Capital Market : Account Aggregator, A boon for the financial ecosystem by Motilal Oswal Financial Services Ltd

Unlocking the next step in financial inclusion and data empowerment

* In our capital market thematic report (click here), we highlighted the importance of the account aggregator (AA) framework for growth in the capital markets space. In this report, we have deep-dived into the current status of the AA framework.

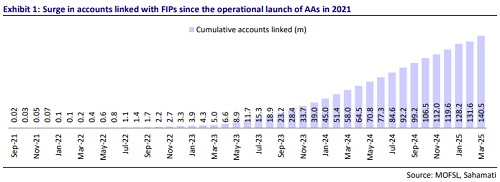

* The AA framework, a pioneering initiative by the RBI, is rapidly revolutionizing credit, insurance, and wealth management services in India by enabling secure, userconsented sharing of financial data. With 2.12b+ accounts having the facility of AA, the framework has become the foundation for open finance in India.

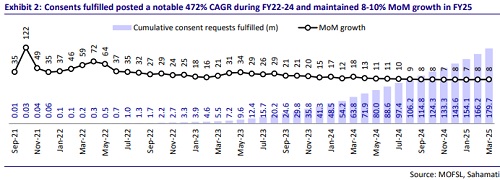

* Driven by regulatory push, strong players are taking AA licenses (up from 4 in Sep’21 to 17 at present), and the rising Fintech adoption over the last few years has led to a surge in cumulative consent requests under AA to 179.7m in Mar’25 from a paltry 0.33m in Apr’22. The requests are rapidly growing at 8-10% MoM.

* Use cases during the launch of AA were predominantly around credit underwriting and are now moving to wealth management and insurance, opening new monetization avenues for AAs and cost optimization opportunities for players in those industries. Currently, AAs earn revenue from data fetching, but the next phase will likely be fueled by bundled offerings and platform licensing.

* Competition within the AA space is at a nascent stage with 17 licensed AAs. Players like CAMS Finserv and OneMoney are leveraging existing MF infrastructure to provide high-quality platforms. With limited pricing pressure and a low scope for product innovation, differentiation will emerge through tech capabilities and FIU relationships.

* The lack of awareness about the AA ecosystem, however, remains a key concern. Strategic outreach efforts to amplify engagement and adoption can boost monthly consents from 10m currently to 100m, which will help achieve Sahamati’s goal of 5b transactions by 2027.

* India’s AA stack has had a push start on the back of regulatory support, potential scale, and strong existing digital infrastructure (UPI, Aadhaar, etc.), which positions the ecosystem for an inclusive growth trend. Over the long term, higher awareness can spur customer adoption and make AA the “UPI of data” as the framework expands to underserved customers and contributes towards financial inclusion.

* While the contribution of the AA framework is low in the non-MF revenue pie of CAMS and KFintech, the existing strong tech capabilities of both, along with continued growth momentum in the AA space, will benefit the business segment. We have a BUY rating on CAMS and a Neutral rating on KFintech.

Enabler of faster and more secure financial data sharing

* The need for a seamless and secure mechanism to consolidate and share data with third-party financial service providers resulted in combined efforts of regulators (such as RBI, SEBI, IRDAI, and PFRDA) towards implementing the consent-based data-sharing AA framework.

* AAs are entities that use the digital ecosystem to assist individuals in the easy, fast, and secure exchange of data between various financial institutions like banks, insurance providers, and AMCs. The entities act as consent managers for customers to give, manage, review, and withdraw consents related to data access.

* The discussions around the AA framework started in early 2016, and in Sep’16, the RBI issued master directions for AAs. The network went live in 2021 with players like OneMoney, CAMS Finserv, Finvu, and NESL being granted the first AA licenses. Since then, the network has seen tremendous expansion to 17 licensed AAs and 600+ financial institutions with ~2.2b accounts.

* The first AA transaction was done through OneMoney in May’21, and as of Mar’25, the AA framework has fulfilled 179.7m consent requests, reflecting rising demand for data usage. The framework surpassed 100m consents in three years, making it the fastest-growing open finance network in the world. As of Mar’25, the accounts linked into the AA framework were at 140.5m.

* The stellar growth of the ecosystem in such a short period has been propelled by: 1) the regulatory push and fast collaboration between regulators, 2) mature digital public infrastructure in place through UPI, DigiLocker et al., and 3) continuous product innovation to gauge multiple use cases.

* AA has the potential to become the ‘UPI moment equivalent’ in the financial services industry, providing a comprehensive verified financial profile to service providers in one place and enabling enhanced product customization along with faster processing. This in turn will reduce data errors as well as costs and improve customer experience.

Asset-light revenue scaling potential for AAs

* The major participants of the AA ecosystem are account aggregators, financial information providers (FIPs), and financial information users (FIU). FIPs hold user data, which is shared with the FIUs for various services such as loans, insurance, wealth management, etc., via requests through an AA.

* AAs primarily earn revenue from FIUs by facilitating consent-based data transfers and charging a data fetch fee (companies like Finvu charge INR20-30 per fetch). Volume-based standard pricing fees are also charged by AAs.

* With the infrastructure in place, AAs have the potential to earn significant revenue through various other streams, including 1) subscription fees to offer differentiated services like dashboards, analytics, etc. to FIUs, 2) license fees to offer core AA infrastructure to FIPs and FIUs, and 3) offering of bundled services (such as AA + Video KYC) as a broader tech stack.

Multiple use cases with strong growth potential

* Currently, the majority of the transactions are around lending, personal finance management, and insurance. Multiple use cases around creating a marketplace for financial products, account onboarding, financial dashboards, product customization, and fraud prevention have been implemented.

* Retail Lending

* Lenders dominate the AA ecosystem, driving a majority of the consents fulfilled with NBFCs, private banks, PSU banks, and RRBs. They contributed ~76% of cumulative consents fulfilled as of Dec’24.

* Data such as bank statements, EMI data, income & expense profiles, etc., are fetched for products like personal loans, credit cards, & unsecured business loans.

* The AA ecosystem provides a vast opportunity for the lending ecosystem to improve operational efficiency, reduce turnaround times, address inefficiencies in data collection, and extend financial inclusion deeper into the country.

* Wealth Management

* SEBI-regulated entities such as portfolio managers, stockbrokers, investment advisors (RIAs), and research analysts (RAs) have been early adopters of the AA framework as FIUs. In FY24, SEBI-registered FIUs in the ecosystem surged ~4x YoY, while cumulative consents fetched jumped ~10x YoY, reflecting a rapid adoption of the AA framework.

* As of Dec’24, 24% of the cumulative consents fulfilled were contributed by Registered Investment Advisors (RIAs) and stockbrokers, largely for demat account opening and personal financial management. RIAs have been one of the earliest adopters of the AA framework, with steady growth in consents and a stable share of ~12-13%. Conversely, stockbrokers have witnessed fast growth, with shares rising significantly to 10-11% in Dec’24 from 2-3% earlier.

* About 50% of cumulative consents taken by the SEBI FIUs have been for income verification for F&O account opening, 48% for personal finance management, and 2% for portfolio review and management, as of FY24.

* AAs have enabled FIUs to aggregate data of financial holdings into one single portfolio view, fetch bank statements for income profiling, and analyze historical financial behavior to build tailored investment strategies.

* While most of the discretionary financial products are primarily used by HNIs and UHNIs, the retail investor base is accustomed to the distributor-led model due to the low availability of RIAs (~1 per mn people). Through the use of AAs, RIAs can achieve scalability as well as operational efficiency by providing customized, data-driven advisory services.

* Growing retail participation in MFs, reflected by a surge in the demat accounts and all-time high SIP flow, along with SEBI’s push for regulated RIAs, will drive the need for AAs in this segment for various use cases.

* Insurance

* As of Dec’24, insurers contributed ~0.1% of cumulative consents fulfilled, reflecting the nascent stage of AA ecosystem integration in this segment.

* An AA framework enables insurance providers to validate the income of customers for sum assured calculation, access credit records of policyholders for early fraud detection, and also underwrite claims according to the lifestyle patterns of the customer. Going forward, health records via the Ayushman Bharat initiative of the GoI may also be fetched through AA, which will likely enhance the underwriting capabilities of insurance providers.

* Currently, use cases for the insurance segment are largely helping in reducing mis-selling, preventing fraud, access to better risk data, and improving the persistency ratios. However, in the future, better AA integration can help insurance providers with faster onboarding, data-driven underwriting, and usage-based pricing models, which will in turn drive growth for the ecosystem.

* According to CAMS Finserv, 1.5b use cases exist for financial data aggregation in a year, reflecting single-digit market penetration and large headroom for growth. Use cases are expected to surpass 2b by FY26 in credit and insurance, with strong segment expansion likely from capital market use cases.

Growth opportunities leading to intensifying competition in the AA space

* The AA ecosystem has grown significantly over the years, with 9-10% of the Indian population having linked accounts (112.3m as of Nov’24). This has been driven by the growing base of licensed AAs from 4 in Sep’21 to 17 currently. Players such as FinVu, OneMoney, CAMS Finserv, and NESL-AA marked the beginning of India’s operational AA ecosystem.

* CAMS Finserv

* One of the first AAs to go live in the industry with use cases across lending, capital market, insurance, and pension domains.

* Ranked No. 3 in the AA space with 146 live FIUs (25% market share), 94 FIPs, and 264 FIUs signed.

* Market share for cumulative consents has grown to 11% from 0.2% in Apr’23, driven by monthly consent market share in the high teens.

* A dominant player in the capital market use cases with ~90% market share in the F&O account opening use case.

* Collaborated with Microsoft India in 2022 with the aim to enhance digital transformation and develop a robust tech stack.

* The company had guided 1m/day data pulls and analysis by FY28 on its platform and now expects to achieve the same in FY26, reflecting a strong growth trajectory of the overall AA industry.

* Kfintech

* Acquired a 25.63% stake in the parent company of OneMoney, India’s first licensed AA, in 2023.

* The acquisition helped Kfintech to embed AA infrastructure into its wealth management offerings and cross-leverage investor data from mutual funds, insurance, and pensions.

* OneMoney is among the top AAs in the country for cumulative consent requests, with strong traction in lending and microcredit from the start and significant expansion into mutual fund aggregation, insurance policy data, and EPFO integration post-Kfintech acquisition.

* Consent requests have grown 15-20% MoM consistently since 2022, reflecting strong traction, due to which multiple players have taken the RBI license, including large players like PhonePe. The requirement of interoperability reduces the scope of product innovation, and hence, the scope for differentiation lies in tech stack, client servicing, speed, and support.

Potential to reshape the financial services sector

* India’s AA framework has laid the foundation of a robust, inclusive Open Finance model, fostering collaboration among regulators, financial institutions, and tech providers. The banking sector has been at the forefront of AA adoption, followed by capital markets.

* As of Dec’24, out of the total estimated 3.5b financial accounts in the country, 2.12b accounts have been activated on AA, reflecting 60% penetration. While demat and pension accounts have seen 100% penetration, deposits have seen 60-75% penetration across SCBs and RRBs.

* According to Sahamati’s analysis, while the credit use cases will remain prominent going forward, the contribution of transactions will increase from other sectors as well, primarily the capital market (expected to contribute 41% in 2027). Improved integration of insurance policies in the framework will grow the insurance transactions as well.

* The number of transactions is expected to reach 5b by 2027, as per Sahamati, driven by the continued growth of the current use cases coupled with the emergence of several more innovative use cases. Broadening the FIP base, interoperability of AAs, deepening usage, product innovation, increasing customer awareness, and continued regulatory support will be key growth drivers for the adoption of the AA ecosystem.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

More News

Capital Market : Mixed performance across parameters by Motilal Oswal Financial Services Ltd