The Evolving Story of Gold by Bajaj Finserv AMC

After racing to fresh INR highs in mid-October, gold and silver have slipped into a correction. On Multi Commodity Exchange of India Limited, gold eased from around ?1.32 lakh per 10g at the peak to the ?1.19–1.22 lakh range at recent lows.

The setback appears more like positioning and sentiment rebalancing than a shift in long-term fundamentals.

KEY CATALYST OF GOLD’S RECENT PERFORMANCE

Considered a safe-haven in times of volatility: The initial surge in gold was driven by fear and uncertainty. Inflation soared, geopolitical tensions deepened, and whispers of a global slowdown sent investors scrambling to limit their downside. In those moments of panic, gold fulfilled its timeless role — a refuge when paper assets seemed fragile.

SHIFTING MARKET DYNAMICS: WHAT HAS CHANGED

As 2025 unfolded, volatility began to ease, inflation expectations stabilized, and global equity markets regained confidence. The Federal Reserve’s likely rate cuts were already priced in, reducing the urgency to seek shelter in gold. The result: the premium that had propelled prices upward began to lose momentum.

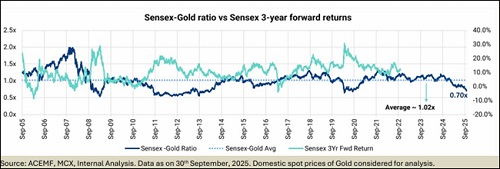

SENSEX–GOLD RATIO

The Sensex-to-Gold ratio, which measures the relative value of equities versus gold, currently sits around 0.70x, well below its long-term average of 1.02x. Historically, such levels have coincided with periods when equities outperform gold over subsequent years.

This suggests that while gold remains resilient, equities now present relatively better value — a sign of shifting market dynamics.

WHAT STILL SUPPORTS GOLD

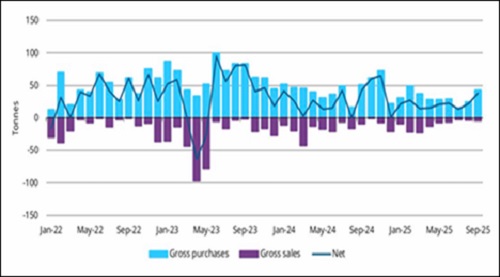

Around the world, central banks have been diversifying away from the US dollar and building their gold reserves at a historic pace.

For three consecutive years, global gold purchases have exceeded 1,000 tonnes annually, well above the long-term average. The Reserve Bank of India (RBI) alone has expanded its holdings to around 880 tonnes, increasing gold’s share in its reserves from 6.9% in 2021 to 11.4% in 2025.

These are not short-term speculative moves — they represent a strategic rebalancing of global reserves, underscoring gold’s growing role in an increasingly multipolar financial system.

OUR OUTLOOK:

Gold has risen nearly 50% in India over the past year, outpacing largely flat equities. This rally was initially fuelled by flows, but now these appear to be slowing as global uncertainty eases. At the same time, steady central bank accumulation continues to offer a firm base of support.

With the Sensex-to-Gold ratio at 0.70x— below its long-term average of 1.02x— equities seem relatively better positioned. Gold now functions more as a core hedge than a growth asset, warranting moderate exposure while investors look to equities for incremental potential opportunities and stay alert to shifts in risk and valuation dynamics for long-term wealth creation.

Above views are of the author and not of the website kindly read disclaimer