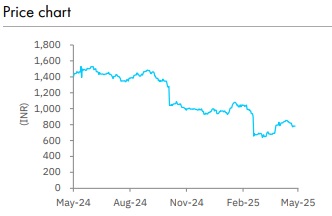

Sell IndusInd Bank Ltd for Target Rs. 720 by Elara Capitals

In for the long haul

IndusInd Bank (IIB IN) Q4FY25 was characterized by a series of financial irregularities, which had a cumulative impact of ~INR 49bn, resulting in a Q4 loss of INR 22bn. Not only this, but a lot is left unanswered: 1) how is such a lapse possible despite audits, 2) why did the auditors not share any qualifications, 3) how did this issue go undetected for so long, and 4) most importantly, is this the end or is there more to come. Operationally as well, the quarter was softer and ensuing challenges will feed into softer core performance in FY26, beside the volatility part of it. Stepping into FY26, questions around management change (which will decide direction and drift of the bank), deposit flows, and liquidity position will dominate discussions. Looking at these variables at play, the bank is in for the long haul and would rather be delivering sub-10% ROE even by FY27. After factoring in financial irregular adjustments and softer core, we prune our FY26E BV by 11% and our FY27E BV by 15%, resulting in a lower TP of INR 720. We reiterate Sell.

Moot question – is it over or more in store? We saw a series of financial irregularities reported by IIB – a few larger ones being: 1) derivative related of INR 19.6bn, 2) MFI provisions as a few assets were wrongly classified worth INR 17.9bn, and 3) MFI interest income irregularities of INR 4.3bn, which saw a cumulative impact of INR 49bn. Given this, the bank reported an operating loss, but as per management normalized (excluding one-offs) operating profit was INR 30.6bn. Considering this, the core was reasonably weak, which positions FY26 on a soft peddle. We see uncertainty in FY26, which has the potential to further drag earnings; thus, further downgrade to earnings cannot be ruled out.

Slippages were higher (5.8% of loans), which was driven by MFI slippages (~60% contribution) as the bank recognized prior period stress (few accounts were wrongly classified). Even excluding this. MFI slippages were higher, which we see continuing until H1FY26, not to mention, other portfolio may see challenges (which was not the case this quarter). In a nutshell, credit cost was higher, but FY26 will see elevated numbers. The bank has utilized the entire buffer pool; thus, the margin of error hereafter is rather low. We believe such instances have dented investor confidence and created a vulnerable position.

Reiterate Sell with a lower TP of INR 720: A lot remains unanswered for us to call for a potential bottoming. We see the bank can deliver a mere 10% level ROE even by FY27E with some event plays rendering volatility. With lack of strategic directions (new management pending), it is difficult to take a constructive call amid such uncertainty regardless of valuation. We watch for a period of stability, outflows on deposits, and new management strategy, which will probably take time. After factoring in financial irregular adjustments and softer core, we prune our FY26E BV by 11% and our FY27E BV by 15%Hence, we reiterate Sell with a lower TP of INR 720 from INR 830 based on 0.8x (unchanged) FY27E P/ABV.

Please refer disclaimer at Report

SEBI Registration number is INH000000933