Nifty, Bank Nifty, Fin Nifty & NIFTY Midcap Expiry Report by Motilal Oswal Wealth Management

NIFTY : 23486

Nifty Index opened positive near 23700 zones but failed to hold its opening hour high and dripped lower by around 300 points and touched 23450 zones. It formed a bearish candle on the daily chart and negated its higher highs - higher lows formation of the last eight trading sessions. Index has witnessed a slight rub off and profit booking after the rally of the last week. Now if it manages to cross and hold above 23500 zones then some bounce could be seen towards 23750 then 23900 zones or else could see downside move towards 23350 then 23200 zones.

Expiry day point of view :

Overall trend is likely to be volatile and now if it manages to cross and hold above 23500 zones then some bounce could be seen towards 23750 then 23900 zones or else could see downside move towards 23350 then 23200 zones.

Trading Range :

Expected wider trading range : 23200/23350 to 23750/23900 zones.

Option Strategy :

Option traders can initiate monthly Bull Call Spread (Buy 23500 CE and Sell 23700 CE) to play the upside move.

Option Writing :

Option writers are suggested to Sell Nifty Monthly 23150 Put and Sell 23800 Call with strict double SL.

Weekly & Monthly Change :

Nifty is up by 1.28% at 22486 on a weekly basis. Nifty VWAP of the week is near 23650 levels and it is trading 160 points below the same. On monthly scale Index is up by 4.17% while VWAP is near 22800 levels and it is trading 700 points above the same which indicates buy on dips sentiments for the monthly expiry day point of view.

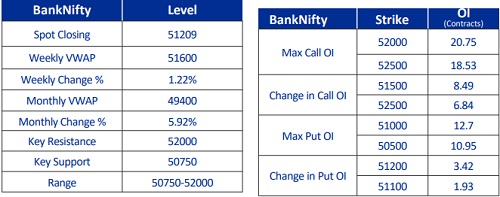

Bank Nifty : 51209

Bank Nifty Index opened on a flattish note but failed to hold 51800 levels and gradually drifted lower towards 51050 zones at latter part of the session. It formed a Bearish candle on daily scale as some cool off was seen from higher levels and it negated the formation of higher lows after ten sessions. Index is likely to consolidate in wider range in between 50800 to 52000 zones after a sharp rally of around 4000 points in last few sessions. Now it has to hold above 51000 zones for an up move towards 51500 then 52000 levels while on the downside support is seen at 51000 then 50750 zones.

Expiry day point of view :

Overall trend is likely to be positive and now it has to hold above 51000 zones for an up move towards 51500 then 52000 levels while on the downside support is seen at 51000 then 50750 zones.

Trading Range :

Expected wider trading range : 50750/51000 to 51500/52000 zones.

Option Strategy :

Option traders can initiate Bull Call Spread (Buy 51200 CE and Sell 51500 CE) to play the upswing.

Option Writing :

Option writers are suggested to Sell Bank Nifty 50200 Put and Sell 52200 Call with strict double SL.

Weekly & Monthly Change :

Bank Nifty is trading up by 1.22% at 51209 on weekly basis. Bank Nifty VWAP of the week is near 51600 levels and it is trading 400 points below to the same. On monthly scale Index is up by 5.92% while VWAP is near 49400 levels and it is trading 1800 above the same which suggests positive bias for expiry day point of view.

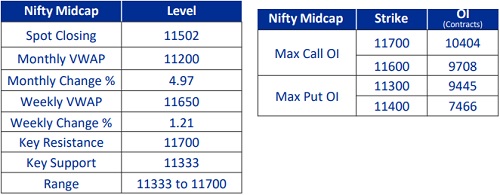

NIFTY Midcap Select : 11502

Nifty Midcap Select opened flattish and moved up to 11675 in the first hour. However, after last week’s strong 600 point rally, it faced profit booking at higher levels. The index kept slipping throughout the day, breaking its higher highs pattern. This indicates a possible pause or consolidation after the recent uptrend. It formed a bearish candle on the daily chart and closed near its 50 Dema. Now if it manages to cross and hold above 11550 zones then some bounce could be seen towards 11650 then 11750 zones or else could see downside move towards 11400 then 11333 zones.

Expiry day point of view :

Overall trend is likely to be volatile and now if it manages to cross and hold above 11550 zones then some bounce could be seen towards 11650 then 11750 zones or else could see downside move towards 11400 then 11333 zones.

Trading Range :

Expected wider trading range : 11333/11400 to 11650/11750 zones.

Option Strategy :

Option traders can initiate Bull Call Spread (Buy 11500 CE and Sell 11550 CE) to play the upside move.

Option Writing :

Option writers are suggested to Sell Nifty Midcap select Monthly 11250 Put and Sell 11700 Call with strict double SL.

Weekly & Monthly Change :

Nifty Midcap select is up by 1.21% on a weekly basis. It’s VWAP of the week is near 11650 zones and it is trading 150 points below the same. On monthly scale the Index is up by 4.97% while VWAP is near 11200 levels and it is trading 300 points above the same which indicates buy on dips sentiments for the expiry day point of view.

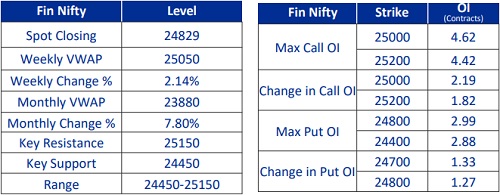

FIN NIFTY : 24829

Fin Nifty Index opened on a flattish note and it tested 25150 in opening hour, however it failed to sustain at higher level and had a decline led by profit booking after a sharp up-move of over 2000 points in last 10 sessions. It formed a bearish candle on the daily scale as it negated the higher high formation of nine trading sessions. Now it has to hold above 24650 zones for an up move towards 25000 then 25150 levels while on the downside support is seen at 24650 then 24450 zones.

Expiry day point of view :

Overall trend is likely to be positive with volatile swings and now it has to hold above 24650 zones for an up move towards 25000 then 25150 levels while on the downside support is seen at 24650 then 24450 zones.

Trading Range :

Expected wider trading range : 24450/24650 to 25000/25150 zones.

Option Strategy :

Option traders can initiate Monthly Bull Call Spread (Buy 24800 CE and Sell 24900 CE) to play the upswing.

Option Writing :

Option writers are suggested to Sell Monthly Fin Nifty 24400 Put and Sell 25250 Call with strict double SL.

Weekly & Monthly Change :

Fin Nifty is trading up by 2.14% at 24829 on weekly basis (Thursday day close to Wednesday close). Fin Nifty VWAP of the week is near 25050 levels and it is trading 200 points below to the same. On monthly scale Index is up by 7.82% while VWAP is near 23880 levels and it is trading 950 points above to the same which suggests positive bias with volatile swings for expiry day point of view.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)

More News

MOSt Advisor April 2025 by Siddhartha Khemka, Sr. Group Vice President, Head - Retail Resear...