Strategy : Nifty50 Analyser – Aug'25 by JM Financial Services Ltd

Nifty50 Analyser – Aug’25

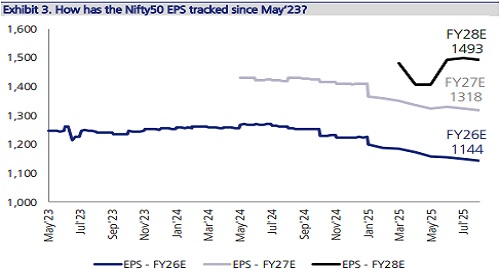

In our Nifty50 Analyser, we take a close look at Nifty50 EPS movements in Aug’25. In the last 12 months from Aug’24 to Aug’25, the Nifty50 has delivered -3.2% return, while FY26E and FY27E EPS have seen cuts of 8.9% and 8% respectively. In Aug’25, EPS estimates for FY26E and FY27E saw a MoM decrease of 0.6% and 0.4% respectively. These follow a 0.5% MoM decrease for both FY26E and FY27E EPS in Jul’25. Further, the number of Nifty companies that saw an EPS cut increased from 40% in Jul’25 to 60% in Aug’25, with Oil & Gas, Utilities, Insurance, Banks, Metals & Mining, Auto and Infrastructure & Ports being key contributors. The stocks that saw the biggest EPS cuts include IndusInd Bank, Adani Enterprises, Bharti Airtel, Sun Pharma, and Grasim Industries, while stocks that saw the largest upgrades include Apollo Hospitals, Adani Ports, Titan, Bajaj Finserv, and Eicher Motors.

* Nifty50 down 3.2% YoY, while FY26E EPS estimates cut by 8.9% over last 12 months: In the last 12 months from Aug’24 to Aug’25, the Nifty50 has delivered -3.2% return, while FY26E and FY27E EPS have seen cuts of 8.9% and 8% respectively. In Aug’25, EPS estimates for FY26E and FY27E saw a MoM decrease of 0.6% and 0.4% respectively. These follow a 0.5% MoM decrease for both FY26E and FY27E EPS in Jul’25.

* 60% of Nifty50 companies saw EPS cuts in Aug’25 (vs. 40% in Jul’25): In Aug’25, 30 Nifty50 companies (60%) saw cuts in FY26E estimates. Amongst the larger sectors, higher cuts were seen in: (1) Oil & Gas: 2 out of 2 (100%); (2) Utilities: 2 out of 2 (100%); (3) Insurance: 2 out of 2 (100%); (4) Banks: 5 out of 6 (83%); (5) Metals & Mining: 3 out of 4 (75%); (6) Auto: 4 out of 6 (67%) and (7) Infrastructure & Ports: 2 out of 3 (67%).

In Aug’25, 10 Nifty50 companies (20%) saw upgrades in FY26E EPS. Amongst the larger sectors, higher upgrades were seen in: (1) Cement: 1 out of 2 (50%)

* Sector-wise movements in EPS: Key sectors that witnessed >1% cuts in FY26E EPS on a MoM basis include: (1) Telecom (4.8%), (2) Cement (1.5%), (3) Infrastructure & Ports (1.5%), (4) Oil & Gas (1.4%), (5) Auto (1.3%), (6) Pharmaceuticals and (7) Consumer (1.1%). No sector witnessed EPS upgrades in Aug’25.

Nifty50 down 3.2% YoY, while FY26E EPS cut by 8.9% over last 12 months

* In the last 12 months from Aug’24 to Aug’25, the Nifty50 has delivered -3.2% return, while FY26E and FY27E EPS have seen cuts of 8.9% and 8% respectively.

* In Aug’25, EPS estimates for FY26E and FY27E saw a MoM decrease of 0.6% and 0.4% respectively. These follow a 0.5% MoM decrease for FY26E and FY27E EPS in Jul’25.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361