Utilities Sector Report : Generation continues downward trajectory

Total generation dipped 0.94% YoY to 134BU in November 2025 due to cooler temperatures

and softer industrial activity, marking the first November demand contraction in five

years. Thermal output fell 6% YoY with plant load factor (PLF) sliding to 67%, while hydro

and renewables delivered growth of 16% YoY and 28% YoY, respectively. Despite FY26 YTD

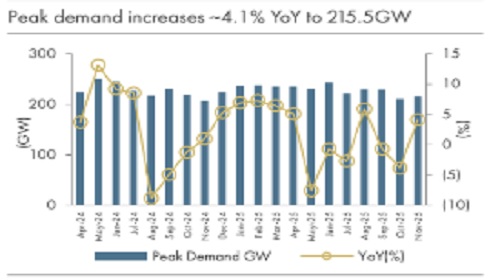

generation remaining lower, early December trends show a 5.74% rebound. Peak demand

rose 4% YoY to 215.5GW, supported by gradual normalization post an early Monsoon.

Market activity remains robust, with IEX volume up 17.7% YoY, driven by a 40.2% jump in

real-time market (RTM) trades.

Power generation declines ~0.9% YoY in November to 134BU: After a subdued October,

generation continues downward trend in November. Power generation declined ~0.9%

YoY to 134BU in November. Lower temperature and slowdown in industrial activity kept

electricity demand weak. This was the first instance in at least five years where power

demand contracted in November. Usually, demand strengthens in the late months of the

year as industrial operations ramp up and agricultural activity rebounds following the

Monsoon. Generation for coal plants declined 6% YoY to 97BU. PLF of thermal plants fell

to 67.0% vs ~69.5% last year. Hydro generation increased 16% YoY to 10.9BU. Renewable

generation rose 28% YoY to 18.5BU. Generation declined 0.47% YoY to 1,239BU for FY26

YTD. Despite subdued performance in FY26 YTD, power generation is reviving in

December and has risen~ 5.7% YoY to 37.63BU for the first eight days of December on high

base, up 9.3% YoY in December 2024.

Peak demand increases 4% YoY in November: Irrespective of declining power generation,

peak demand revived, up 4%YoY to 215.5GW in November. Peak demand increased 2.4%

MoM. The Central Electricity Authority (CEA) had projected peak power demand to touch

270GW in FY26, but actual demand fell short, due to early Monsoon, which reduced cooling

needs. Peak power demand had touched an all-time high of 250GW in May 2024. The

previous all-time high peak power demand of ~243.3GW was recorded in September 2023.

However, this Summer (from April), record peak power demand was ~242.8GW in June.

Lower temperatures on early arrival of Monsoon led to lower demand for cooling during the

Summer months.

Volume rises 17.7% YoY in November: IEX achieved monthly electricity traded volume of

11,409MU in November, up 17.7% YoY. Around 0.474mn of Renewable Energy Certificates

(REC) were traded. The day-ahead market (DAM) segment achieved 5,668MU volume in

November 2025 vs 5,651MU in November 2024, up 0.3% YoY. RTM volume rose to 4,233MU

in November 2025 from 3,019MU in November 2024, up 40.2% YoY.

Regulated firms, renewables and hydro attractive: We prefer regulated PSU companies,

such as NTPC and Power Grid Corporation, due to assured returns from regulated assets

and robust capacity addition pipeline. CESC offers potential upside, driven by its

significant renewable capacity expansion targets while NLC India appears attractive with

plans to double its regulated equity by FY30. In the long term, the hydro sector looks

promising, due to upcoming capacity addition and renewed focus on the industry.

Renewable tenders of 1.87GW floated in November

More than 1,870MW of RE tenders were issued in November 2025 under the project development

category. CESC has invited bids for a 600MW ISTS connected wind-solar hybrid project to be located

anywhere in India. More than 3,250MW of EPC tenders were issued in November 2025. NTPC has

issued a 2.67GWh standalone BESS EPC tender for BESS implementation at nine of its thermal power

stations in six States. In November 2025, a total of 1,000MW of RE capacity and 7,330MWh of energy

storage capacity was allocated to RE developers under the project development category. REMCL’s

1,000MW RTC Auction was awarded in November 2025, with ReNew Power (200MW), Bhalki Solar

(200MW) and Purvah Green (180MW) emerging as the winners with the highest awarded capacity.

The discovered tariff amounted to INR 4.35/kWh. Around 1,900MW of EPC solar capacity was

allocated this month. The largest award was NREDCAP’s 1,200MW rooftop EPC tender, with key

allocations going to Kosol Energie (~291.5MW), Rotomag Enertec (~139.5MW), Sadbhav Futuretech

(90MW) and several smaller vendors in the 10–80MW range. Other awards include MAHAGENCO’s

300MW solar EPC tender split between Pace Digitek (200MW) and Bondada Engineering (100MW),

and SECI’s 200MW Madhya Pradesh Solar EPC package awarded to Amar Infrastructure

Above views are of the author and not of the website kindly read disclaimer