quo in development projects:

Average ridership of the Hyderabad Metro was flat YoY at 444,000 passengers. Net loss contracted to ~INR 2.0bn from ~INR 2.5bn YoY, led by lower interest payment. LT continues to evaluate opportunities to divest assets at fair valuation.

Retain Accumulate with a TP of INR 4,051:

Given the government’s focus on infrastructure development for Viksit Bharat 2047, management expects policy continuity along with fiscal discipline. Also, Middle east countries energy transition initiatives would unlock incremental opportunities. Also, stepping up projects in green energy (electrolyzer), semiconductors and data centers would open new growth frontiers. We retain our estimates. We reiterate Accumulate with a SOTP-based TP of INR 4,051, valuing the E&C business at 26x FY27E P/E, and the subsidiaries valued at a 20% discount to market and book value.

Please refer disclaimer at Report

SEBI Registration number is INH000000933