The Corner Office Interaction with the CEO Shri Suresh Iyer, MD & CEO, Can Fin Homes by Motilal Oswal Financial Services Ltd

Near-term growth headwinds; efforts to mitigate impact of tech transformation

We met with the senior leadership team of Can Fin Homes (CANF), represented by Mr. Suresh Iyer, MD & CEO, at their corporate office in Bangalore to discuss the company’s growth outlook, the impact of the current situation in Karnataka and Telangana, and how the company plans to mitigate the potential impact of its ongoing tech transformation on disbursements.

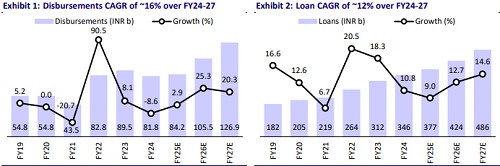

CANF is navigating near-term business challenges in Karnataka, driven by lower e-Khata issuances and weak property transactions in Telangana due to Project Hydra. While disbursement trends in Karnataka show signs of recovery, the outlook in Telangana remains weak, potentially leading to subdued loan growth in FY25. However, the company remains confident in achieving ~20% disbursements growth in FY26. CANF has embarked on a large-scale technology transformation aimed at enhancing operational efficiency, streamlining processes, and reinforcing risk management. The management outlined the steps being taken to mitigate the potential impact of this tech transformation on business volumes. The company is leveraging digital advancements such as Aadhaar-based verification, geo-tagging, and centralized disbursements to strengthen processes and elevate customer experience. Its disciplined funding strategy will ensure stability in a declining interest rate environment and help safeguard NIMs. With strong momentum in other key markets (excl. Karnataka and Telangana), along with an expanding branch network, CANF is well-positioned to deliver stronger loan growth (while maintaining its pristine asset quality) from FY26 onwards.

Navigating near-term headwinds in Karnataka and Telangana

* CANF has faced near-term disruptions due to e-Khata challenges in Karnataka and uncertainties stemming from Project Hydra in Telangana. While conditions are gradually improving, the impact has been significant, particularly due to the company's extensive presence in Karnataka.

* During 1HFY25, CANF achieved strong double-digit growth in Karnataka. However, due to recent disruptions in the state, full-year FY25 disbursements in Karnataka are expected to remain largely flat YoY. While there has been no significant improvement in e-Khata issuances over the last 15-20 days, issuances from the Bruhat Bengaluru Mahanagara Palike (BBMP) have shown some improvement, leading to better business volumes in Karnataka. Disbursement trends are showing signs of recovery, with Jan’25 and Feb’25 disbursements exceeding ~INR2b, and Mar’25 disbursements in Karnataka expected to exceed INR2.5b.

* Additionally, Project Hydra in Telangana presents certain challenges, as the government is individually assessing properties to determine their classification as authorized, unauthorized, or government-owned land. Given the uncertainty surrounding property classifications, CANF is exercising caution when sanctioning loans in the state. However, none of the properties financed by the company have been subject to demolition so far. As a result, disbursements in Telangana have declined ~33% YoY in 9MFY25. Despite this, the company does not anticipate any further moderation in business volumes and expects disbursements to recover next year as the situation stabilizes.

* While disbursements in Karnataka and Telangana were impacted, growth in other states was largely in line with the company’s expectations. Northern states exhibited ~20% YoY growth, while Western states showed ~15% YoY growth in disbursements.

* Despite the temporary setbacks in Karnataka and Telangana, CANF is confident that it can achieve ~20% YoY growth in disbursements once conditions stabilize.

Transforming technology with minimal disruption for greater efficiency

* CANF is undergoing a comprehensive technology transformation to enhance its operational efficiency. Historically, tech transformations have often disrupted operations, and a key challenge in this transition has been the lack of integration between the Loan Origination System (LOS) and Loan Management System (LMS) due to different service providers. This issue is further exacerbated by resistance to system changes and compatibility constraints with the existing accounting infrastructure.

* To address this issue, the company has strategically sourced both the LOS and LMS from the same vendor and awarded the tech transformation project to a vendor with proven large-scale execution capabilities, aiming to minimize disruptions.

* CANF has set up a dedicated IT transformation team to oversee the transition and ensure seamless implementation. Additionally, the company has partnered with IBM to develop a structured employee training program, equipping its workforce with the necessary skills to effectively adapt to the new system.

* Budgeted spending on tech transformation: CANF anticipates a ~1% increase in the cost-to-income ratio from FY27 onwards, driven by a total investment of INR2.97b (INR1b in capex and INR1.97b in opex). The project is scheduled for completion by 31st Dec’25. After implementation, annual technology costs are expected to rise to INR550m (INR350m in opex and INR200m in depreciation on capex). Given that the company currently incurs INR150m in technology expenses, the net impact on PBT is projected to be INR400m per year.

* Key digital initiatives: CANF has already enhanced several of its digital capabilities, including Aadhaar verification via UIDAI, automated bank statement retrieval through Account Aggregators, property valuation with Valocity, geo-tagging for site visits, and CIBIL integration through Karza to streamline the credit assessment process.

Well-placed to manage NIM volatility from rate cuts

* CANF anticipates a ~5-7bp reduction in its overall cost of borrowings due to the recent repo rate cut, which it plans to pass on to customers from Apr’25 after realizing the benefits during quarterly repayments in the last week of March. With 60% of its borrowings sourced from banks, of which ~80% is linked to the Repo/EBLR, the company is well-positioned to capitalize on the declining interest rate environment.

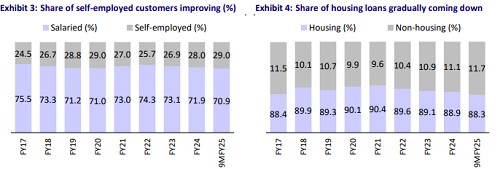

* The company does not foresee any material impact on its NIMs from the recent repo rate cut. Since CANF’s loans to customers are benchmarked to its internal PLR rather than EBLR, rate reductions to customers will only be passed on once there is a corresponding decline in its cost of funds. Additionally, a steady increase in LAP and self-employed borrowers is expected to help sustain margins. CANF has guided for spreads of ~2.5% and NIMs of ~3.5% going forward.

* Furthermore, only ~20-25% of CANF’s loan book is currently on a quarterly reset cycle, limiting any immediate impact. However, the company anticipates that an increasing number of customers will opt for quarterly interest rate resets as the interest rates cycle continues to decline.

Strengthening growth through branch expansion

* CANF expanded its network with 14 new branches over the past 18 months, which now contribute ~INR300m in incremental monthly disbursements. These branches are expected to achieve breakeven within 18-24 months and contribute ~INR600m in incremental monthly disbursements by Dec’25.

* The company aims to further expand its footprint by adding 15 new branches in FY26, which will support its targeted ~20% YoY growth in disbursements next year.

Valuation and view

* CANF has consistently maintained strong asset quality over the years, and we expect this trend to continue. However, to achieve its guided loan growth and unlock further valuation re-rating, the company will need to accelerate disbursements in the coming quarters. A sustained pickup in loan growth, combined with steady margins and controlled credit costs, will be key factors driving investor confidence.

* We estimate a loan CAGR of ~12% over FY24-27, as there may be some transitory impact on business volumes while the company undergoes its tech transformation. The stock trades at 1.2x FY27 P/BV, and we estimate a CAGR of 10%/9%/12% in NII/PPOP/PAT over FY24-27, with an RoA of 2.2% and RoE of ~16% in FY27. We maintain a Neutral rating on the stock with a TP of INR675 (premised on 1.4x Sep’26E P/BV).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

More News

Nifty immediate support is at 25000 then 24800 zones while resistance at 25300 then 25450 zo...