Power Sector Update : Transition Tracker By JM Financial Services

Energy consumption/ peak demand in Feb’25 stood at 131BU (3%YoY)/ 238GW (7%YoY). Power generation (conventional) was 121BU in Feb’25 (2% YoY) as demand was supported by hydropower (6.9 BU in Feb’25) which grew 17% YoY. Maintaining the momentum 3,998 MW of new RE tenders were issued. Upto Feb’25, 20,752MW of Solar capacity and 2,702MW of Wind capacity were added, taking the cumulative RE capacity to 168 GW (excl. large hydro). Utilisation (PLF) of coal-fired and gas-fired plants stood at 73% and 9% during Feb’25 vs. 71% and 13% during Feb’24. Wind / Solar capacity addition in Feb’25 was 223MW/ 2236MW (21%/ 1.8x YoY). Net thermal capacity addition during YTDFY25 stood at 4.4GW with addition of 1.3GW/1.5GW/1.7GW thermal capacity in Dec’24/ Jan’25/ Feb’25 respectively. Here, we present a collection of 52 charts/exhibits representing important data points that help us track energy transition in India.

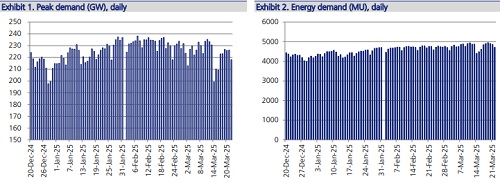

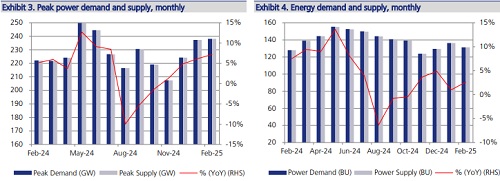

* Power demand: Energy/ peak power demand in Feb’25 stood at 131BU (3% YoY)/ 238GW (7% YoY). With this, YTDFY25 Energy/ Peak demand stands at 1,548 BU/ 250 GW, 3.4%/2.7% YoY. However, in first three weeks of Mar’25 weekly energy demand/ peak demand was up ~7%/ ~5% indicating a likely rebound in ensuing months.

* Generation: Total power generation (conventional) was 121 BU in Feb’25 (2% YoY). Hydro generation during Feb’25 was 6.9BU (+17% YoY) due to better hydrology as compared to last year but was down -6% MoM. RE generated 19BU (-12% MoM/ 3% YoY) with increase in solar and decrease in wind generation by +1%/-28% MoM.

* Renewables momentum continues: In Feb’25, a total of 3,998 MW of RE tenders were issued. SECI floated a 500 MW utility-scale solar project, while NGEL invited bids for a 110 MW wind project in Gujarat. In the battery energy storage system (BESS), multiple tenders were floated: 500 MW/1000 MWh NHPC in Andhra Pradesh, 500 MW/1000 MWh NVVN in Rajasthan, 250 MW/1000 MWh NVVN Pan India, and 375 MW/1500 MWh SJVN in Uttar Pradesh. A total of 1,286 MW of RE capacity was allocated to various developers. SJVN auctioned its 1,200 MW ISTS-connected FDRE tender, with 448 MW awarded to five developers at the tariff of INR 4.82/kWh. SECI’s 125 MW/500 MWh standalone BESS tender was awarded to JSW Energy.

* Capacity addition: In YTDFY25, about 20,752 MW of Solar capacity and 2,702MW of Wind capacity were added, taking the cumulative RE capacity to 167.7 GW (excl. large hydro). Wind capacity addition in Feb’25 was at 223MW vs. 185MW in Feb’24 due to challenges related to land and connectivity. Solar capacity addition is gaining traction with addition of 2,236MW (1.8x) capacity in Feb’25. YTDFY25 net thermal capacity addition stood at 4.4GW with addition of 1.3GW/1.5GW/1.7GW Thermal capacity in Dec’24/ Jan’25/ Feb’25 respectively. There was no hydro capacity addition for YTDFY25.

* Merchant tariff moderated: WAvg Market Clearing Price (MCP) on the exchange stood at INR 4.38/kWh in Feb’25 (purchase/ sell/ cleared volume 9678/10335/5409GWh) vs. INR 4.9/kWh in Feb’24 (purchase/ sell/ cleared volume 7773/8776/4742GWh) due to subdued power demand in Feb’25.

* Utilisation (PLF) remained subdued: The PLF of coal-fired and gas-fired plants stood at 73% and 9% during Feb’25 vs. 71% and 13% during Feb’24.

* Coal production growth: Coal production in Feb’25 was 98MT, 4% YoY taking YTDFY25 production to 929MT, 5% YoY. Coal dispatches in Feb’25 was 86MT, 5% YoY taking YTDFY25 dispatches to 929MT, 5% YoY.

* Solar input material cost mostly stabilized: Price for global mono PERC modules are at USD 0.08/Wp (-30% YoY) in Feb’25. Prices for domestic modules for Mono PERC 500Wp/ Bifacial Modules/ Topcon Modules stood at INR 17.5/Wp / INR 17.5/Wp / INR 18.5/Wp showing signs of traction after hitting low of INR 13.5/Wp / INR 14.2/Wp / INR 15.5/Wp in Sep’24.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361

Tag News

NTPC rises on signing MoU with GMDC

More News

Cement Sector Update : Q2FY26 Quarterly Results Review by Choice Institutional Equities