IPO Note : Canara Robeco AMC Ltd by InCred Equities

Canara Robeco AMC

Modest valuation; high potential

* Canara Robeco AMC focuses on active equity funds, which helped it to sustain its market share at ~1.5% as of Jun 2025.

* Around 87% of its MAAUM as of Jun 2025 was through retail accounts, in line with the management’s long-term investment approach.

* At the upper price band of Rs266, we see a higher rerating potential vs. other PSU players, given its retail-focused approach.

Steady ~1.5% market share fueled by focused active-equity strategy

Canara Robeco Asset Management Company has strategically focused on active equity funds in recent years, and this shift appears to have helped it sustain an overall ~1.5% market share as of Jun 2025 over the last three years with an AUM of Rs1tr. We believe its ability to increase its share in a competitive landscape reflects both its strategic clarity and execution. Its resilience stems from more than just active equity investing, as it is also leveraging Canara Bank’s extensive branch network, especially in B-30 cities which have growth potential, and Orix Corporation’s expertise in investment, product and risk management. As its equity funds’ share is stabilizing, management foresees a rise in yield, thereby strengthening its competitive edge.

High retail base leads to sticky granular flows

With ~87% of MAAUM contributed by retail and HNI investors, Canara Robeco AMC demonstrates a deeply retail-driven and long-term investor profile. This retail stickiness offers stability against volatile flows and in anchoring client relationships. Around 92% of its AUM is in equity-oriented funds (~80% equity and ~12% hybrid). Around 8% of its AUM comes via Canara Bank. Management sees a comfort zone in keeping that distribution from the parent bank in the range of 8-12%. The strong retail presence and a diversified channel mix enable it to balance its reach, with resilience in client acquisition and retention

Performance of its schemes is key to yield movement

With competition intensifying in the mutual fund industry, scheme performance is gaining importance. Our initial analysis indicates that Canara Robeco AMC is having relatively high distribution payout ratios vs. some of the larger peers. We had highlighted a peer comparison over key parameters with the listed peers in an earlier note - Canara Robeco MF: An Overview. Thus, despite a high equity base, its revenue yield stands at 0.39%, leaving a relatively lower buffer to offer further increase in payouts to distributors to stay competitive. However, equity scheme concentration also results in missed flows in fastgrowing passive/ETF funds.

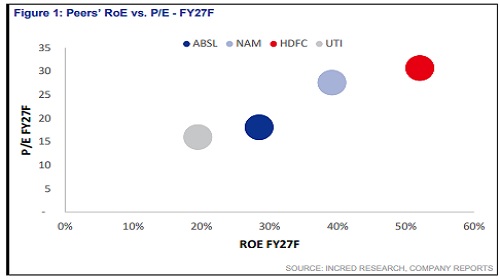

Valuation and outlook

Post Initial Public Offer (IPO), parent Canara Bank’s stake will fall from ~51% to ~38%, and under the Reserve Bank of India norms, it must further pare it down to ~30% by FY30. At the upper price band of Rs266, the stock is valued at 28x FY25 EPS, which appears fair relative to peer multiples (Fig. 1). We believe the company is an attractive bet in the small AMC space and has a higher potential to rerate with a slight improvement in the performance of its schemes and yields, as compared to a few other peers, given its retail focus and a higher proportion of equity AUM.

Above views are of the author and not of the website kindly read disclaimer