Spot Gold may stay firm and rise on safe haven demand and rate cut hopes-ICICI Direct

Metal’s Outlook

Bullion Outlook

* Spot Gold is likely to hold its gains and move higher on safe haven demand and rate cut optimism. Recent dovish comments from the US Fed members have increased the probability of interest rate cut. Further, US-China trade tension and political uncertainty in France would increase safe haven bids. Prices would also get support from economic uncertainty and extension in US Government shutdown which could bring more inflows via ETFs. In September ETF inflows hit its highest in this year. Further, continued buying from the major central banks would also support the yellow metal to scale new highs.

* Spot gold is likely to move higher towards $4250, as long as it holds above $4150. Above $4250 it would rise towards $4300. MCX Gold December is expected to rise towards Rs.128,000 level as long as it holds above Rs.126,200 level.

* MCX Silver Dec is expected to hold support near Rs.158,000 level and rise towards Rs.164,500 level.

Base Metal Outlook

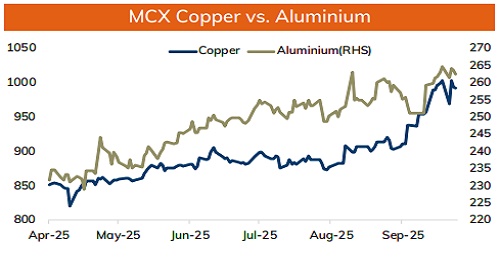

* Copper prices are expected to find its ground and regain its strength amid weak dollar and tight supply. Dovish comments from the US Fed Chair Jerome Powell and other Fed members have increased the probability of 2 rate cuts in this year. Further, forecast of tight supplies due to major supply disruption would provide support to the red metal. Meanwhile, uncertainty over US-China trade negotiations could restrict the upside in the metal.

* MCX Copper Oct is expected to hold support near Rs.980 and move back towards Rs.1010 level.

* MCX Aluminum Oct is expected to rise towards Rs.267 level as long as it stays above Rs.261 level.

* MCX Zinc Oct looks to rise towards Rs.294 as long as it holds key support at Rs.288.

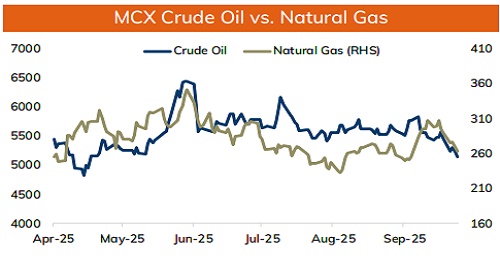

Energy Outlook

* NYMEX Crude oil is likely to face hurdle near $60 per barrel and move lower amid expectation of record surplus in the coming year. International Energy Agency has increased its global oil surplus to 4 million barrels per day in the next year. Further, expectation of rise in US crude oil inventory levels would weigh on oil prices. In addition to that US Government shutdown and trade war concerns would also hurt demand outlook. Meanwhile, slowdown in Russian oil purchase by India and expectation of China to reduce Russian oil imports could bring some relief to prices.

* MCX Crude oil Oct is likely to slip towards Rs.5100, as long as it trades under Rs.5300 level. NYMEX crude oil is likely to move in the band of $58 and $60 per barrel. A move below $58 it would slide towards $57 mark.

* NYMEX Natural Gas is expected to trade lower amid mild US weather forecast. MCX Natural gas Oct is expected to slip towards Rs.260 level as long as it trades under Rs.272 level.

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631