Neutral Indraprastha Gas Ltd For Target Rs.435 by Motilal Oswal Financial Services Ltd

Valuations inexpensive as margin recovery resumes

* IGL delivered a 12% beat on our EBITDA estimates as margin came in 9% above our estimates and volumes remained strong. The impact of APM twin de-allocation was clearly visible as margins contracted INR2.2/scm QoQ. Spot LNG prices have remained high, averaging ~USD14/mmbtu, over the past four months and are expected to remain elevated in the midterm. Post the APM re-allocation, the net reduction in APM allocation now stands at ~0.9mmscmd. Further, IGL is expected to receive 0.5mmscmd New Well (NW) gas from Feb’25.

* While margins are likely to remain under pressure in 4Q amid high Spot LNG prices, IGL has entered into long-term gas contracts to reduce the impact. In addition, we believe that the opportunity to implement CNG price hikes in Delhi will arise post Delhi elections, which are due in Feb’25.

* Since the downgrade in Feb’23, IGL has delivered a negative return of 12% over the past two years. With volume and margin expectations at a weak level, we upgrade the stock to neutral. IGL currently trades at 12x 1Y fwd P/E, which we think is inexpensive. Our revised TP on the stock is INR435, which is based on 15 Dec’26 EPS.

NW gas allocation and long-term contracts to support margins

* While the twin APM de-allocation in 3Q led to a ~1.9mmscmd decline in APM allocated toward CNG, ~1mmscmd APM gas was restored w.e.f. 16th Jan’25. Hence, the net reduction in APM allocation stands at ~0.9mmscmd.

* From Feb’25, the company will also receive 0.5mmscmd NW gas, which will be ~25% costlier than APM gas. Further, management does not expect more than 20% of the current APM gas to be replaced by NW gas.

* IGL has secured ~1.65mmscmd contracts at competitive rates for sourcing RLNG gas. This includes 1mmscmd gas with pricing linked to Henry Hub (HH) for five years, and another 0.65mmscmd gas initially linked to HH-based pricing, which will get converted to Brent-linked pricing from FY27 (volumes will also increase to 1mmscmd gradually).

Possibility of CNG price hike in 4Q; guided margins at INR7-INR8/scm

* On 25th Nov’25, IGL implemented CNG price hikes of ~INR1.5 to INR4 per kg, which impacted ~30%-35% of the regions where IGL’s CNG business operates (i.e. excluding Delhi). We believe that post Delhi elections in Feb’25, IGL might implement further price hikes in Delhi.

* Management guided for EBITDA margin of INR7-INR8 per scm, going forward. At current prices, management believes that an INR2/scm CNG price hike will be required to deliver the guided margin.

~1mmscmd p.a. guided volume growth in FY26/FY27

* Management expects to end FY25 with volumes reaching 9.5mmscmd. Further, it expects volumes to grow 1mmscmd p.a., reaching 10.5mmscmd/11.5mmscmd in FY26/FY27.

* This growth will be driven by:

* 30% YoY growth in new gas, which accounts for 0.7mmscmd CNG volumes in 3Q, and 5% YoY growth in Delhi NCR

* Increase in PNG customers by 300k p.a.

* Robust CNG vehicle additions (~17,100 CNG vehicles added in 3Q)

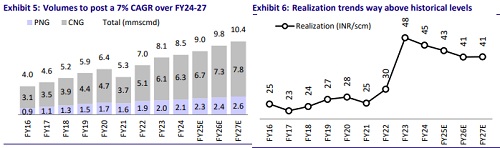

* We estimate total volumes for IGL to reach 9.8mmscmd/10.4mmscmd in FY26/FY27 (7% CAGR over FY24-FY27E), as we continue to maintain a conservative stance over CNG volume uptake in Delhi.

Upgrade to Neutral as we build in an increase in FY26E/FY27E margins

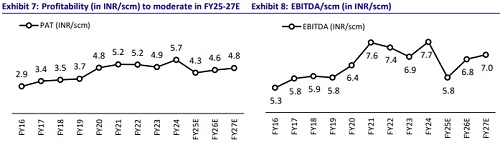

* With 56% of the APM gas cut being compensated by NW gas, which is cheaper in comparison to Spot LNG, and post the signing of long-term gas sourcing contracts, we increase our FY25E/FY26E/FY27E margin assumption to INR5.8/INR6.8/INR7 per scm (vs. INR5.4/INR6.3/INR6.9 previously), led by:

* A bulk of the APM gas cut being compensated by NW gas, which is cheaper in comparison to Spot LNG, leaving only 0.4mmscmd uncovered,

* IGL entering into long-term gas sourcing contracts for 1.65mmscmd, and

* Possibility of CNG price hikes in 4Q.

* The stock has corrected 12% post our downgrade in Feb’23. Further, the stock currently trades at 12x 1Y fwd P/E, which we think is inexpensive and we foresee a limited downside from this level. Hence, we upgrade our rating on the stock from Sell to Neutral, with a TP of INR435 (valued at 15x Dec’26 EPS).

Beat on EBITDA driven by stronger-than-anticipated margins

* Total volumes were in line with our estimate at 9.1mmscmd (+7% YoY).

* While CNG volumes came in line with estimates, PNG volumes were above estimates.

* EBITDA/scm came in above our est. at INR4.3.

* Gross margin was lower QoQ, while opex remained similar QoQ.

* Resulting EBITDA was 12% above our estimate at INR3.6b (-35% YoY), primarily due to higher-than-estimated margins and robust volumes.

* Other income was significantly above our estimate, resulting in a 41% beat on PAT of INR2.9b (-27% YoY).

* The company has authorized a 1:1 bonus issue, with 31st Jan’25 set as the record date.

* In 9MFY25, IGL’s net sales grew 5% to INR110b, while EBITDA/PAT declined 20%/18% YoY to 14.8b/11.2b. In 4QFY25, we estimate net sales/EBITDA/PAT to decline 9%/18%/24% YoY.

Valuation and view

* IGL recently had a 0.9mmscmd net decline in APM gas allocation for its CNG businesses. While IGL’s volumes posted a 9.8% CAGR in FY16-24, we estimate a 7% CAGR in FY24-27.

* The stock has corrected 12% post our downgrade in Feb’23. Further, the stock currently trades at 12x 1Y fwd P/E, which we think is inexpensive and we foresee a limited downside from this level. Hence, we upgrade our rating on the stock from Sell to Neutral, with TP of INR435 (valued at 15x Dec’26 EPS)

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412