MCX Silver July is expected to rise towards Rs 98,500 level as long as it trades above Rs 96,500 level - ICICI Direct

Metal’s Outlook

Bullion Outlook

• Spot Gold is expected to rise back towards $3340 amid weakness in dollar and softening of U.S. treasury yields. Further, demand for safe haven may increase on mounting trade war concerns after U.S. President Donald Trump said he planned to increase tariffs on imported steel and aluminum to 50% from 25% and the increased tariff would also apply to aluminum products. EU said Europe is prepared to retaliate against US plan to double tariffs, raising prospect of escalating trade fight. Moreover, US accused China of violating an agreement, reigniting trade tension between 2 largest economies. Meanwhile, investors will keep a close eye on manufacturing data from U.S. and Fed Chair Powell Speech.

• Spot gold is likely to rise towards $3340 level as long as it stays above $3270 level. MCX Gold Aug is expected to rise towards Rs 96,700 level as long as it stays above Rs 95,400 level

• MCX Silver July is expected to rise towards Rs 98,500 level as long as it trades above Rs 96,500 leve

Base Metal Outlook

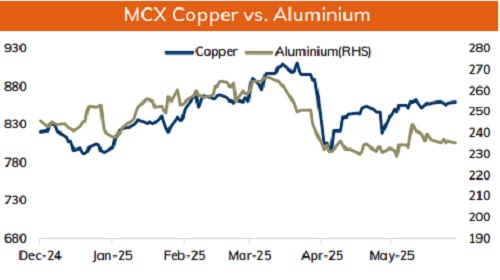

• Copper prices are expected to trade with negative bias on risk aversion in the global markets following uncertainty over the Trump administration's tariff policies and signs of weaker Chinese demand. Further, China’s manufacturing activity shrank for a 2 nd month in May, signaling slowdown in economy. The official purchasing managers' index (PMI) rose to 49.5 in May versus 49.0 in April. Additionally, expectation of disappointing economic data from U.S will hurt prices. U.S. ISM manufacturing PMI data is forecasted to show that activity in sector continued to contract for 3 rd consecutive month. Moreover, US plan to double tariffs on imported steel and aluminum would add further uncertainty to global economy

• MCX Copper June is expected to slip further towards Rs 856 level as long as it stays below Rs 870 level. On contrary, a break above Rs 870 level prices may rally further towards Rs 875 level

• MCX Aluminum June is expected to rise back towards Rs 240 level as long as it stays above Rs 235 level. MCX Zinc June is likely to move south towards Rs 247 level as long as it stays below Rs 254 level.

Energy Outlook

• Crude oil is likely to slip back towards $60 level on pessimistic global market sentiments and escalating trade tension between U.S and its major trading partners. Investors fear that trade war will hurt global economic growth and dent demand for crude oil. Further, eight OPEC+ countries decided to hike July output by 411,000 bpd, same as in in May and June. Since April, the OPEC+ eight have now announced increases totaling 1.37 million bpd, or 62% of the 2.2 million bpd. Additionally, weak economic data from China has raised concerns over economic health of the country. Meanwhile, sharp fall may be cushioned on escalating geopolitical tension in Eastern Europe after Ukraine launched drone attacks on four military airports inside Russia

• MCX Crude oil June is likely to slip towards Rs 5150 level as long as it stays below Rs 5400 level.

• MCX Natural gas June is expected to slip towards Rs 289 level as long as it stays below Rs 307 level

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631