Sell Cocudakl Apr @ 2700 SL 2740 TGT 2660-2620. NCDEX - Kedia Advisory

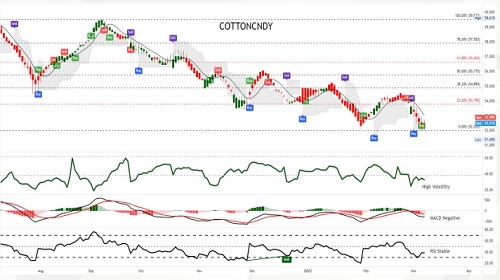

Cottoncandy

BUY COTTONCANDY MAR @ 52500 SL 52200 TGT 52800-53000. MCX

Cottoncandy prices declined by 0.21% to Rs.52,550 due to a significant increase in supply and subdued mill buying. Mills are currently well-stocked and have no immediate purchasing requirements, contributing to weaker demand. Brazil’s cotton production for the 2024-25 season is expected to rise by 1.6% to 3.7616 million tons, with a 4.8% increase in planting area, signaling ample supply. Additionally, the Cotton Corporation of India (CCI) is expected to procure over 100 lakh bales at the Minimum Support Price (MSP) this season. According to the Cotton Association of India (CAI), total cotton output for the 2024-25 season is estimated to decline to 301.75 lakh bales due to lower yields in Gujarat and northern regions, compared to 327.45 lakh bales in the previous season. By January 2025, the total cotton supply was 234.26 lakh bales, consisting of 188.07 lakh bales from fresh pressings, 16 lakh bales from imports, and an opening stock of 30.19 lakh bales. Meanwhile, cotton consumption up to January was 114 lakh bales, and export shipments stood at 8 lakh bales. Ending stock levels were estimated at 112.26 lakh bales. CAI retained its domestic consumption projection at 315 lakh bales for the season, while exports are expected to decline to 17 lakh bales from 28.36 lakh bales in 2023-24. Technically, the market is under long liquidation, with open interest remaining unchanged at 257 contracts. Immediate support is at Rs.52,420, and a break below could push prices to Rs.52,290. On the upside, resistance is seen at Rs.52,760, with a potential move towards Rs.52,970 if prices rise further.

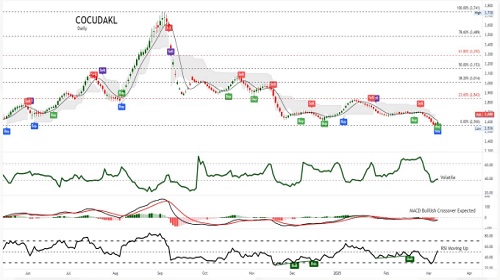

COCUDAKL

SELL COCUDAKL APR @ 2700 SL 2740 TGT 2660-2620. NCDEX

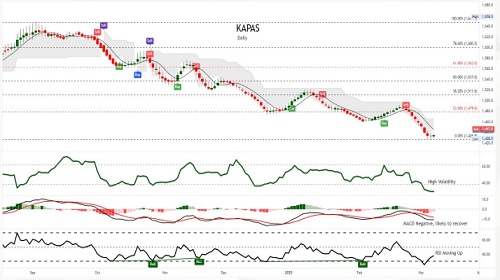

KAPAS

BUY KAPAS APR @ 1440 SL 1430 TGT 1450-1460. NCDEX

More News

Commodity Intraday Technical Outlook 01 April 2025 - Geojit Financial Services Ltd