Oil & Gas Sector Update : Crude Compass - Weekly Oil Market Dossier by Choice Institutional Equities

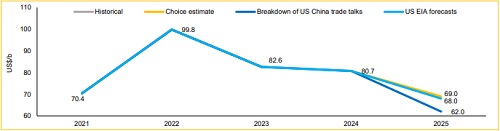

We maintain our estimate for Brent at US$69.0/b for the Calendar Year 2026 (as published on June 13, 2025) compared to YTD average of US$69.9/b.

In our view, following three aspects will drive the oil price, going forward:

* Probably positive outcome of negotiations regarding tariffs imposed by the US against China; will boost global oil demand as 35% of the oil demand comes from these two countries.

* Meanwhile, actual increase in output by OPEC+ will drive the prices lower compared to mere announcement of increase in supply.

* However, as there is expectation of supply glut, we believe that the equilibrium among supply, demand and oil prices will be driven by fiscal deficit of Saudi Arabia and continued viability of marginal oil production in the US.

Given the ongoing developments -- particularly the possibility of US tariff impositions and subsequent renegotiations - we anticipate some market volatility. Nonetheless, Brent crude is likely to remain range-bound between US $60 and $75/b in absence any geopolitical escalation. Below US$60/b, marginal US supply becomes uneconomical, while above US$75/b, demand elasticity is expected to increasingly moderate prices in the current macroeconomic climate.

Moreover, as per the commentary from APPEC (Asia-Pacific Petroleum Conference - one of the biggest gatherings for oil market professionals in the world), the current oil demand and price are held due to oil purchases by China for its Strategic Petroleum Reserve. Furthermore, this buying might be through shadow trades from Iran, Venezuela and Russia, while China keeps its inventory data confidential.

In our view, the absence of above-mentioned trade flows will result in muted reaction from the oil markets, as only few countries might be able to absorb the sanctioned crude.

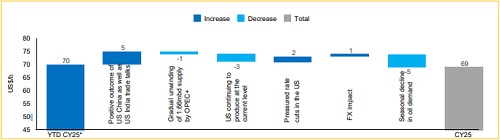

Chart 1: Catalysts for Brent

Source: FactSet for Historical data, Choice Institutional Equities

*Note: YTD CY25 price as of Sept 11, 2025

Chart 2: Brent estimates

Source: FactSet for Historical data, Choice Institutional Equities

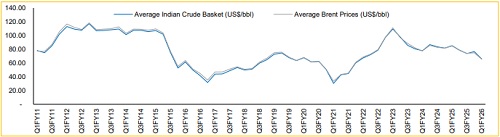

Chart 3: Average Indian Crude Basket (US$/bbl) against Average Brent Prices (US$/bbl)

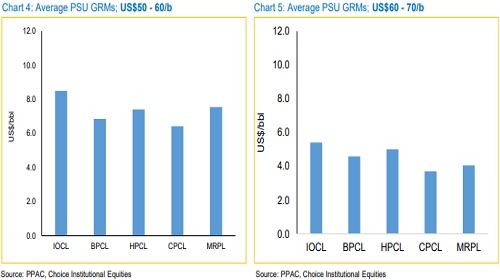

Impact of Oil Price on GRMs

What has happened during the past week:???????

* OPEC+ on Sunday (Sept 7, 2025) agreed to boost the oil supply by 137kbd. This forms a part of 1.65mbd (about 2% of world demand), an additional layer of production which was originally scheduled to be kept back until the end of CY26. Additionally, OPEC+ stated that, contingent to market conditions, it will reimburse all or a portion of 1.65mbd of additional supply. The group has not provided detailed timeframe for the reimbursement. However, delegates stated that supplies will be added on a monthly basis, until September of the next year. The next meeting is scheduled for October 5.

Our view:

a. The increase in supply has been baked in to Brent Oil prices during the week of Sept 1st to 5th, wherein crude oil price plummeted by 3% to US$65.5.

b. Moreover, the increase in actual supply will move the needle farther than the quantum mentioned in their announcement. As observed in a couple of months between June and Sept 2025, actual output differed from planned increases.

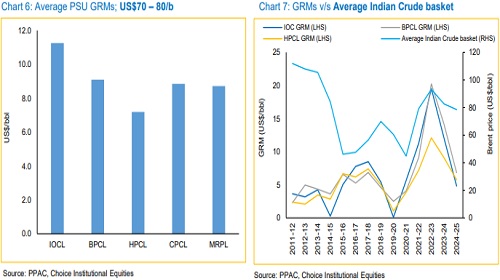

To tackle volatility, we have mapped the average GRMs between FY12 to FY25 of refining businesses of PSUs across various ranges of Brent prices.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131

More News

Top Conviction Ideas : Metals & Mining: Q2FY26 Review by Axis Securities Ltd