Neutral ONGC Ltd for the Target Rs. 245 by Motilal Oswal Financial Services Ltd

Production growth remains soft

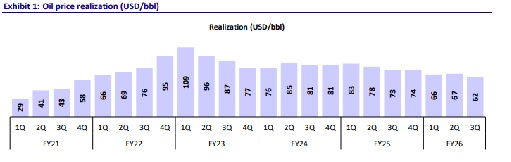

? ONGC’s 3QFY26 revenue came in line at INR315.5b. Crude oil/gas sales were in line at 4.7mmt/3.9bcm. Crude oil production declined marginally QoQ/YoY, while natural gas production remained flat QoQ/YoY. Standalone EBITDAX came in line at INR173b. However, PAT came in 21% above our estimate, as other income stood significantly above the estimate, and the tax rate stood below.

? Key things we liked about the result: 1) ONGCs management has maintained its FY27 SA total production guidance of 42.5mmtoe, which implies a robust 7.7% YoY growth on our SA FY26 estimate. 2) Gas production is expected to increase by 9- 10mmscmd by the end of FY27, as production ramps up from KG-D6, the Daman upside project, and DSF. 3) NWG contribution is expected to increase from currently 18% to 23-24% of total gas revenue in FY27.

? Key investor concerns: 1) Production volumes remained soft in 3Q as crude oil production declined marginally QoQ/YoY, while natural gas production remained flat QoQ/YoY. Total oil and gas production declined ~1% YoY in 9mFY26. 2) OPaL’s weak performance continues as it reported a loss of INR5.4b in 3QFY26 (vs. a loss of INR4.6b/INR7.7b in 2QFY26/ 3QFY25). However, profitability should improve as petchem prices have risen. 3) OVL has also reported weak performance in 9mFY26 as its EBIT is down 40% YoY. 4) Exploratory well write-offs are likely to be higher QoQ in 4QFY26, which could dent ONGC’s earnings.

? Valuation and view: We reiterate our Neutral rating on the stock and arrive at our SoTP-based TP of INR245 as we model a CAGR of 1.8%/2.5% in oil/gas production volume over FY25-28.

Key takeaways from the management commentary

? The 9MFY26 NW gas revenue is 18% of total gas revenue. This should ramp up to 23-24%.

? The KG 98/2 project is advancing well with all 26 wells drilled, subsea infrastructure nearing completion, and the processing platform with living quarters and utility platform fully installed.

? Daman Upside Development project (~4-5mmscmd peak gas output) is expected to be operational by 4QFY26’end, while DSF is under development and targeted for commissioning by 4QFY27.

? Capex: Capex incurred during 9MFY6 is INR244b. FY27 standalone capex guidance: INR320-330b. 20 major development, redevelopment, and infrastructure revamp projects are under execution with a total combined capex of about INR770b.

? OPAL is operating at more than 90% capacity utilization with the average 9MFY26 capacity utilization of 92%.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412