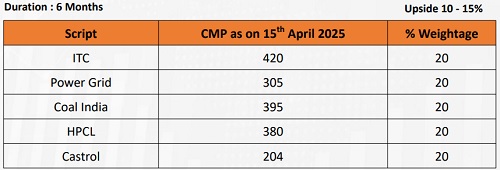

Smart Basket : Dividend Yield Basket by Motilal Oswal Wealth Management

Dividend Yield Basket

* With markets being volatile due to global trade uncertainty, one can look at high dividend yield stocks which can provide margin of safety to the portfolio.

* We have curated a basket of five high dividend paying companies that have made consistent dividend payouts in the past.

* These companies are likely to declare good set of dividends to shareholders in the near term as they are cash rich.

* ITC: ITC’s core business of cigarettes has shown steady performance. With stable taxes on cigarettes, we anticipate sustainable growth in this business. ITC has announced acquisition of Aditya Birla Real Estate's paper business, 'Century Pulp and Paper' (CPP), as going concern on a slump sale basis for 35Bn. It strengthens ITC's presence in pulp and paper industry, expanding its capacity & market reach. ITC is expected to have 3.5% FY25 dividend yield.

* Power Grid: With the government adjusting its transmission capex estimate to INR9.16t till FY32 as per NEP 2032, company is strategically positioned to leverage these investments as the NEP represents a significant commitment to capacity expansion and the advancement of clean energy technologies. Despite near-term margin pressure, a strong order book (INR1.43t) and steady project wins, support long-term growth. It has FY25E dividend yield of 3%.

* Coal India: The energy demand outlook remains robust for medium-to-long term as CEA projects peak power demand in summer to hit 270GW over Mar-Jun'25 (~363GW by FY30). COAL produces over 75% of India's coal, with 80% supplied to the power sector, making it a dominant player. Recent stock correction offers an attractive valuation, trading at below its 10-yr historical average. This has led to attractive dividend yield of 7.1% for FY25E.

* HPCL: Oil price decline due to OPEC+ output hike and US tariffs is likely to improve HPCL’s gross marketing margins along with Rs50 price hike by the Center, will help offset Rs.76b LPG under-recoveries. Key triggers include the demerger and potential listing of the lubricant business, commissioning of the bottom upgrade unit in Q4FY25, and Rajasthan refinery launch in CY25. With expected FY26 RoE of 17%, current valuations look attractive.

* Castrol: Brent Crude has fallen to its 4-year low at $60 per barrel amid US-China trade tensions and rising supply. This is beneficial for lubricant companies like Castrol, leading to improved profit margins. For its lubricant business, it is targeting above industry average growth rate of 4-5%. Castrol's focus on brand building, distribution, and new products supports its market leadership. Company is expected to have dividend yield of 6.5% for FY25.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

More News

The Corner Office Interaction with the CEO Shri Suresh Iyer, MD & CEO, Can Fin Homes by Moti...