Retail Securitisation: Volumes decline 6% to Rs 1.13 lakh crore for H1FY26 by CareEdge Ratings

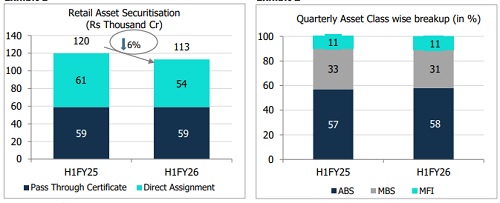

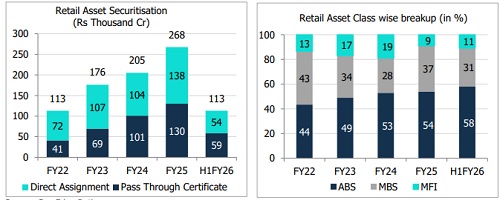

The retail asset securitisation market witnessed a decline of 6% in H1FY26 for the first time in recent years. The aggregate volume stood at Rs 1,13,000 crore (CareEdge Ratings Estimates) for H1FY26, encompassing both passthrough certificate (PTC) issuances and direct assignment (DA) transactions. This dip, though modest, marks a departure from the growth trajectory observed in previous periods.

A standout event in Q2FY26 was the issuance of wholesale asset-backed securitisation (ABS) PTCs originated by one of India’s largest conglomerates (cumulative volume of around Rs 21,000 crore). This deal set a new benchmark for scale, innovation, and mutual fund participation. These transactions have not been considered in the retail asset securitisation volumes of Rs 1,13,000 crore

In H1FY26, the deal composition between PTC and DA transactions rebalanced after Q1FY26 witnessed higher PTC volumes. PTCs accounted for 52% of total volumes (refer to Exhibit 3), bringing the split closer to the split witnessed in the last two fiscals, where DA typically held a slight edge.

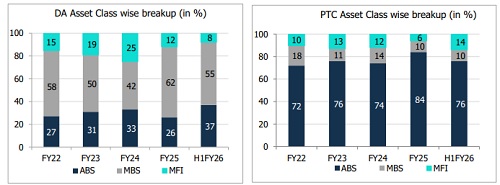

As can be seen below (refer to Exhibits 5 and 6), Asset-backed securitisation (ABS) continued to dominate the retail securitisation landscape in H1FY26, accounting for 76% of PTC volumes and increased traction in DA transactions with a 37% share. Mortgage-backed securitisation (MBS) transactions remained steady at 10% of PTC volumes, while continuing to lead the DA segment accounting for 55%. A notable shift was the rise in PTC issuances from microfinance institutions (MFIs), which climbed to 14% from 5% last year (H1FY25). In contrast, DA transactions backed by MFI loans declined to 8% (16% in H1FY25), indicating a shift in investors’ risk appetite for select asset classes.

Within ABS pools (refer to Exhibit 6), vehicle loans (includes loans backed by commercial vehicles, passenger cars, two-wheelers, construction equipment, and tractors) remained the largest contributor, making up 58% of PTC volumes in H1FY26. However, the share of vehicle PTCs declined as investors diversified into unsecured personal and business loans, as well as gold loans. This diversification signals growing investor interest in alternative retail credit segments across both PTC and DA structures.

CareEdge Ratings View

“The decline in securitisation volumes in H1FY26 vis-a-vis H1FY25 can be attributed to comparatively lower participation by a few large originators, driven by excess on-balance-sheet liquidity and an improving credit-deposit (CD) ratio. Additionally, the slowdown reflects recalibrated credit growth in select retail segments and a cautious stance adopted by some investors, particularly in the unsecured loans. The retail PTCs rated by CareEdge Ratings witnessed nine instances of downgrades in MFI backed pools in H1FY26. The overall market, including said 9 deals, witnessed total 24 instances of downgrades - 15 MFI deals and 5 unsecured loans (including 4 downgraded to D). Barring these instances, the performance of rated retail pools continues to remain robust,” said Vineet Jain, Senior Director, CareEdge Ratings.

Retail securitisation volumes have shown consistent year-on-year growth over the past four years, underscoring the sector’s resilience and expanding investor base. However, H1FY26 marks the first instance of a year-on-year decline. Despite this temporary dip, the underlying fundamentals remain strong. With GST reforms expected to stimulate consumption and the festive season likely to boost credit demand, the market could see renewed momentum. Whether this translates to the securitisation market volume recapturing the highs of FY25 will depend on how originators and investors respond to evolving macroeconomic cues,” said Sriram Rajagopalan, Director, CareEdge Ratings.

Above views are of the author and not of the website kindly read disclaimer