MCX Crude oil May is likely to rise further towards Rs.5300 level as long as it stays above Rs.5100 level - ICICI Direct

Metal’s Outlook

Bullion Outlook

* Gold is expected to slip further towards $3220 level on strong dollar and surge in US treasury yields. Further, demand for safe haven may fade on optimism over potential trade deal between US and its major trading partners including China. US and China ended trade talks on positive note easing concerns over trade war between 2 largest economies. US Treasury Secretary Scott Bessent is expected to provide more details in a full briefing, which will offer more clarity on talks. On the geopolitical front, India and Pakistan agreed upon ceasefire over the weekend and Ukrainian President Volodymyr Zelenskiy said he was ready to meet Russian leader Vladimir Putin in Turkey for direct talks.

* Spot gold is likely to slip further towards $3220 level as long as it stays below $3320 level. MCX Gold June is expected to slip back towards Rs.94,500 level as long as it stays below Rs.96,500 level

* MCX Silver July is expected to slip further towards Rs.94,300 level as long as it trades below Rs.97,000 level.

Base Metal Outlook

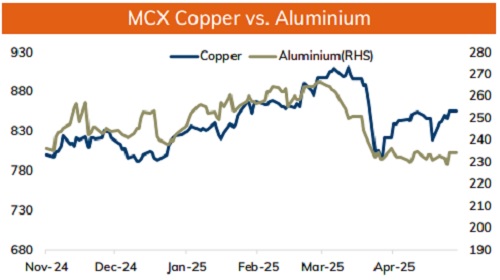

* Copper prices are expected to trade with positive bias on rise in risk appetite in the global markets and signs of improved demand from China . Moreover, Yangshan copper premium, which reflects demand for copper imported into China, reached $103 per ton, highest since December 2023. Additionally, better than expected fundamentals along with falling inventories would be supportive for the prices. The Shanghai Futures Exchange reported decline in copper inventories again on Friday. Copper inventories on the SHFE decreased by 10% since the end of April. Furthermore, US-China trade talks ended on positive note easing concerns over trade war between 2 biggest economies

* MCX Copper May is expected to rise towards Rs.860 level as long as it stays above Rs.840 level. A break above ?860 level prices may rise further towards Rs.865 level

* MCX Aluminum May is expected to rise towards Rs.237 level as long as it stays above Rs.232 level. MCX Zinc May is likely to move north towards Rs.254 level as long as it stays above Rs.247.50 level.

Energy Outlook

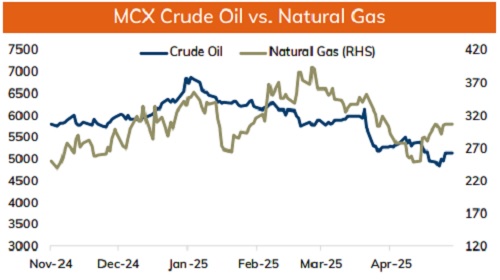

* NYMEX Crude oil is expected to trade with positive bias and rise towards $62.50 level on optimistic global market sentiments. Further, prices may move up on optimism over potential trade deal between US and its major trading. Additionally, US-China ended trade talks on positive note, lifting market sentiments that worlds largest economies may be moving towards resolution of their trade dispute. Meanwhile, planned increased of oil output by OPEC+ could limit further price gains. Moreover, US-Iran nuclear deal would also add more oil into markets

* MCX Crude oil May is likely to rise further towards Rs.5300 level as long as it stays above Rs.5100 level. A break above Rs.5300 prices may rally further towards Rs.5380 level.

* MCX Natural gas May is expected to rise further towards Rs.330 level as long as it stays above Rs.308 level.

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631