Commodity Article : Gold recovers as dollar slips from highs; Crude bounced back Says Prathamesh Mallya, Angel One

"Daily Commodity Article" by Mr. Prathamesh Mallya, DVP Research, Non-Agro Commodities & Currency, Angel One Ltd.

Gold recovers as dollar slips from highs; Crude bounced back.

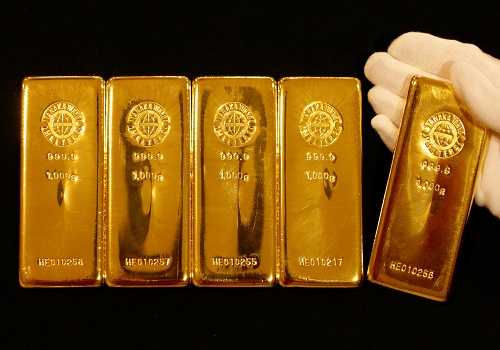

GOLD

The yellow metal began the new week on a higher note after concluding the week before on a lower note, as the dollar eased from a five-week high.

Despite remarks from Federal Reserve officials, gold prices rose on Monday as traders held to their predictions of interest rate reduction before the year's end and kept an eye on the US debt ceiling negotiations.

In the meantime, the debt-ceiling negotiations to prevent a catastrophic default started a crucial week with President Joe Biden and Republican House Speaker Kevin McCarthy.

Most market participants continued to predict at least one rate reduction before 2023 comes to a conclusion. Gold with a zero yield has less appeal as interest rates rise.

Outlook: We expect gold to trade higher towards 61450 levels, a break of which could prompt the price to move higher to 61800 levels.

CRUDE

Crude prices on Monday witnessed a bounce back, as it inched higher and concluded the day in the positive territory. Both the benchmark indices ended with gains.

Oil prices increased as a result of US plans to buy oil for the Strategic Petroleum Reserve, which provided support as raging Canadian wildfires fueled supply concerns.

At one point, more than 30,000 people were evicted from their homes due to the massive fires in Alberta, Canada, which also shut down at least 319,000 barrels of oil equivalent per day (boepd), or 3.7% of the country's production.

Due to worries about a potential US recession and the possibility of a historic government debt default in early June, Brent and WTI futures declined for a fourth consecutive week last week. In September 2022, the benchmarks last had a comparable run of weekly falls.

Outlook: We expect crude to trade higher towards 5990 levels, a break of which could prompt the price to move higher to 6090 levels.

BASE METALS

The base metals pack finished the holiday-shortened week on a weaker note. The LME Nickel was the week's biggest losing metal.

Poor demand predictions in China, along with rising supply, kept metals prices under pressure. According to figures released on Tuesday, China's imports declined significantly in April, while export growth halted, raising fears about weak domestic demand.

Due to a delayed economic recovery and a weak export market, China's consumption of industrial metals has remained subdued during the second quarter, which is often regarded as peak demand time.

Furthermore, a strong dollar was another headwind that weighed on metal prices.

Outlook: Given the liquidity injection from China's central bank, which could offer some economic assistance, metal prices are predicted to remain high.

Please find attached the media kit from Angel One Ltd. (Formerly known as Angel Broking) for your reference.

Please Note: The name of the company has been changed from Angel Broking Limited to Angel One Limited, according to the approval of the Registrar of Companies (ROC). The Certificate of Incorporation pursuant to the change of name and the new logo are attached for ready reference

Above views are of the author and not of the website kindly read disclaimer