Technical Morning Ideas 25th August by Vaishali Parekh Vice President - Technical Research, PL Capital Group - Prabhudas Lilladher Ltd

Below the Technical Morning Ideas 25th August by Vaishali Parekh Vice President - Technical Research, PL Capital Group - Prabhudas Lilladher Ltd

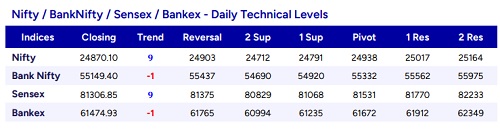

“NIFTY / SENSEX

Nifty witnessed heavy profit booking during the intraday session to form a bearish candle on the daily chart with a lower top formation to signify bias turning weak, and we can expect downward movement in the coming sessions. The index would have the important 50EMA level near the 24850 zone and, as mentioned earlier, has got the crucial and important support near the 24500 zone, which needs to be sustained to keep the overall trend intact. On the upside, a decisive breach above the 25000 zone shall change the sentiment once again; thereafter, expect a further upward move. Sensex found resistance near the 82000 zone and slipped, with profit booking seen to end below the 50EMA level of the 81400 zone, with once again the index precariously placed and having the bias maintained with a cautiously positive approach. As mentioned earlier, the index has the crucial and important support zone of the 20 DMA level at 80980, which needs to be sustained, and on the upside, as mentioned earlier, only a decisive breach above the 82300 level shall establish conviction to expect further rise ahead. The support for the day is seen at 24700 levels, while the resistance is seen at 25000 levels.

BANKNIFTY / BANKEX

BankNifty finally plunged from the 56000 level, with bias getting weaker as the day progressed to end near the 55100 zone, nearing the crucial support of the 55000 level. The overall sentiment has once again turned cautious with many developments in the pipeline that shall decide the course of the market in the coming days. The index is precariously placed, and a decisive breach below the 55000 zone shall trigger fresh downward movement with the trend turning weak. Bankex once again slipped down, with profit booking seen forming a lower top pattern on the daily chart, and further ahead, it has the important and crucial support zone of 61000 levels, which needs to be sustained, failing which, it can trigger selling pressure with 60500 as the next support level. On the upside, as mentioned earlier, we would need a decisive breach above the 50EMA zone of 62400 levels to improve the bias, and thereafter we would expect a further rise in the coming days. BankNifty would have the daily range of 54700-55700 levels.”

Above views are of the author and not of the website kindly read disclaimer

More News

Market Wrap : Markets slipped after a brief rebound, losing over half a percent as the chopp...