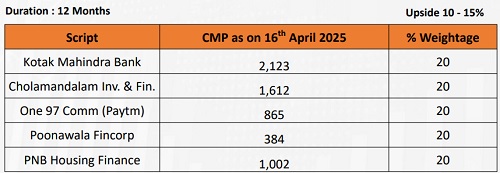

Smart Basket : FinRise Basket by Motilal Oswal Wealth Management

Dividend Yield Basket

* Banks are well-positioned to outperform, supported by robust balance sheets and the ability to navigate macro-economic uncertainties.

* NBFCs are expected to pivot back to growth after the current period of moderation, supported by repo rate cuts and an easing of the regulatory stance.

*Given reasonable valuations and a healthy growth outlook, we have curated a basket of Banking and NBFC stocks.

* Kotak Mahindra Bank: The bank has reported a resilient performance, with steady growth and profitability over the past one year, backed by robust margins. With the RBI lifting significant regulatory restrictions imposed on the bank, we expect business growth and underlying profitability to pick up, with stronger traction in the consumer banking business.

* Cholamandalam Inv. & Fin.: Management anticipates NIM expansion in a declining rate environment and has guided for improvement in vehicle finance margin in FY26. Company has also developed its digital platform, where it is doing personal loans/business loans. Its diversified portfolio and focus on NIM expansion supports a healthy AUM CAGR of 24% over FY24-27E.

* One 97 Comm (Paytm): Paytm has successfully navigated regulatory challenges, retaining a strong merchant base (43m, +9% YoY) and scaling its loan distribution business via FLDG partnerships. With 85% of GMV from merchants, Paytm expects a 24% GMV CAGR over FY25-27E and a 25% revenue CAGR, driven by financial services.

* Poonawala Fincorp: The company outlined its vision to evolve into a multi-product lender, expanding its offerings from four to ten products. Additionally, it plans a phased rollout of 400 new branches starting from 1QFY26, targeting 30-40% AUM growth over FY26-27.

* PNB Housing Finance: PNB Housing is confident of scaling its retail loan book to ~INR1t by FY27, supported by sustained mortgage demand and the revival of PMAY. NIMs are expected to improve to ~4% by FY27, driven by a better product mix, despite competitive pressures. With a focus on retail expansion and affordable housing, it is well-positioned for growth.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

More News

MOSt Market Roundup : Nifty future closed negative with losses of 0.14% at 23665 levels - Mo...