Motilal Oswal Wealth Management Advisor October 2025

Siddhartha Khemka Sr. Group Vice President Head – Retail Research

Key Highlights

* Gold, Silver at record highs, while equities consolidate

* US Fed cut rates by 25bps – its first in 2025

* Key Events: Q2FY26 earnings, Start of Festive season

Indian markets ended Sept’25 on a positive note despite heightened volatility. Nifty 50 rose 0.8% MoM, snapping a two-month losing streak, while the broader market outperformed — Nifty Smallcap 100 and Midcap 100 gained 1.9% and 1.4% respectively. However, FIIs remained net sellers for the third straight month, with outflows of Rs.35,301 cr.

In its Oct’25 MPC meet, the RBI held the repo rate steady at 5.5% for the 2nd consecutive time, while announcing a set of reforms to enhance bank lending. It raised FY26 GDP growth forecast to 6.8% (from 6.5%) and lowered CPI inflation projection to 2.6% (from 3.1%), further improving sentiment.

Several global agencies upgraded India’s growth outlook, citing resilient domestic demand, policy support, and a strong services sector. S&P Global and World Bank raised forecasts to 6.5%, while Fitch lifted its FY26 estimate to 6.9%, reinforcing India’s position as a key growth driver globally.

On the global front, the US Fed delivered its first 25 bps rate cut of the year, bringing the policy range to 4.00% - 4.25%. It also signalled two more cuts by year-end. Fed easing improves global liquidity and provides a supportive backdrop for Indian equities. However, US announcements on H1B visa fee hikes and 100% tariffs on branded pharma imports dampened sentiment in Indian IT and Pharma sectors.

As the Q2FY26 earnings season begins, we expect earnings growth to bottom out, with Nifty50/MOFSL Universe earnings estimated to grow 6%/9% YoY. Corporate commentary will be crucial to gauge the impact of policy reforms on demand and margins.

Consumption sectors remain in focus, supported by strong festive demand, the best monsoon in five years (8% above LPA), and recent GST rate cuts.

We believe that the government is committed to lifting and stimulating the Indian economy in the face of frosty global headwinds. In our view, the proactive steps of the government in tandem with the RBI’s stimulus measures have kick-started a cycle of positive uptrends for the equity market. Current valuation at ~20.6x (vs. LPA of 20.7x) is reasonable and has room to expand given our expectations of double-digit PAT growth for Nifty/MOFSL for FY27.

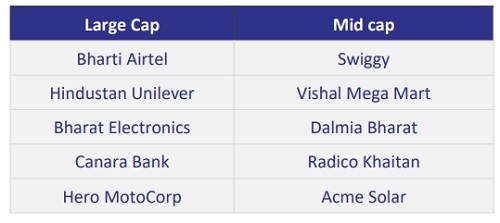

Focus Investment Ideas

* “Focus Investment Ideas” highlight our Top Picks for the month.

* The report contains Investment Ideas under both large-cap and midcap space, along with their valuation summary and rationales.

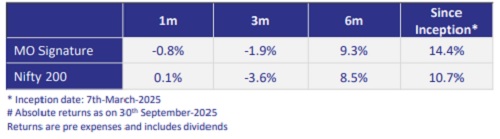

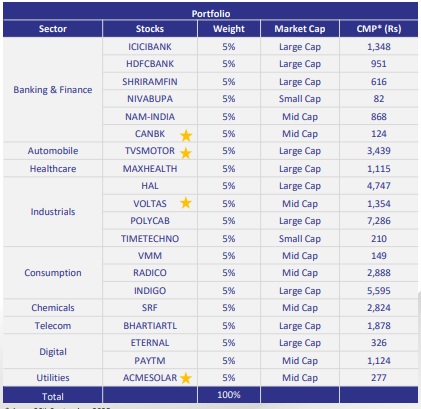

MO Signature - Model Portfolio

Portfolio Performance

Model Portfolio Recommendation

Equity Portfolio Review

What is Equity Portfolio Review?

Equity Portfolio Review is a comprehensive report that analyzes your client’s equity holdings and offers actionable insights. It evaluates each stock, reviews overall portfolio health, and suggests practical steps — whether to buy, hold, reduce, or exit. Think of it as a health check-up for your equity portfolio, backed by robust fundamental and quantitative research.

Why Equity Portfolio Review?

* Markets evolve — and portfolios must too. This review helps you:

* Spot top and underperforming stocks

* Rebalance based on sector, stock, or market cap exposure

* Align portfolios with the client’s risk appetite

* Make informed, objective decisions

* Stay on track with long-term investment goals

How to Get Started:

* Using Equity Portfolio Review is simple:

* Login to Advisor Dashboard / Advisory Pro

* Enter the client code ? Select ‘Portfolio Review’

* Choose risk profile – Aggressive, Conservative, or Low Risk

* Download the report instantly

Key Features at Your Fingertips:

* Comprehensive Portfolio Analysis – Investment, P&L, allocation by stock, sector, and market cap

* Stock-Specific Suggestions – Clear calls to buy, hold, reduce, or exit

* Backed by Rationale – Every recommendation explained

* Risk-Based Customization – Tailored to the client’s profile

* 2,500+ Stock Coverage – Research-driven, with both fundamental and quant views

Bonus Advantage

Even prospective clients can benefit—just upload their holdings from other brokers and showcase the power of the PR report. A great way to on-board with value.

Do not let portfolios go unchecked. Bring clarity, control, and confidence to your client conversations with Equity Portfolio Review. Try it today—because better advice begins with better insights. Try the Equity Portfolio Review now.

Pay Later (MTF)

Powering Your Capital

What is Pay Later (MTF)?

Pay Later (MTF) is a facility that allows you to invest in stocks by paying only a fraction of the total amount upfront. The remaining amount is funded by us. The stocks stay in your demat account (pledged), and you can continue to hold them by paying interest on the funded amount.

Why Use Pay Later (MTF)?

* 4X Buying Power E.g., Invest Rs.4 lakh with just Rs.1 lakh

* Hold Beyond T+1 No square-off pressure like intraday trades

* Increase market exposure using the same capital

* Stocks Stay in Your Demat Account

* Access to a larger pool of 1000+ Stocks

See Pay Later (MTF) in Action:

Let’s say you have Rs.1,00,000 and want to invest in ABC stock

* With Pay Later (MTF), you can buy up to Rs.4,00,000 worth of ABC shares

* You pay Rs.1,00,000, and we fund the rest of Rs.3,00,000

* You pay interest only on the funded Rs.3,00,000

* You can hold the shares for 365+ days by maintaining minimum margin

Is Pay Later (MTF) Right for You?

Yes, if you fall in the below category:

* Are you looking to capture medium-to long-term opportunities?

* Do you want to capture market movements?

* Do you want to enhance your trading potential without deploying full capital?

Want to get started with Pay Later (MTF)?

To activate or check your eligible funding limit, connect with your advisor today.

Pay Later (MTF) = More Exposure = More Flexibility = More Control

Technical & Derivatives Outlook

* Nifty index was driven by the bulls right from the start of the September month and moved by more than 1000 points in the initial three weeks. It inched towards 25450 zones but encountered profit booking towards the end and wiped off most of the gains. The month commenced with the index attempting to extend its upward momentum, but repeated failures to cross key resistance levels sunk it lower. On the sectoral front, we have witnessed continuous buying interest in the Auto sector while fresh buying interest is witnessed in sector like Metal, PSU Bank, Private Bank, Energy, Infra, Finance, Defence and PSE with weakness and short build up in Pharma, Reality, IT and Healthcare.

* Technically, Nifty formed a small bodied candle with a longer upper shadow on the monthly chart, highlighting pressure at higher levels. Now the index needs a short covering wave to decisively hold above the psychological 25k barrier. For October series, positional supports are seen at 24600 and then 24400 zones, while a decisive hold above 25000 could open the gates for the next leg of the rally towards 25500 and 25700 levels.

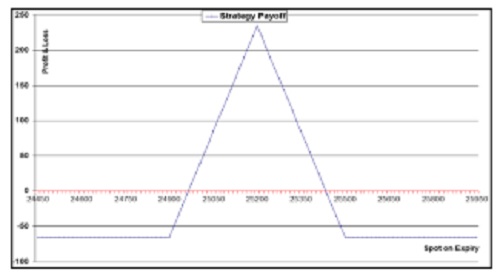

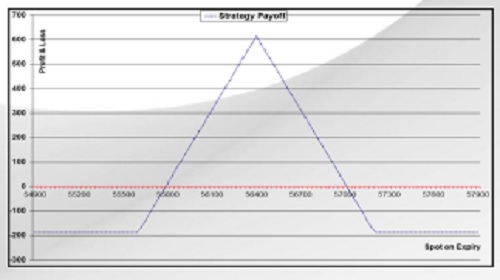

Derivative Strategy

Nifty

* Nifty index witnessed a strong recovery from lower levels and formed a bullish candle on the weekly chart.

* The index is now forming a higher highs structure on both daily and weekly timeframes after a sharp correction and has swiftly sustained above its short term moving averages.

* Maximum Put OI remains intact at 25000 strike while Call OI is also concentrated at the same level.

* This setup suggests deploying a Bull Call Butterfly Spread to capitalize on the upside momentum along with decline in volatility.

BUY 1 LOT OF 24900 CALL

SELL 1 LOT OF 25200 CALL

SELL 1 LOT OF 25200 CALL

BUY 1 LOT OF 25500 CALL

Margin Required : Rs.80,000

Net Premium Paid : 70 Points (Rs.5250)

Max Risk : 70 Points (Rs.5250)

Max Profit: 230 Points ( Rs.17250)

Lot size : 75 Profit if it remains in between 24970 to 25430 zones

Bank Nifty

* Bank Nifty index has seen good recovery from lower levels and formed a strong bullish candle on weekly scale.

* Rate sensitive is trading above its short term moving averages and momentum likely to continue going ahead as good buying interest visible across banking stocks.

* Maximum Put OI is intact at 55000 levels while Call OI is at 57000 strike.

* Thus suggesting Bull Call Butterfly Spread to play the upside momentum with decline in volatility

BUY 1 LOT OF 55600 CALL, SELL 1 LOT OF 56400 CALL,

SELL 1 LOT OF 56400 CALL, BUY 1 LOT OF 57200 CALL

Margin Required : Rs.1,30,000

Net Premium Paid : 190 Points (Rs.6650)

Max Risk : 190 Points (Rs.6650)

Max Profit: 610 Points (Rs.21350)

Lot size : 35 Profit if it remains in between 55790 to 57010 zones

Commodities & Currency Outlook

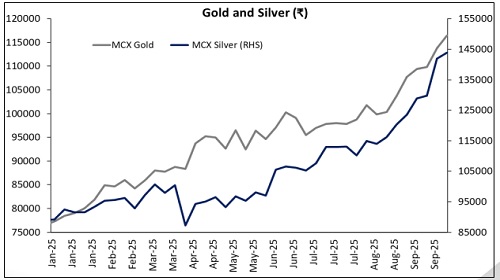

* Gold marked one of its best months in 14 years, with silver also trading at a 14 year high, just a few points away from its all-time high on COMEX

* MCX Gold and Silver reported ~11% & ~18% gains in September and ~60% and ~68% YTD, respectively

* Rupee hovered close to 89, depreciated by ~2.5% YTD, while Dollar index witnessed marginal rebound from recent lows of 96

* Optimism regarding rate cut increased after the Jackson Hole symposium and revised dot plot for 2025 in September meeting

* Fed in their September meeting cut rates by 25bps for the first time in 8 months

* However, Fed also revised growth and inflation providing mixed signals in market

* Probabilities for Oct’25 and Dec’25 is also up by more than 70%

* Economic data last month showed economies resilience while, inflation remained steady

* Non-farm payrolls were revised down, erasing previously reported addition of over 9 lakh jobs last year.

* Geo-political tensions remained elevated: with no sign of cease fire in Middle East

* Israel–Gaza conflict and Ukraine uncertainty lifted safe-haven buying

* Russia continued to acquire near border areas while, Ukraine attacked formers’ energy facilities

* President Trumps’ tariff war increased as he announced major tariffs on several products

* He also tightened grip on Russia by announcing bans and sanctions

* Despite US and China meeting in Stockholm there was no major development the two

* Trump–Powell meeting drew attention but didn’t alter market expectations

* Surprise announcement from China regarding them holding custody of Global gold supported market sentiment

* Shanghai gold vault hit a new record high at 70 ton supporting the demand side story

* China’s central bank gold buying streak and Poland’s reserve hike added support

* Total Gold ETF inflows hit highest since June 2023

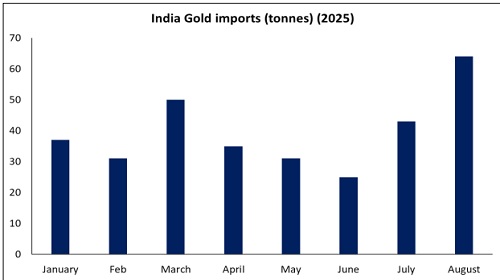

* China’s physical gold market is trading at a five-year discount, while in contrast, strong wedding and festive demand keeps the domestic market in premium

* Indian jewellers have been quoting a premium despite higher prices, amidst festive and wedding season

* Silver’s outperformance in Gold, weighed on Gold/Silver ratio as well, which inched towards 81

* Domestic Imports of both Gold and Silver nearly doubled from previous month, despite record prices

* Factors to watch: Governor Powell’s comments, President Trump’s tariff war, Geopolitical developments, fluctuation in currency i.e. USDINR and Dollar index, economic data amidst US shutdown and demand trends

* Some profit booking could be warranted after hitting all-time highs, however buy on dips stance can be maintained for both Gold and Silver

Commodities & Currency Outlook

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

More News

Nifty immediate support is at 22350 then 22222 zones while resistance at 22700 then 22850 zo...