Logistics Sector Update : Freight and cargo monthly by Emkay Global Financial Services Ltd

Freight and cargo monthly

We monitor monthly indicators for assessing freight and cargo movements across multiple modes of transportation. Unsurprisingly, GST e-way bill volumes declined 2% MoM in Aug-25, on the back of anticipated GST rate-cuts (which are now confirmed), following the strong momentum in Jul-25 (up 10% MoM). We, however, expect Sep data to remain robust on pent-up demand, owing to GST rate-cuts, the upcoming festive season, and the continued positive trend in the manufacturing PMI. Truck freight rates have now remained flat for the third consecutive month amid volatility in freight volumes and stable diesel prices, with ATF prices holding up in Aug. Major ports’ volumes remained tepid for the fourth month in a row (up 2.5% YoY in Aug; lower than FY25 growth of 4.3%), with container volume growth also tapering to 4% YoY (vs 29% growth in APSEZ’s container volumes). Container shipping rates are now at a 20-month low, down 19% MoM as on 18-Sep (46% below the highs seen in Jun-25), on US tariffs dampening global trade and continued fleet expansion.

Pause in GST e-way bill momentum; freight rates unchanged

GST e-way bill volumes fell 2% MoM in Aug-25, from the highs seen in Jul-25. Intra-state volumes were down/up 2%/25% MoM/YoY, respectively, while inter-state volumes fell/rose 2% MoM/17% YoY, respectively. We anticipate robust volumes in Sep, on delayed demand in Aug spilling over to Sep (owing to the anticipated GST rate-cuts, which are now confirmed), along with pre-festive season demand and positive trends sustaining in the manufacturing PMI (59.3; up by 20bps MoM in Aug-25). Despite the volatility in volumes, average freight rates on trunk routes were flat sequentially, albeit up 3% YoY (flat on a 3M rolling average basis) led by a broad-based uptick in May-25. Diesel prices were stable QoQ and YoY. ATF prices remained flat since May-25, down 28% from the Oct-23 peak. Brent crude, meanwhile, saw a 4% MoM decline in Aug-25, although up 5% since May-25.

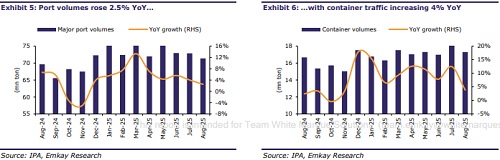

Container volume growth moderates at major ports

In Aug-25, volume growth moderated further across major ports (up 2.5% YoY; 4% on a 3M rolling average basis vs FY25 growth of 4.3%). Container volume growth took a pause, increasing 4% YoY vs the 3M rolling average of 8%. The divergence between major ports’ container volumes and APSEZ volumes continues to persist and expand, with APSEZ’s container volumes growing 29% YoY in Aug-25 (up 22% in FY25). In terms of commodities, coal saw a 6% YoY decline due to thermal coal declining 12% YoY, although offset by coking coal traffic growing 10% YoY. POL/Fertilizers/Other liquids led the growth, increasing 14%/26%/12% YoY, respectively. Iron volumes decreased for the third consecutive month, with a sharp decline of 20% YoY. Among major ports, JNPT, Kolkata, and Visakhapatnam saw the strongest YoY volume growth of 9%, 5%, and 5%, respectively. However, volumes at Mumbai/Tuticorin ports fell 5%/9% YoY, respectively

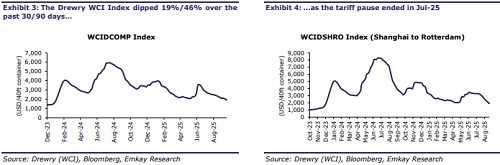

Container shipping rates at a 20-month low now

Per the Drewry WCI Index, container shipping rates have reversed all the gains seen over May to Jun-25 as US tariffs came into force. The Index has dipped 19%/46% over the past 30/90 days (USD1,913 per 40ft container as on 18-Sep-25), respectively. Industry reports suggest that the contraction in spot rates, particularly for Asia-Europe routes, is due to a lack of demand against an increase in supply of ships. With demand volatility sustaining on tariff uncertainty (refer to Exhibit 11) and geopolitical issues, shipping rates are likely to remain under pressure even in the upcoming peak season.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354