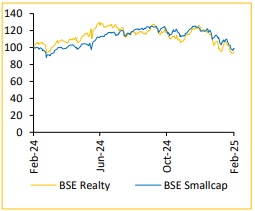

Real Estate Sector Update : Developers- Approval delays have an adverse impact on Q3FY25 pre-sales by Choice Broking Ltd

Developers- Approval delays have an adverse impact on Q3FY25 pre-sales

Godrej Properties Ltd (GPL) has outperformed its FY25 guidance on all fronts, achieving 71% of its pre-sales guidance of INR 2,70,000 Mn, 67% of its customer collection guidance of INR 1,50,000 Mn and has delivered 11 msft, which is 79% of its guidance of 15 msft. In addition, GPL has done business development of INR 2,34,500 Mn, achieving 117% of its guidance of INR 2,00,000 Mn. GPL has a strong launch pipeline planned for Q4FY25 Q3FY25 pre-sales were INR 54,460 Mn, down 5% YoY and up 5% QoQ. Collections were at INR 30,690 Mn, up 27% YoY and down 23% QoQ ..

Mahindra Lifespace Developers Ltd(MLIFE) and Sobha Ltd (SOBHA) had a subdued quarter with a poor operational performance.

• MLIFE Q3FY25 pre-sales were INR 3,340 Mn, down 25% YoY and 16% QoQ. Collections for Q3FY25 were at INR 3,660 Mn, down 5% YoY and 20% QoQ.

• MLIFE finalized the fund raising of INR 15,000 Mn via rights issue which will be used to decrease its current debt levels and support to meet its long term GDV target of INR 4,50,000 Mn from the current INR 1,60,000 Mn level.

• SOBHA’s Q3FY25 pre-sales were INR 54,460 Mn, down 5% YoY and up 5% QoQ and Collections were at INR 30,690 Mn, up 27% YoY and down 23% QoQ.

• SOBHA has completed its INR 20,000 Mn rights issue and boosted land investments by 266% to INR 6,330 Mn in 9MFY25. However, rising land prices in Tier-I and Tier-II cities could affect the overall IRR of new projects. Additionally, residential sales are expected to consolidate after 2 years of strong growth.

Flexible Work Space Market

EEFC(I)Ltd (EFCIL) revised its FY25 guidance downwards and are now anticipating 50% revenue growth however growth story remains intact with plans to almost double seat capacity to 1,10,00 seats in the next 3 years.

• In the Office Rental Segment, EFCIL recorded healthy revenue growth of 31% YoY and 8% QoQ

• EFCIL added 5,650 seats , taking the total operational seat capacity to 57,000 with blended occupancy level of 90%.

• EFCIL’s D&B (Design and Build) Vertical revenue increased 27% YoY and decreased 13% QoQ to INR 676 MN. Execution of orders is expected to pick up in Q4FY25 for this vertical

• The Furniture Manufacturing Unit began operations at the end of Q2 FY25, with capex completed. It reported INR 133 Mn revenue in Q3 FY25, with performance expected to improve as capacity scales. A joint venture with e-commerce Pepperfry Ltd is set to boost future revenue visibility.

• Management aims to file the DRHP for its SM REIT by February end.

Awfis Space Solutions (AWFIS) is on track to surpass its FY25 revenue growth guidance of 30%, having recorded a 41% YoY revenue growth in 9MFY25. The share of seats under the Managed Aggregation (MA) model has grown from 46% in FY21 to 67% currently, in line with its strategy of increasing seat capacity under this asset light MA model.

• AWFIS recorded strong revenue growth of 52% YoY and 12% QoQ.

• AWFIS added 11,554 seats taking the total operational seat capacity to 1,20,000 with blended occupancy level of 73%. AWFIS Management has guided that capacity utilization will inch up from 73% to ~83% over time due to increasing contribution from more than 1 year old seats.

• The Construction and Fitout segment recorded robust growth of 35% YoY and 7% QoQ, backed by a robust orderbook with an increasing contribution of higher margin orders from external clients.

Infrastructure

The Infrastructure sector experienced subdued order inflows in Q3FY25, primarily due to reduced government capex spending and execution delays caused by monsoons and heatwaves. However, we remain optimistic about Q4FY25, given the robust pipeline of new order opportunities across sub-sectors. For FY26, the Indian government allocated INR 11.21 lakh crore for capital expenditure, marking a 0.9% YoY increase. Key infrastructure allocations include Road Transport & Highways (26%), Railways (24%),Drinking Water & Sanitation (7%),Metro rail and Mass Rapid Transport System(3%) and Airport Infrastructure(0.2%).Overall, both public and private capex are expected to pick up, driving economic growth and order execution in Q4FY25 and FY26.

* PSP Projects (PSPPL) Q3FY25 consolidated revenues was INR 6,302 Mn, down 11% YoY and 8% QoQ.

* EBITDA for Q3FY25 was reported at INR 355 Mn, down 49% YoY and 6% QoQ. Net profit for Q3FY25 stood at INR 51 Mn, down 84% YoY and 51% QoQ.

* Current orderbook of PSPPL is INR 64,170 Mn, up 44% YoY. Order inflow for 9MFY25 is INR 14,450 Mn and order inflow for FY26 is anticipated to cross INR 50,000 Mn.

* The management has increased the FY27 revenue guidance to INR 40,000 Mn due to strong revenue visibility backed by orders from the Adani group of companies post the agreement on the 30% open offer by Adani Infra. The partnership aims to leverage Adani group's extensive portfolio in infrastructure development, which includes ports, airports, data centers, and realty.

* The management has lowered its EBITDA margin guidance to the 9-10% range from 10-11% range stated earlier.

* PSPPL saw a delay in execution of orders which were awarded in Q4FY24 which led to a subdued performance in Q3FY25 and 9MFY25. Execution of these contracts has just started in the end of Q3FY25, which will support revenue growth going forward

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131

.jpg)