Buy Ellenbarrie Industrial Gases Ltd For Target Rs. 550 By JM Financial Services

Scaling profitably on India’s industrialisation story.

Ellenbarrie Industrial Gases (EIGL) was incorporated in 1973 and is one of the oldest operating industrial gases companies in India, with a rich legacy of over 50 years (Exhibit 11). It has grown from a single oxygen plant (set up in 1976) into a trusted partner for industrial and healthcare customers, delivering oxygen, nitrogen, argon, etc. through its network of its air separation units (ASUs) and cryogenic distribution systems. It is the market leader in the states of West Bengal, Andhra Pradesh and Telangana, in terms of installed capacity as of end-FY25.

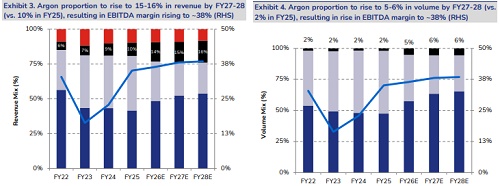

EIGL has built robust competitive advantage in an industry dominated by MNCs via its regional focus and agile customer engagement; this gives it a distinct edge for scalable growth by building plants closer to end-users, customising offerings and targeting under-served regions. Leveraging industry tailwinds, the management is driving aggressive capacity expansion to make EIGL a pan-India player. It is building three ASUs, which will lift its total capacity to 2,121 tonnes per day (TPD) by 1QFY27 (from the current 1,361TPD); this is likely to drive 29% CAGR in merchant volume over FY25-28. Further, we expect EIGL’s high-margin argon production to grow at 83% CAGR from ~9TPD in FY25 to +50TPD by FY28. Hence, EIGL is strategically positioned for further expansion in EBITDA margin to 38% in FY28 (from 35% in FY25% and 24% in FY24). Hence, we expect EIGL to deliver a CAGR of ~30%/34%/32% in revenue/EBITDA/PAT over FY25-28. We initiate coverage with BUY (TP of INR 550) based on 40x FY28E P/E (vs. Linde India trading at ~57x FY28 P/E despite lower earnings growth expectations with a similar RoE profile).

Key risks: a) decline in price/volume of argon; b) lower volume growth due to delay in start of new capacity and/or slower rampup; c) high customer, industry and region concentration.

EIGL’s pan-India ambition to drive long-term capacity-led growth: EIGL is building three ASUs, which will increase its total capacity to 2,121TPD by 1QFY27 (from the current installed capacity of 1,361TPD). This is likely to drive 29% CAGR in merchant volume over FY25-28 — Exhibit 1-2. Further, it is also actively looking for expansion opportunities in West India, marking its ambition to build a pan-India presence.

Margin to further strengthen with rise in contribution from high-margin argon: We expect EIGL’s argon production to grow at 83% CAGR from ~9TPD in FY25 to +50TPD by FY28 once all the announced expanded capacity is commissioned. Hence, EIGL is strategically positioned for further expansion in EBITDA margin to 38% in FY28 (from 35% in FY25% and 24% in FY24) given argon’s EBITDA margin is significantly higher at 70- 80% vs. 30-35% in case of oxygen and nitrogen — Exhibit 3-4.

EGIL has built robust competitive edge in an industry dominated by MNCs; well positioned to capitalise on industry tailwinds: Indian industrial gases industry is projected to see strong growth supported by government initiatives like “Make in India”, “Aatmanirbhar Bharat”, PLI schemes and import substitution policies, alongside rising demand from various end-use industries. EIGL’s diverse customer base, long-term customer relationships, extensive product portfolio and demonstrated flexibility imply it is well-placed to leverage these industry tailwinds and convert market growth into sustained revenue and profitability gains.

Initiate with BUY rating with TP of INR 550: We expect EIGL to deliver a CAGR of ~30%/34%/32% in revenue/EBITDA/PAT over FY25-28, driven by: a) 29% CAGR in merchant volume on account of strong capacity expansion; and b) EBITDA margin improvement to 38% in FY28 (from 35% in FY25% and 24% in FY24) due to rise in proportion of revenue from highmargin argon. Hence, we initiate coverage on EIGL with BUY rating with a TP of INR 550 based on 40x FY28E P/E (vs. Linde India trading at ~57x FY28 P/E despite lower earning growth estimate with a similar RoE profile).

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361