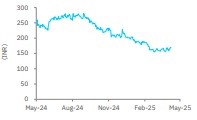

Accumulate Bajaj Consumer Care Ltd For Target Rs. 190 By Elara Capital

Clear strategy set; awaiting market momentum

Bajaj Consumer Care (BAJAJCON IN) witnessed a muted performance, primarily hit by headwinds in its core Almond Drop Hair Oil (ADHO), contraction in the wholesale channel, and an overall slowdown in the hair oil segment. In response, management has sharpened its strategic focus on diversifying the ADHO franchise and the recent acquisition of the South India-based brand Banjara marks a key step in expanding its product portfolio and regional reach. Along with these efforts, intensified distribution initiatives are underway, which management believes will drive a gradual revival in ADHO performance. We reiterate Accumulate with a lower TP of INR 190 based on 18x FY27E P/E.

Improved performance in ADHO; general trade headwinds persist: Net sales grew 3.2% YoY to INR 2.4bn in Q4, as we had estimated, an improved performance QoQ, as Almond Drops Hair Oil (ADHO) posted growth of 3% YoY and 11% QoQ in Q4 with large- & mid-sized stock keeping unit (SKU) reporting growth of 17% QoQ and 27% QoQ, respectively. BAJAJCON aims to taper off ADHO saliency from ~80% currently to ~60% in the long term, in line with its portfolio diversification strategy. Coconut hair oil delivered monthly revenue of INR 100mn in FY25, up 19%. In terms of channels, general trade continues to be under pressure and declined amid challenges in the wholesale channel while the organized trade channel (29% of sales), increased 30%, as modern trade and eCommerce posted growth of 22% and 33%, respectively, in Q4. The international business posted 30% YoY growth in Q4 where (GCC) and the African Union (AU), Nepal, and Bangladesh grew by 25%, 20%, and 32%, respectively.

Acquisition and distribution initiatives to drive growth: BAJAJCON acquired a 49% stake in Banjara, with the balance acquisition expected to be completed by Q1FY26. This acquisition would aid in portfolio enhancement and distribution expansion up to 3.0x in BAJACON’s weak South India market. In FY25, Banjara reported a revenue of INR 530mn. Moreover, Project Aarohan (launched in Q1) saw significant progress as it was fully implemented in Uttar Pradesh (UP) and Madhya Pradesh (MP) where it added 24,000 new outlets followed by designing route-to-market for four more states (Delhi, Haryana, Rajasthan and Chhattisgarh) in Q4, expanding direct coverage of urban outlets to 1.6x.

Management aims to improve margin in the range of 16-18%: Gross margin dropped 90bp YoY to 54.9% while it rose 230bp sequentially, due to 1) improved saliency of ADHO, and 2) two rounds of price increase undertaken in Q4 to offset copra inflation. EBITDA margin declined 190bp YoY to 13.5%, vs our estimates of 12.4%, due to higher other operating expenses. Directionally, management aims to improve EBITDA margin in the range of 16-18%.

Reiterate Accumulate with a lower TP of INR 190: We upgrade our earnings estimates by 4.3% and 5.2% for FY26 and FY27, respectively, primarily to factor in contribution from the new acquisition. We reiterate Accumulate with a lower TP of INR 190 from INR 200 on 18x (from 20x; in line with its five-year average) FY27E P/E. We introduce FY28 estimates. Downside risk is the sustained slowdown in ADHO and the general trade channel.

Please refer disclaimer at Report

SEBI Registration number is INH000000933

.jpg)