MCX Crude oil April is likely to face stiff resistance near Rs.5950 level and slip back towards Rs.5650 level - ICICI Direct

Bullion Outlook

* Gold is expected to continue with its upward trend amid weakness in dollar and softening of US treasury yields. Further, demand for safe haven may increase on escalating geopolitical tension in Middle East and on fears that US President Donald Trump trade policies will ignite global trade war hurting economic growth. Meanwhile, all eyes will be on US Federal Reserve monetary policy where central bank is likely to keep interest rate untouched and Fed Chair Powell to reiterate that central bank is in no rush to resume rate cuts. Additionally, Fed policymakers will update their interest rate and economic projections. Spot gold is hovering near its record high, if it successfully breaks the immediate resistance of $3040 level then it may rally further towards $3080. Immediate support lies near $3000 level, if it breaches $3000 level then it may slip further towards $2975. MCX Gold April is expected to rise towards Rs.89,000 level as long as it stays above Rs.88,200 level.

* MCX Silver May is expected to rise towards Rs.102,000 level as long as it trades above Rs.99,700 level.

Base Metal Outlook

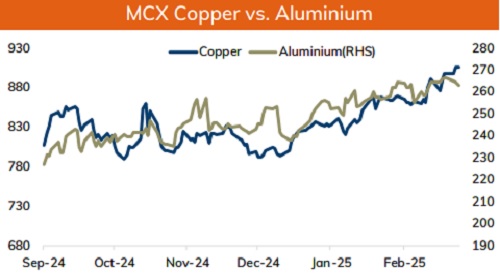

* Copper prices are expected to trade with positive bias on weakness in dollar, stronger than expected economic data from US and China and optimistic global market sentiments. Further, prices may rally as Chinese recent stimulus measures aimed at boosting spending by increasing people’s incomes, reinforcing optimism for stronger industrial demand. Meanwhile, all eyes will be major central bank monetary policy, where they are widely expected to leave policy unchanged, more focus will be on statements to get clarity on future rate paths

* MCX Copper March is expected to rise further towards Rs.915 level as long as it stays above Rs.895 level. A break above Rs.915 level prices may rally further towards Rs.920 levels

* MCX Aluminum March is expected to slip further Rs.261 level as long as it stays below Rs.265.50 level. MCX Zinc March is likely to move back towards Rs.280 level as long as it stays above Rs.275 level

Energy Outlook

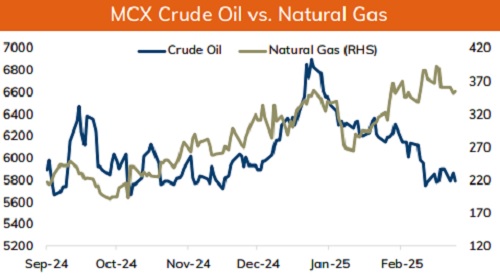

* NYMEX Crude oil is expected to trade with negative bias as Putin agreed to Trump’s proposal that Russia and Ukraine will stop attacking each other’s energy infrastructure for 30 days, fueling hopes of easing sanctions on Russian fuel exports. Additionally, prices may fall on larger than expected rise in weekly domestic crude oil stockpiles. As per API US inventories increased by 4.5M barrels for the week ending 14th March. Moreover, OECD warned that US tariffs would reduce economic growth in the US, Canada and Mexico, weighing on global energy demand. Meanwhile, sharp fall would be cushioned on escalating geopolitical tension in Middle East and on hopes that stimulus measures in China would boost demand for fuel

* MCX Crude oil April is likely to face stiff resistance near Rs.5950 level and slip back towards Rs.5650 level. A break below Rs.5650 prices may dip further towards Rs.5600 level.

* MCX Natural gas March is expected to hold the support near Rs.340 level rise further towards Rs.365 level.

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631