MCX Natural gas June is expected to dip towards Rs 295 level as long as it stays below Rs 320 level - ICICI Direct

Metal’s Outlook

Bullion Outlook

• Spot Gold is expected to rise further towards $3370 level on weakness in dollar and softening of U.S. treasury yields. Dollar and Yields are moving lower on concerns about lack of progress on U.S. trade talks with trading partners. Investors fear that this would have a negative impact on global economic growth and global trade. Further, prices may rally on increase in safe haven demand amid concerns over swelling fiscal deficit and escalating geopolitical tension in Middle East and Eastern Europe. Additionally, expectation of disappointing economic data from U.S. would be supportive for the prices.

• Spot gold is likely to rise further towards $3370 level as long as it stays above $3290 level. MCX Gold June is expected to rise further towards Rs 96,500 level as long as it stays above Rs 95,200 level

• MCX Silver July is expected to rise back towards Rs 99,000 level as long as it trades above ?96,900 level. A break above Rs 99,000 level prices may rally further towards Rs100,000 level

Base Metal Outlook

• Copper prices are expected to trade with positive bias on weakness in dollar and rise in risk appetite in the global markets following U.S. President Donald Trump postponing his recently proposed 50% tariff on EU products to July. Additionally, persistent decline in LME inventories would be supportive for the prices. Meanwhile, sharp upside would be capped as all eyes will be on debate in the U.S. Senate on Trump's taxcut bill that is expected to add to the debt pile.

• MCX Copper June is expected to rise towards Rs 874 level as long as it stays above Rs 857 level. A break above Rs 874 level prices may rally further towards Rs 878 level

• MCX Aluminum June is expected to slip further towards Rs 234 level as long as it stays below Rs 239 level. MCX Zinc June is likely to move north towards Rs 260 level as long as it stays above Rs 254.50 level.

Energy Outlook

• Crude oil is likely to dip further towards $60 level on concern over rising supply and expectation of weak economic data from U.S and Europe. Further, OPEC+ will now meet on 31st May a day earlier than previously planned, where group may decide on July output. OPEC+ is planning a potential increase in output of 411 Kbpd in July, this would be the 3 month in a row were group has agreed to triple the amount. Meanwhile, sharp downside would be cushioned on weakness in dollar and optimistic global market sentiments. Further, escalating geopolitical tension in Middle East and Eastern Europe would prevent further fall in prices. Investors are worried over more sanctions on Iran and Russia that would put energy flows at risk

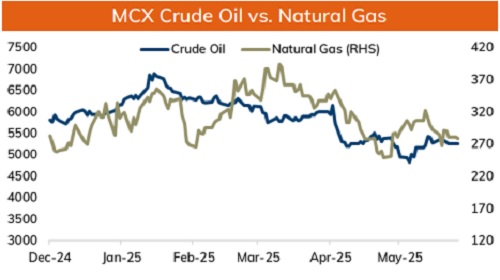

• MCX Crude oil June is likely to slip back towards Rs 5120 level as long as it stays below Rs 5380 level.

• MCX Natural gas June is expected to dip towards Rs 295 level as long as it stays below Rs 320 level.

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631